Another month of ours Senti-Trading-Bot activity on the Binance exchange, in the BTCUSDT pair, has ended. The time has come to summarize its effectiveness.

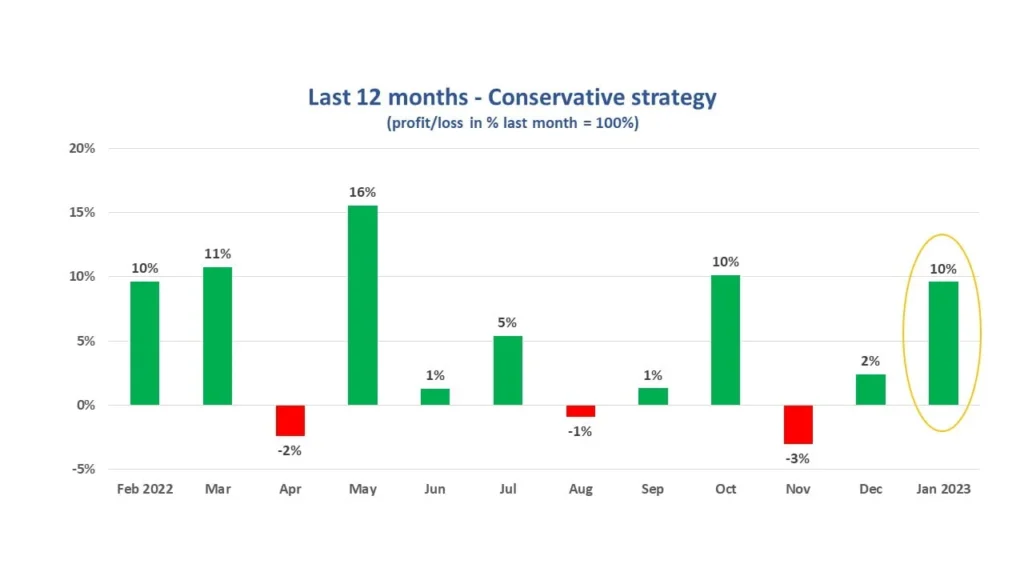

Conservative strategy

Most of our clients use a conservative strategy. January 2023 in this case closed with a profit of +10%. Below is a summary of the last 12 months:

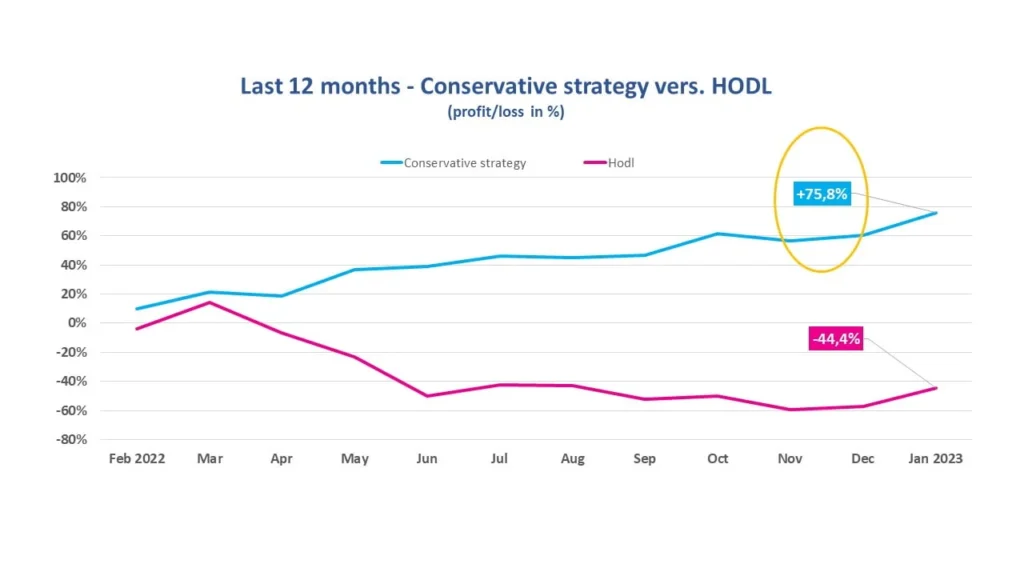

Analyzing the results for the last 12 months (February 2022 – January 2023), the efficiency of the bot with the conservative strategy was nearly +76%. In comparison, the HODL strategy over time recorded a loss of -44%.

The results refer to the date of January 26 – that is, the closing date of the last open position.

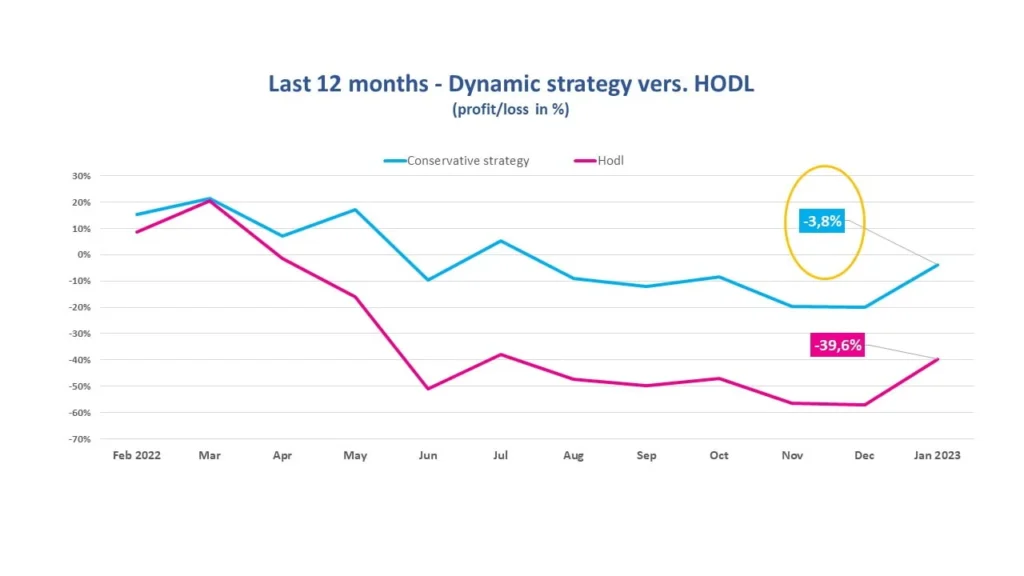

Dynamic strategy

Significant price changes in the stock market in January encouraged some BTC traders to use a dynamic strategy in their bots. As a result, January for this strategy brought a +20% profit.

However, as we emphasize all the time – a dynamic strategy works best in a market with a long-term upward trend. This standpoint is confirmed by the results of the last 12 months.

The results refer to the date of January 31 – that is, the closing date of the last open position.

Unfortunately, the dynamic strategy would not have been profitable during this period, although its performance is still better than the HODL strategy.

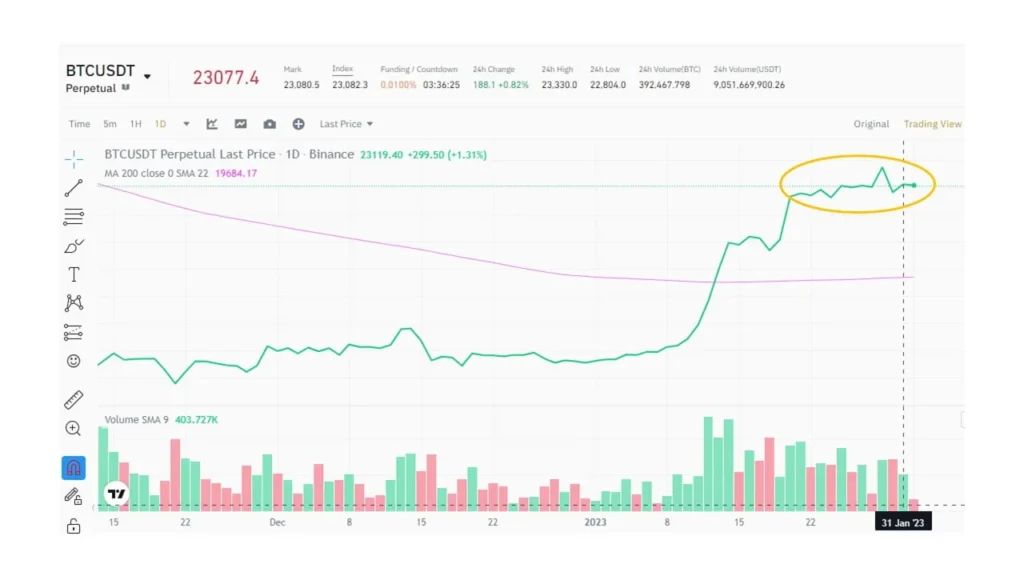

It is up to the user what strategy the bot will use. This decision should be based on the observation of the behavior of the BTC market, which today, after a surge in the second decade of January, has re-entered the stage of a sideways trend. This is shown clearly by the most frequently used technical analysis tool, that is, the average SMA 200.