We are excited to share with you the Senti-Bot results for September 2023. The Sentistocks team delivers a performance-focused tool in the rapidly changing world of cryptocurrencies.

September turned out to be another ‘weird’ month full of unpredictability in the Bitcoin market, due to strong investor emotions, which we use as our advantage.

Table of contents

Table of Contents

Senti-Bot results

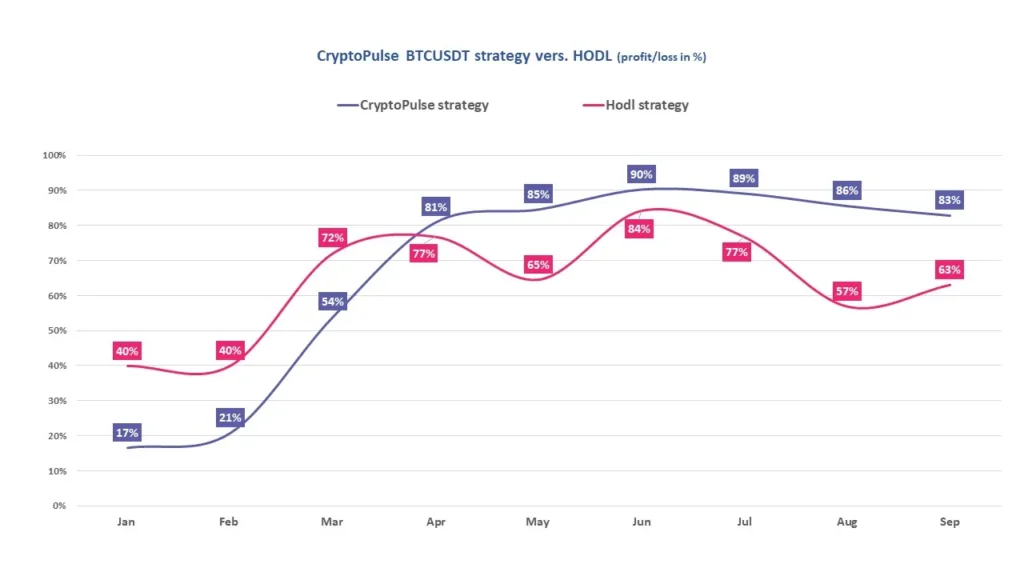

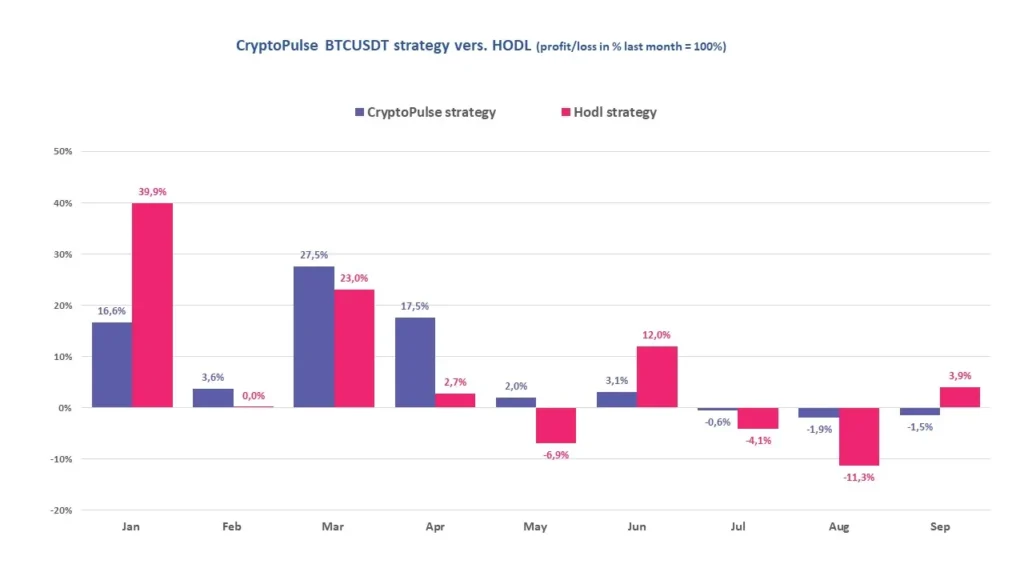

Let’s take a look at Senti-Bot’s performance from January to September. It turns out that a bot running for you on the CryptoPulse strategy (+83%) still performs better than traditional bitcoin farming (+63%).

But something strange happened in September – Senti-Bot ended the month with a small loss. This was mainly due to the ups and downs of investor emotions, as the chart below shows in red and green.

For almost 60% of the month, declines in market confidence dominated, further compounded by sudden surprise spikes. Due to the Senti-Bot’s design, mainly directed at maximizing the protection of your capital, the bot repeatedly closed positions, minimizing expected losses.

Senti-Bot performance indicators

From the beginning, we emphasize that Senti-Bot’s effectiveness should be considered over a period of more than one or two months. In assessing the effectiveness of the tool, important elements are the measurement of indicators such as:

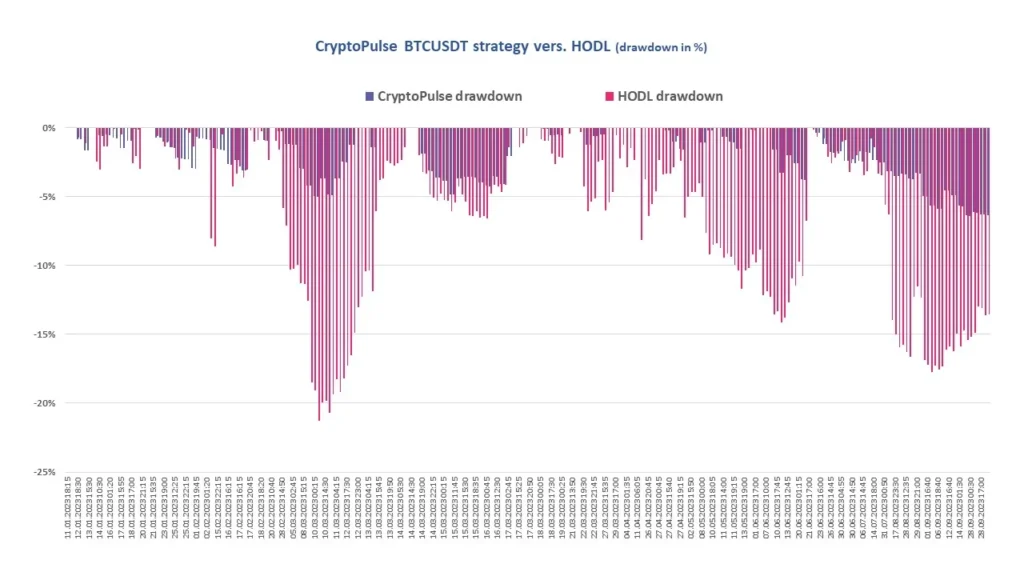

Drawdown

A drawdown is simply the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous level of capital with its current value.

As illustrated by the chart below, this strategy successfully protected your capital from significant losses, achieving a maximum drawdown since the beginning of the year of -6.4%, in contrast to bitcoin’s HODL where it was as high as -21.3%.

Profit Factor

Another measure is the Profit Factor. This ratio, used to evaluate active investment strategies. It is defined as the sum of the value of all trades with a profit, divided by the sum of the value of all trades closed with a loss. It is assumed that its value above 1.50 is considered good enough and above 2.0 is considered to be perfect.

The Profit Factor for Senti-Bot is 2.22 at the end of September 2023, confirming SentiBot’s high performance. (see table below)

Sharpe ratio

To assess the ratio of the return achieved to the risk taken, we track two main indicators. The first is the Sharpe ratio, which measures the risk-adjusted return (measured by mean deviation). The higher the values of this indicator, the better the investment is considered. Investments for which the Sharpe Ratio is greater than 3.0 are considered among the best.

For the Senti-Bot made available to you, this ratio is higher than for the vast majority of investment funds, reaching 4.85 at the end of October, being better than for the herding strategy (3.4). (see table below)

Calmar Ratio

Calmar Ratio is the second main indicator of investment performance, determining the ratio of the return (calculated on an average annual basis) in relation to the maximum slippage. In general, the higher its value, the better. This is because it indicates by how many times the annual average cumulative return exceeds the slippage to date. Values above 1 mean that the rate of return, was higher than the landslide.

For Senti-Bot, the value of this indicator stood at 22.1 at the end of September, more than four times higher than for breeding. (see table below)

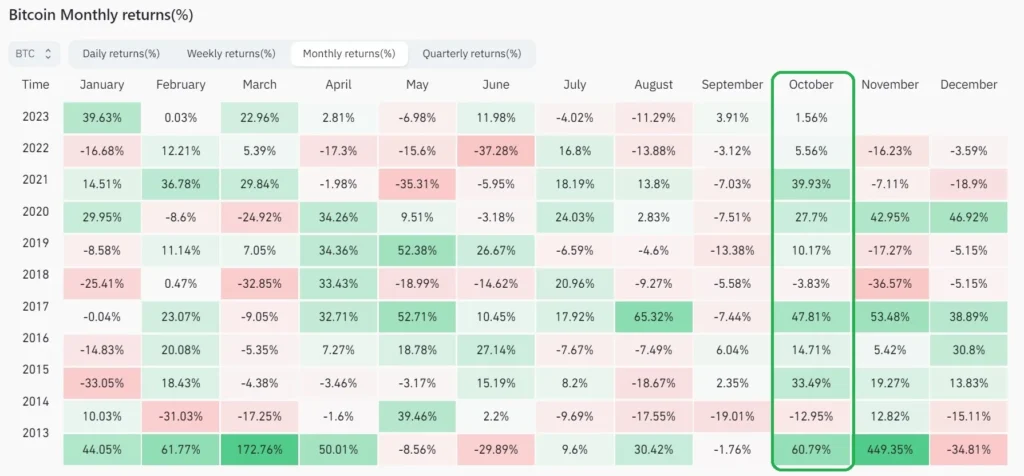

At the same time, we hope that October will repeat being a historic (‘up-tober’) month in which the bot demonstrates its capabilities not only in terms of capital preservation but, above all, profit generation.

Source: Glassnode

Thank you for your trust and encourage you to follow Senti-Bot’s performance in the coming months!

Sentistocks Team