A solid plus in March and the last 12 months of running the Senti-Trading-Bot on the Binance exchange in the BTCUSDT pair. This is also the 7th month since the bot has been commercially available.

Detailed analysis in the article.

Senti-Trading-Bot investment strategy

The market situation prefers a conservative investment strategy. This strategy uses predictions of the BTC price change based on analysis of emotions prevailing in the market. The main thrust of the strategy is to buy only if our analysis predicts a significant increase in the price and sell if a decline is predicted.

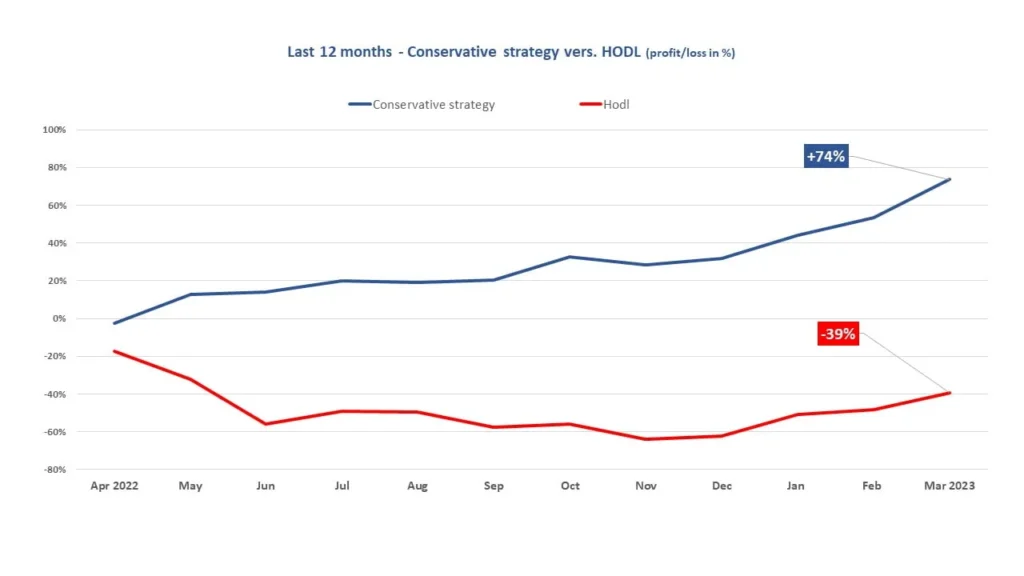

Analysis of the results for the last 12 months (April 2022 – March 2023) shows the effectiveness of Senti-Trading-Bot with a conservative strategy at +74%. In comparison, the HODL strategy recorded a loss of -39% during this period.

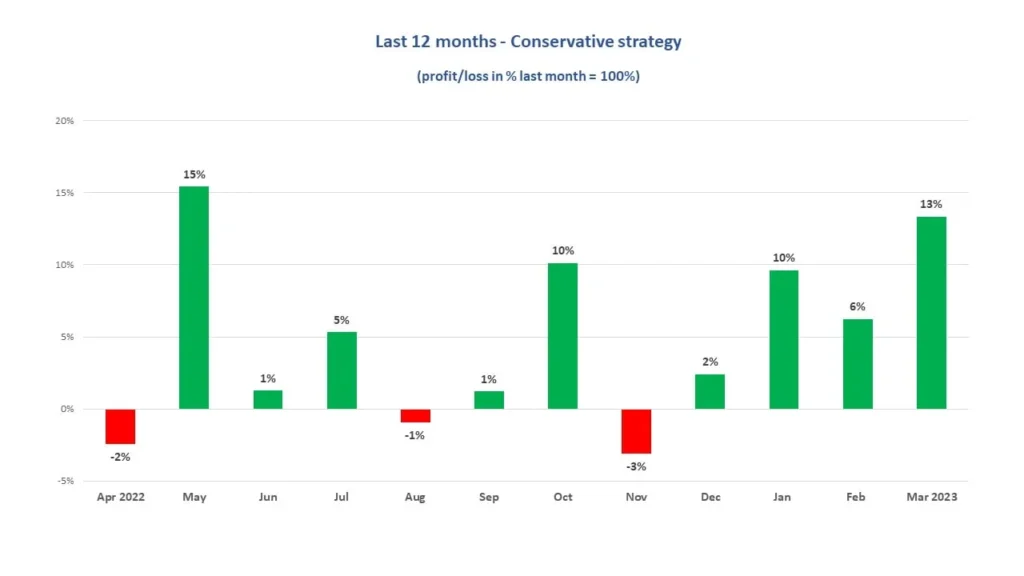

Analyzing the monthly results, it is clear that Senti-Trading-Bot protects the investor from possible large losses while giving the opportunity to generate profits.

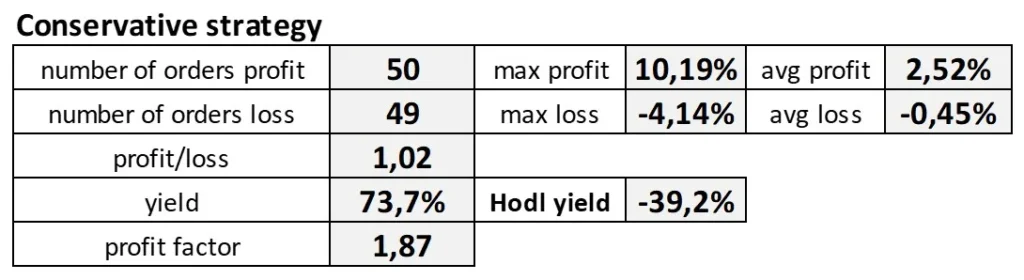

This action pattern of our tool is also confirmed by the detailed analytical data in the table below.

As you can see, the average level of profit from closed positions significantly exceeds the average level of loss. Also, to be noted is the profit factor, which stood at 1.87 at the end of March 2023. This factor is defined as the sum of all transactions with a profit divided by the sum of all transactions closed with a loss. A profit factor above 1.50 is considered good enough, and above 2.0 is considered ideal.

Results of the first commercial bot (conservative strategy)

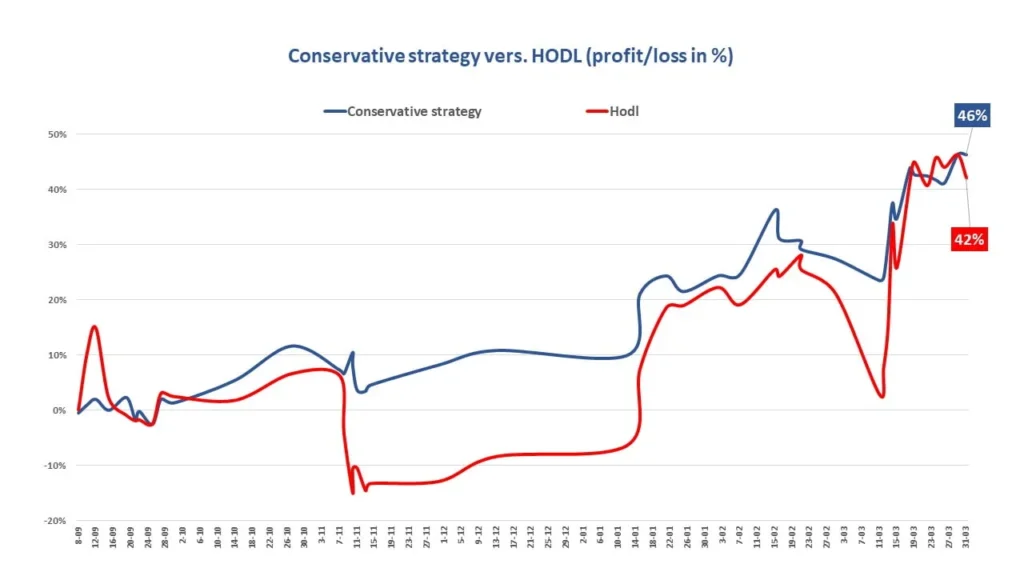

The bot for our first commercial client with a conservative strategy was launched in September 2022. Below are its results recorded at the end of March 2023, compared to HODL for the same period.

In addition to generating profits, Senti-Trading-Bot successfully fulfilled its second main role – it protected the investor from the spikes in the BTC price that occurred in November 2022 and March 2023.