The Senti-Trading-Bot has been running for more than a year on the Binance exchange in the BTCUSDT pair, and has also been available commercially for 6 months.

Conservative strategy in Senti-Trading-Bot

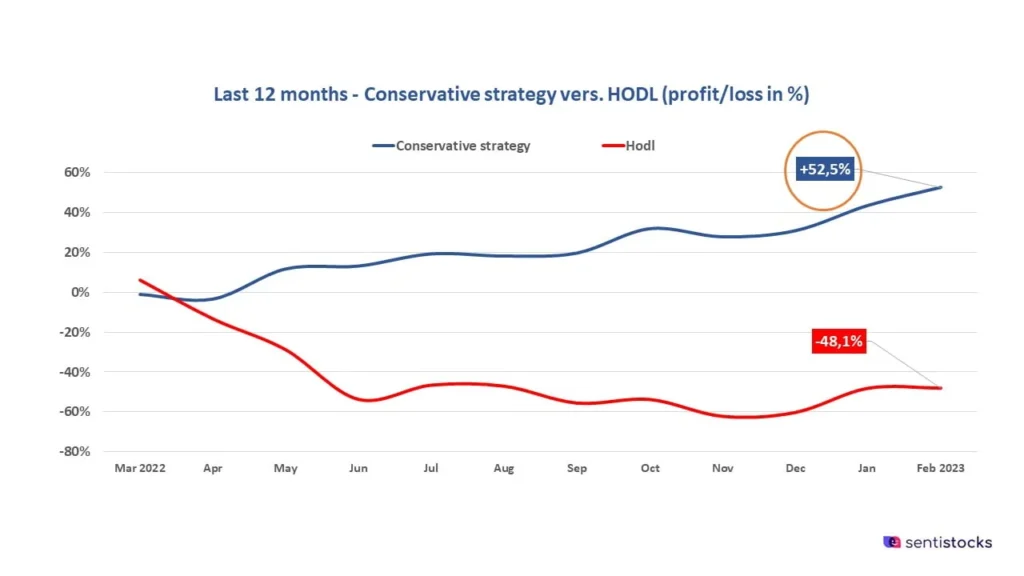

In the current market situation, a conservative investment strategy is preferred by us and our clients. The results achieved confirm its effectiveness in a market overtaken by downward or sideways trends.

Analysis of the results for the last 12 months (March 2022 – February 2023) shows the effectiveness of the bot with the conservative strategy at + 52.5%. In comparison, the HODL strategy over time recorded a loss of – 48.1%.

Results of the first commercial bot (conservative strategy)

The bot for our first commercial client with a conservative strategy was launched in September 2022. Below are its results recorded at the end of February 2023, compared to hodl for the same period.

As you can see, the bot successfully “protected” the client by reacting appropriately to spikes and drops in the BTC exchange rate (in November 2022 and January 2023).

Senti-Trading-Bot’s dynamic strategy

The market situation observed over the long term indicates that this is not the moment to use a dynamic strategy in investing, even if it is profitable in the short term.

We invariably emphasize – the dynamic strategy works best in a market characterized by a long-term upward trend. This is confirmed by the results of the last 12 months.

As can be seen, during the period under review, the dynamic strategy would not have made a profit, although its performance is still better than the HODL strategy.

It is up to the decision of the direct user (customer) what strategy the bot will use. This decision should be based on the observation of the behavior of the BTC market.