We are excited to share with you the Senti-Bot results for August 2023. The SentiStocks team delivers a performance-focused tool in the rapidly changing world of cryptocurrencies.

In August, we did quite an update to Senti-Bot, introducing a new version of the CryptoPulse strategy. Why this is important. The bot now has additional safeguards to protect your capital even against small price drops that could lead to longer downtrends.

Table of Contents

Table of Contents

Senti-Bot results

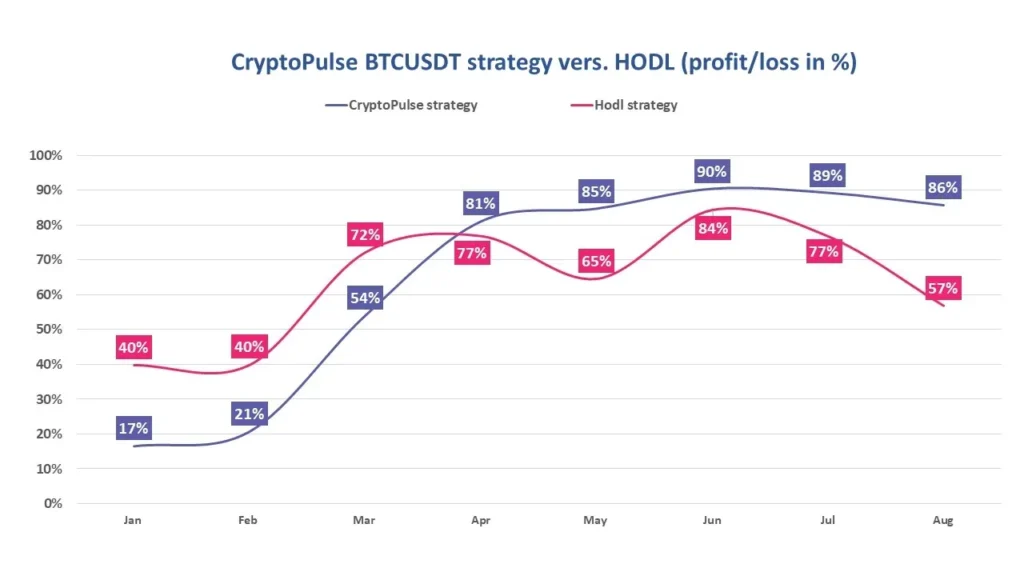

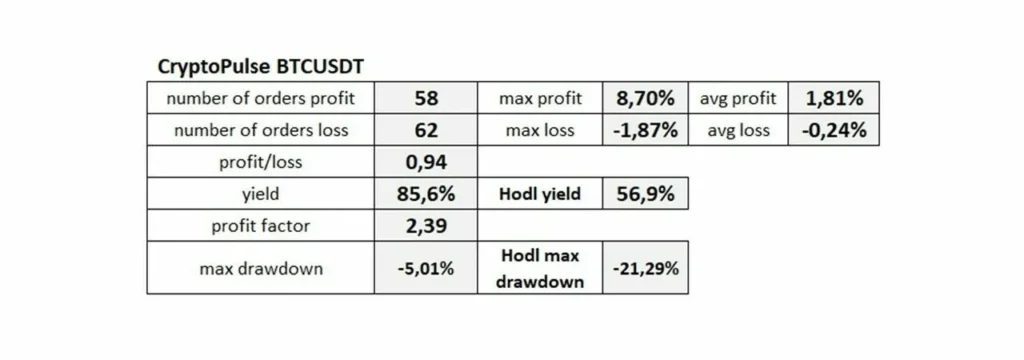

Every month since the beginning of the year, we have analyzed the performance of the CryptoPulse BTCUSDT strategy. The analysis for January to August for closed positions shows that the achievable performance of the bot running on the CryptoPulse BTCUSDT strategy (+86%) is significantly higher than that achieved using the HODL method (+57%).

Analysis from January to August shows that the performance of the bot on the CryptoPulse strategy (+86%) is significantly higher than that achieved with traditional bitcoin farming (+57%).

In addition, when you break down the result over time, you will see that for most months the Senti-Bot performs better than the cryptocurrency breeding. Above all, the CryptoPulse BTCUSDT algorithm does a much better job of protecting the capital invested in you from declines such as those that occurred in May (-6.9%), July (-4.1%) and August (-11.3%).

Unfortunately, August ended with a negative result mainly due to dynamic price movements, especially in intervals shorter than 15 minutes. This short period is crucial for trend and price prediction, where our bot issues potential orders. The problem was that accurate trend prediction based on social media emotion analysis was difficult.

Our research indicated that the optimum period for analyzing posts is 15 minutes, as shorter periods do not allow for reliable measurements of emotion intensity. In such cases, the entries are too short, which could lead to erroneous trend and course predictions.

Our analyses suggest that price movements in intervals shorter than a quarter of an hour usually happen outside the influence of emotion and are most often the result of decisions that are difficult to predict from a trader sentiment perspective. Such as the placing of large orders by institutional investors.

Results of the first commercial bot

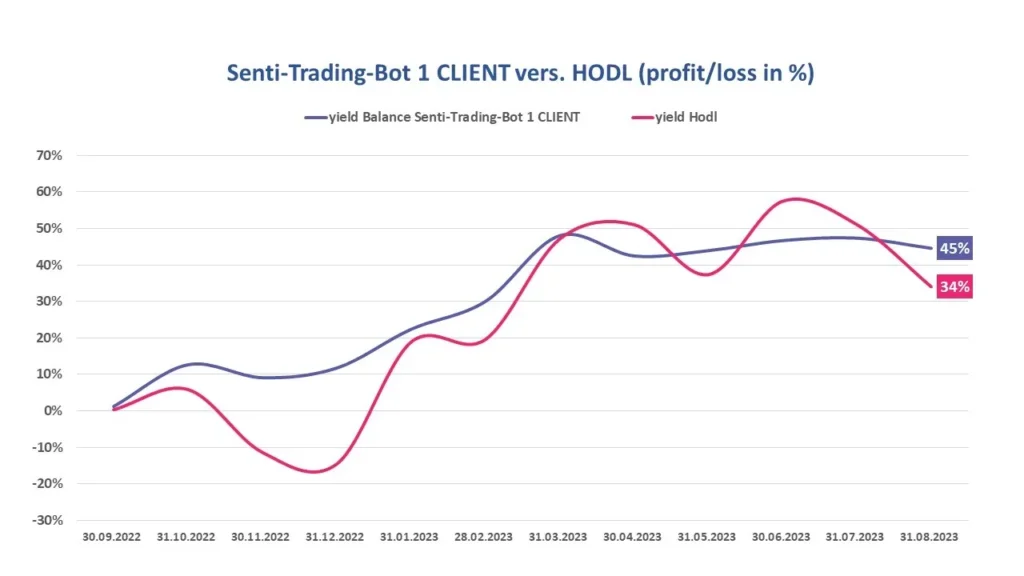

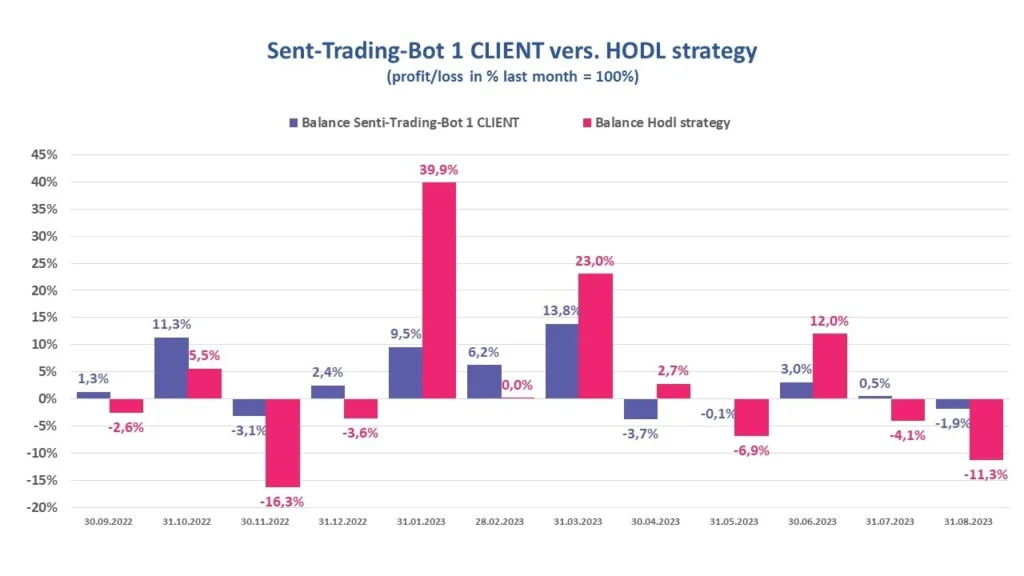

In addition, we present the results of the bot of our first commercial client, which was launched in September 2022. The bot was previously running on a strategy called Conservative, and has already been using the CryptoPulse strategy since July.

At the end of August, the profitability of the strategy involving hodling was clearly lower than the bot’s efficiency. However, it should be noted that over the course of these twelve months, in addition to generating profits, the bot successfully protected the investor from the spikes in the BTC price. The spikes occurred in November 2022 and in May, July, and August. 2023.

Senti-Bot performance indicators

From the beginning, we emphasize that Senti-Bot’s effectiveness should be considered over a period of more than one or two months. In assessing the effectiveness of the tool, important elements are the measurement of indicators such as:

Drawdown

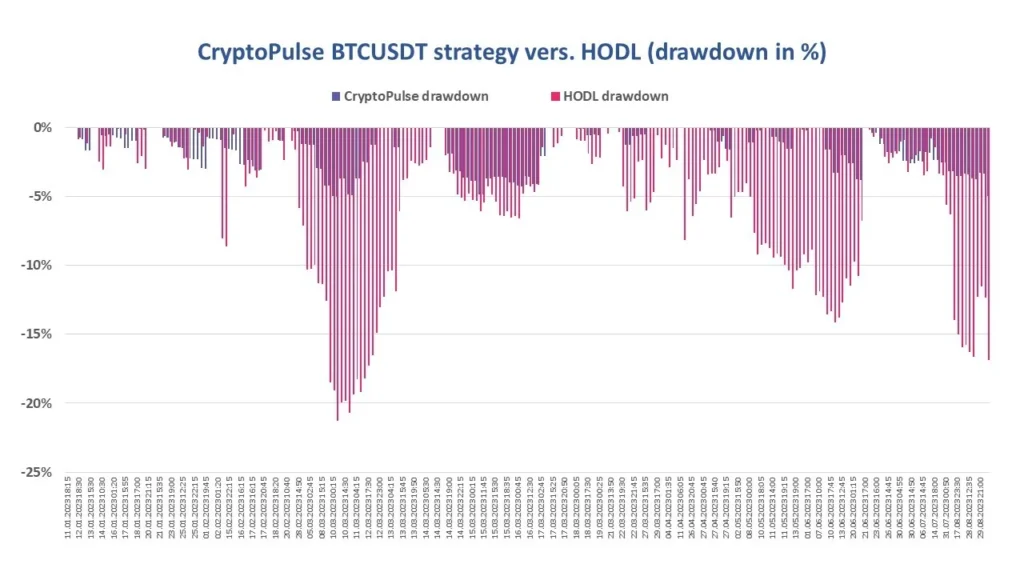

A drawdown is simply the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous level of capital with its current value.

As you can see, in the chart below, the strategy successfully protected your capital from significant losses, achieving a year-to-date drawdown for the CryptoPulse strategy of – 5%, while in the hodl it was 21%.

Profit Factor

Another measure is the Profit Factor. This ratio, used to evaluate active investment strategies. It is defined as the sum of the value of all trades with a profit, divided by the sum of the value of all trades closed with a loss. It is assumed that its value above 1.50 is considered good enough and above 2.0 is considered to be perfect.

The performance of the trades that Senti-Bot has executed for you since the beginning of the year translates into an average profit on closed positions (+1.81%), which far outweighs the average loss (-0.24%).

The Profit Factor for Senti-Bot is 2.39 at the end of August 2023, confirming SentiBot’s high performance. (see table below)

Thank you for your trust and encourage you to follow Senti-Bot’s performance in the coming months!

SentiStock Team