Another month of SentiBot action on the Binance exchange for the BTC/USDT pair has passed. It has been a difficult month due to significant fluctuations in investor emotion, affecting Bitcoin’s price level.

SentiBot investment strategy

For many months, due to the market situation, a conservative investment strategy has been preferred. In addition to generating a return on investment, it is designed to maximize the protection of capital during periods of decline in the price of BTC. Investors’ emotions have a big impact on the price changes. In April, these emotions were put to a big test.

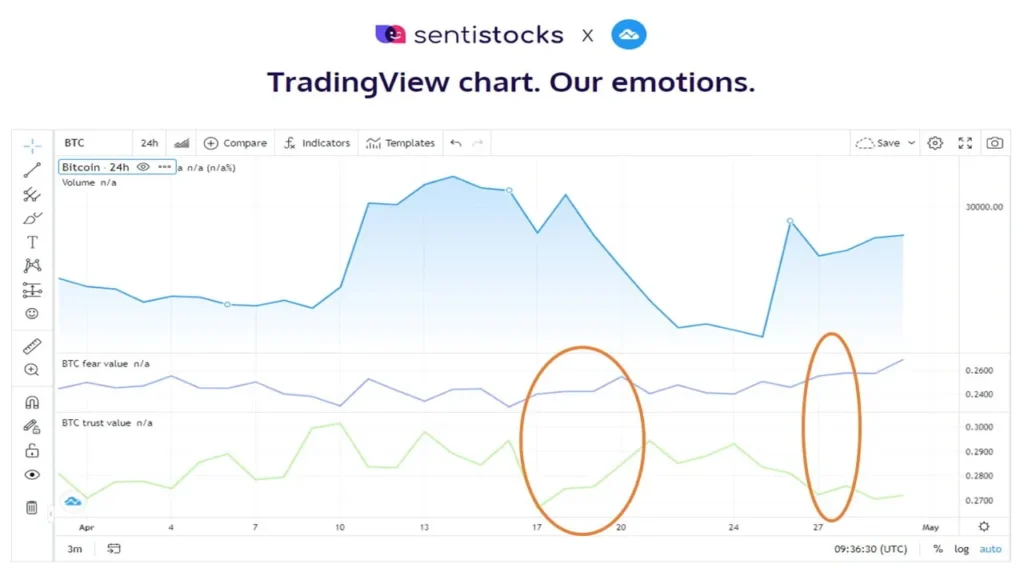

This is shown in a graph measuring the intensity of the emotions of fear and trust (https://tv.sentistocks.com).

As you can see, in April there was a situation where two upward trends of opposing emotions occurred simultaneously in investors. These include confidence and fear. These were also periods of significant changes in the value of the BTC price, which were difficult to interpret. Also, our bot, acting on a conservative strategy, had difficulty with this, and with some delay took a wait-and-see position – that is, a position in USDT.

SentiBot results

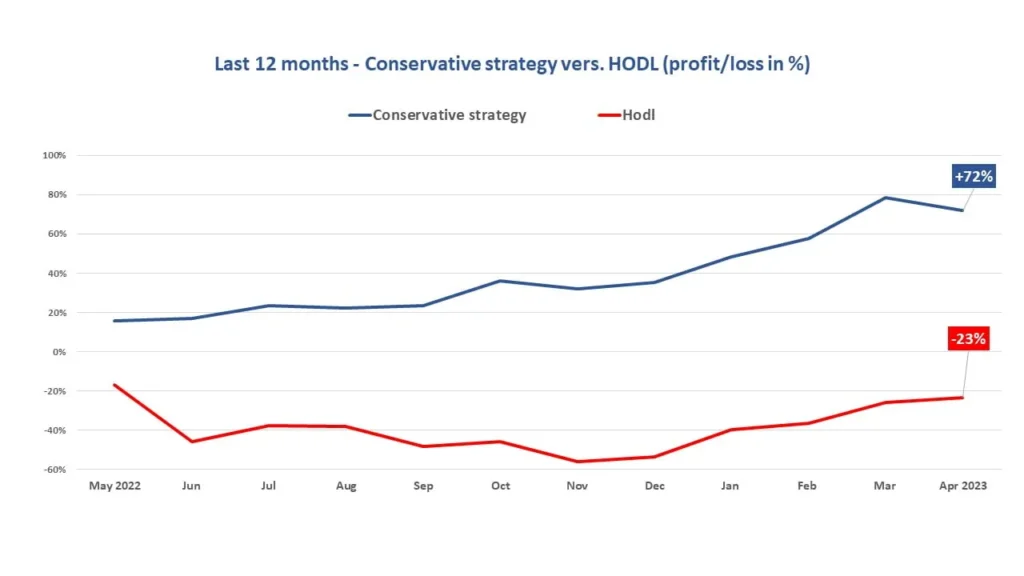

Analysis of results for the last 12 months (May 2022 – April 2023) shows the efficiency of SentiBot with a conservative strategy at +72%. In comparison, the HODL strategy recorded a loss of -23% during this period.

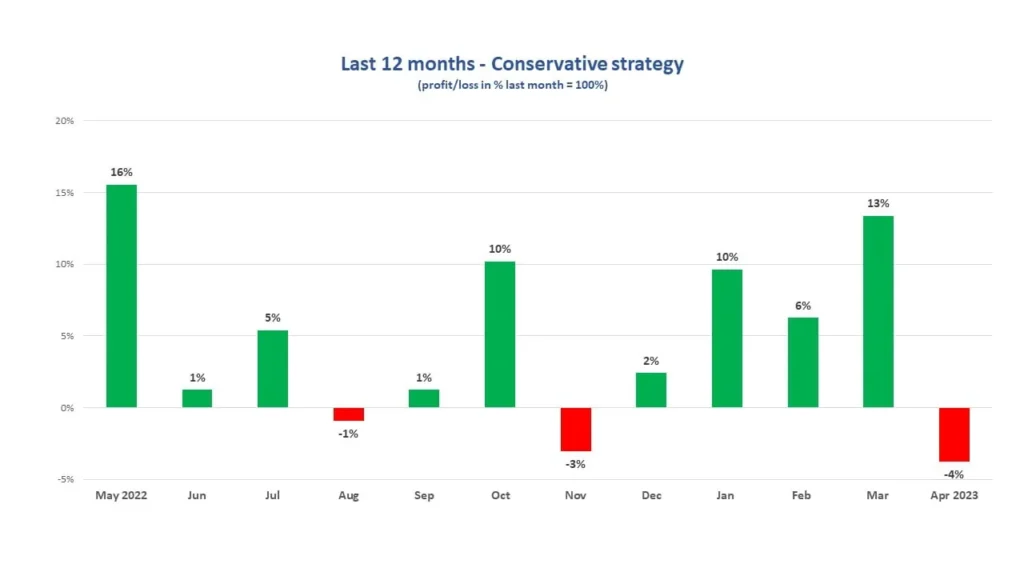

An analysis of monthly results shows that SentiBot protects the investor from possible large losses while providing the opportunity to generate profits. Unfortunately, for the reasons described above, April closed with a loss.

Evaluating the bot’s efficiency over 12 months, it is clear that this is only the third month when a loss is recorded, and that loss does not exceed 5%. The bot’s efficiency is also described by other analytical data, included in the table below.

As you can see, the average level of profit from closed positions significantly exceeds the average level of loss. Also noteworthy is the profit factor, which stood at 1.73 at the end of March 2023. This factor is defined as the sum of all transactions with a profit divided by the sum of all transactions closed with a loss. A profit factor above 1.50 is considered good enough, and above 2.0 is considered ideal.

Conservative versus dynamic strategy – a comparison

A small number of customers have taken advantage of the dynamic strategy opportunity, so let’s briefly summarize the results of this strategy compared to the conservative one, which is used by the vast (more than 95%) majority of customers.

The dynamic strategy made 87 closed trades in April. At the same time, the conservative strategy closed 5 trades. From the point of view of profitability, the dynamic strategy lost -9.16% last month. At the same time, the Binance portfolio using the conservative strategy lost -3.79%.

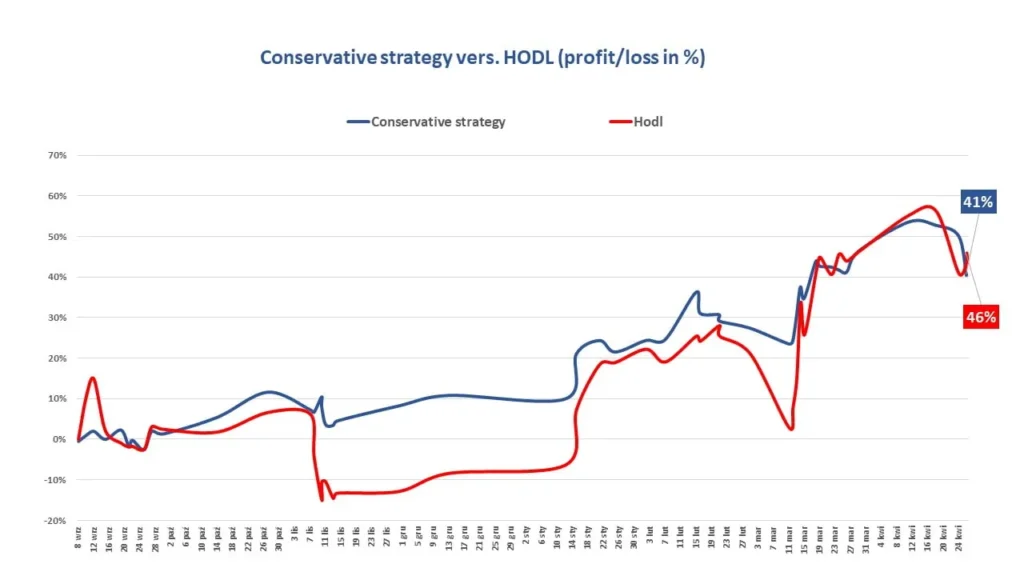

Results of the first commercial bot (conservative strategy)

The bot for our first commercial client with a conservative strategy was launched in September 2022. Below are its results recorded as of the end of April 2023 compared to HODL for the same period.

At the end of April, there was a situation for the second time when the profitability of the strategy involving breeding was higher than the efficiency of the bot. The reasons for this were outlined above. However, it should be noted that over the course of these eight months, in addition to generating profits, the bot successfully protected the investor from the spikes in the BTC price that occurred in November 2022 and March and mid-April 2023.