Sentimenti has created – based on measuring the intensity of emotions in correlation to BTC rates – the Senti-Trading-Bot tool. It allows to invest funds on the crypto market in the BTC/USDT pair. The tool can use, interchangeably, one of two investment strategies – dynamic or conservative.

Who is an investor using the Senti-Trading-Bot tool

Observing the group of investors using Senti-Trading-Bot, it can be seen that they share several common characteristics:

- they closely follow the current market trend of the BTC/USDT exchange rate and therefore choose a suitable strategy for the bot (today it is a conservative strategy),

- they analyze the past performance of Sent-Trading-Bot and plan their investments for longer periods (hence, they use six-month and annual subscriptions),

- carefully observe the current performance of Sent-Trading-Bot and incrementally increase the size of the committed capital (currently the average portfolio level is about $20,000),

- show resilience when the bot records (rare) losses – they do not withdraw capital, do not stop the bot’s work, do not cancel subscriptions.

How important it is to choose the right strategy for the market situation and a longer time horizon for investment is shown by the characteristics of the two strategies used by Senti-Trading-Bot.

The essence of the conservative strategy

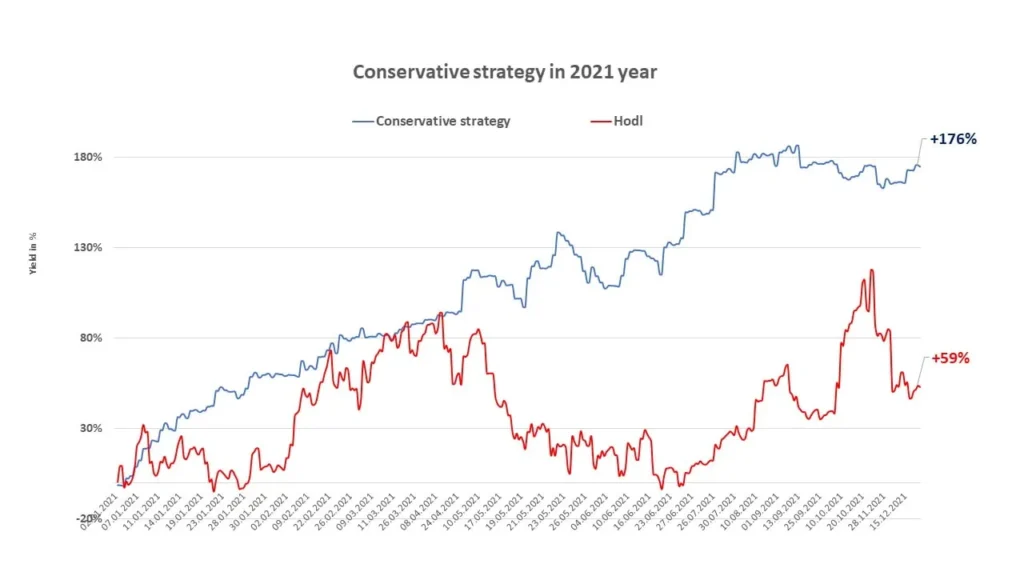

The conservative strategy is designed for its application in a BTC market, characterized by a long-term sideways and downward trend. The essence of this strategy is to make profits in such a market while maximizing protection against declines in invested capital. The assumptions adopted and incorporated into the strategy, even in a market with a long-term sideways trend, make it possible to achieve results far exceeding the usual BUY & HODL strategy and this without the use of leverage. This is shown in the strategy’s performance chart for 2021.

Of course, the effects generated in the form of profits are not as spectacular as in the case of the dynamic strategy (described below), but they are still nearly 3 times greater than with the usual BUY & HODL.

The advantages of the conservative strategy become apparent best in a market where a sideways or downward trend prevails. Such a situation is currently underway as of November 2021 in principle.

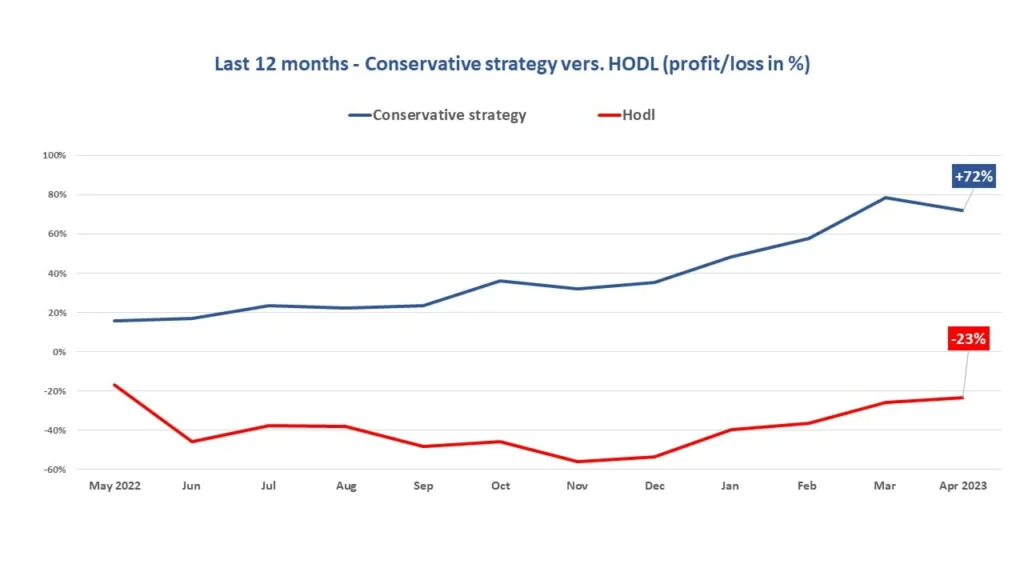

Below is a chart of the profits for the last 12 months made by Senti-Trading-Bot using a conservative strategy compared to the loss on a regular BUY & HODL.

As we mentioned above, the conservative strategy is designed to generate profits, but also to protect capital from losses. This is done even at the expense of the number of transactions carried out by the Senti-Trading-Bot tool. The bot buys only when a significant increase in the price is anticipated, and sells at the first signs of an anticipated decline, exceeding the rate adopted in the strategy. This approach makes it possible to minimize potential losses as much as possible, while at the same time gaining profits thanks to the high success rate of course predictability (more).

The essence of a dynamic strategy

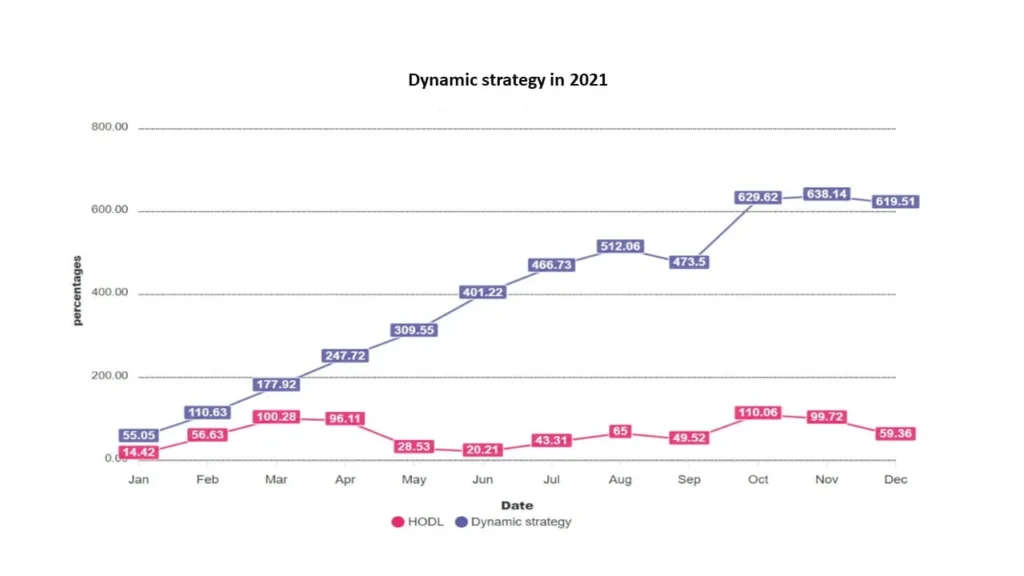

The dynamic strategy, using the experience of 2021, was prepared for the BTC market, characterized by sustained long-term growth. Its assumptions, it is important to emphasize, allow for extremely profitable results in such a market, without the use of leverage.

This strategy uses the basic assumption that price declines are short-term and increases, long-term. With this assumption, even on declines, investments are made (BUY) with the expectation of a quick change in the trend and a return to long-term price growth.

Unfortunately, this strategy is not advisable for the market trend that currently prevails. That is, the long-term sideways/downward trend.

If this is the case, as the performance chart for the period May 2022 – April 2023 shows, investments (BUY) made during a period of falling prices will not yield the expected returns in the future, as there are no conditions for the emergence of a long-term upward trend. Moreover, with a steady sideways or downward trend, these investments will yield losses.

We emphasize again: DYNAMIC STRATEGY IS EFFECTIVE IN A MARKET WITH A STEADY LONG-TERM UPWARD TREND.

The data presented by Sentimenti neither in whole nor in part constitute a “recommendation” within the meaning of the provisions of the Act on Trading in Financial Instruments of July 29, 2005, or Regulation (EU) No. 596/2014 of the European Parliament and of the Council of April 16, 2014. on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC, as well as Commission Delegated Regulation (EU) 2017/565 of April 25, 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organizational requirements and operating conditions for investment firms and terms defined for the purposes of that Directive. The content does not meet the requirements for recommendations within the meaning of the aforementioned law, among other things, it does not contain a specific valuation of any financial instrument, is not based on any valuation method, and does not specify investment risks.