Two bots were given the roles of investors. They used two different emotion-based investment strategies: a conservative one and a dynamic one. We analysed the results of their actions relative to the price of the bitcoin that was traded, the rate of return and the risk that each investment entailed.

An important caveat: the bot makes a choice every hour and only between two options – a long position or no position. For this reason, its profits are solely dependent on the rise in the price of bitcoin. The bot always plays with its full available capital and does not use leverage.

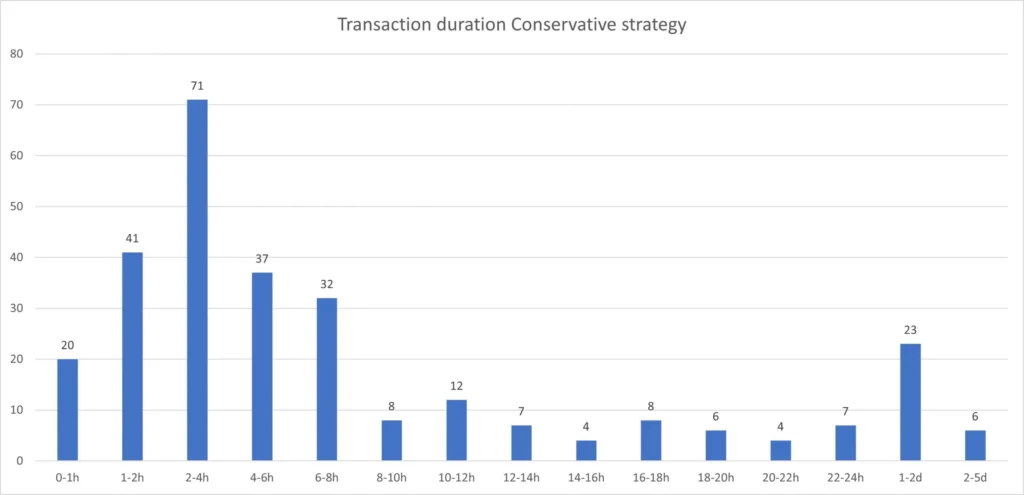

The study lasted for 2 years, or 730 days (from 1 January 2021 to 31 December 2022). The conservative strategy made a total of 287 trades during this period, of which 52.2% were profitable (win ratio). The dynamic strategy, on the other hand, made as many as 2313 trades, of which 47.7% were profitable. The average trade duration for the conservative strategy was 10 hours and 14 minutes (0.43 days), and the longest trade lasted as long as 8.5 days. The distribution of position durations is shown in Chart I.

Chart I: Distribution of transaction duration, conservative strategy

For the dynamic strategy, the average position duration was noticeably shorter, at 3 hours and 43 minutes (0.16 days), and the longest position duration was 40 hours (1.66 days). The distribution of position durations for the strategy is shown in Chart II.

Chart II: Distribution of transaction duration, dynamic strategy

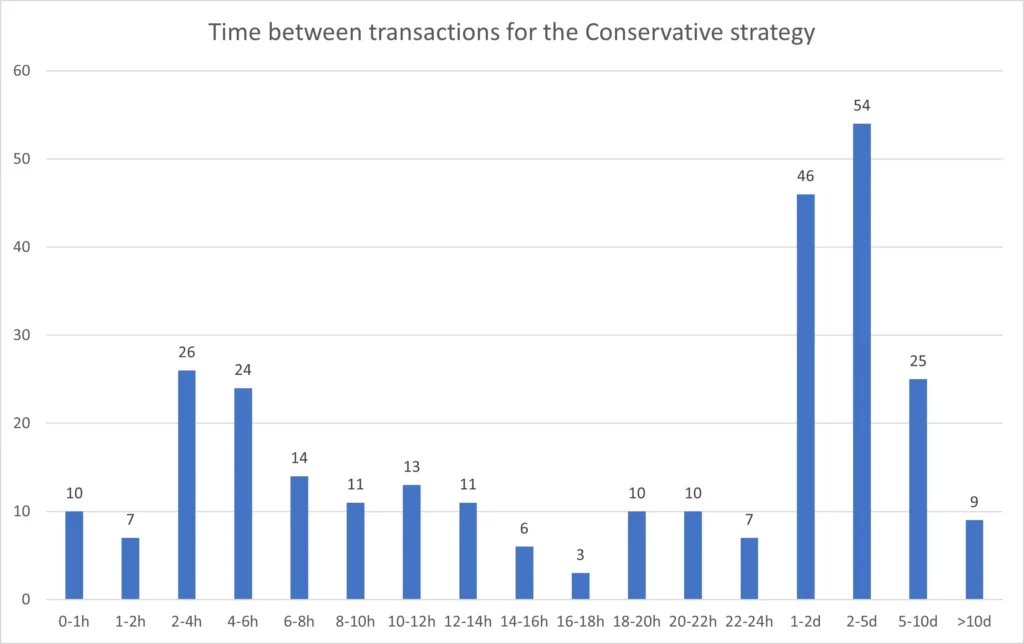

How long, on average, did the bot remain out of position, ‘sitting on cash’? For the conservative strategy, the average period between trades is 2.06 days, and the longest wait to enter a position lasted almost a month, at 28 days (see Chart III).

Chart III: Distribution of the length of time between transactions, conservative strategy

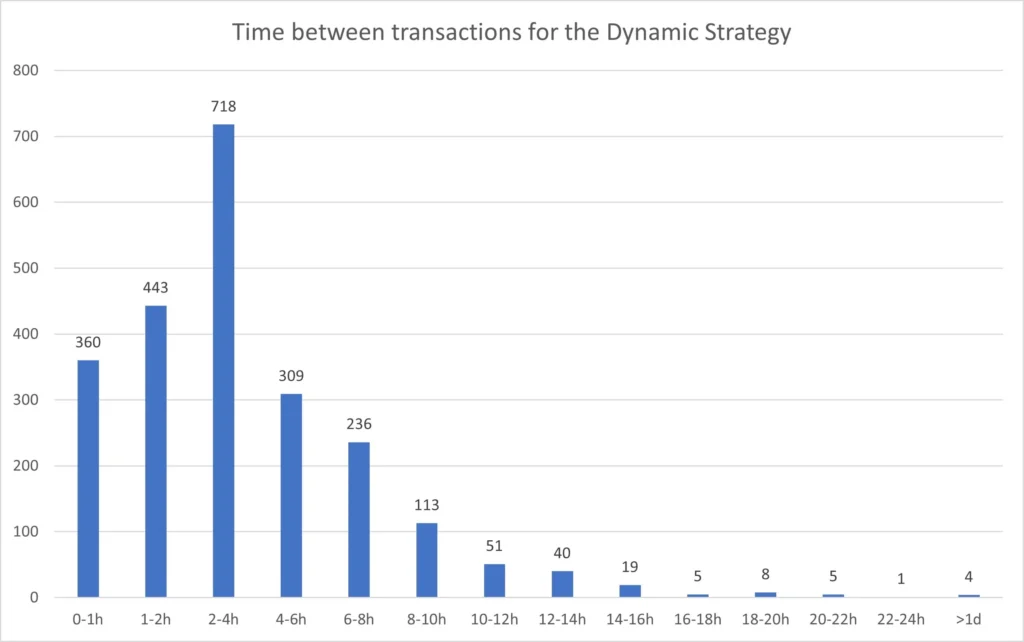

The dynamic strategy almost continuously remained, with an average wait between positions of 3 hours and 51 minutes, and the longest indecision lasted nearly 1.5 days (see Chart IV).

Figure IV: Distribution of the length of time between transactions, dynamic strategy

Risk analysis

When analyzing investment strategies, it is important to consider investment risk. There are a number of approaches to determining risk, including symmetric, according to which greater risk increases the chance of profit, asymmetric, which assumes a level of acceptable investment loss, and factorial, which analyses how individual factors affect an investment portfolio.

Standard deviation

Standard deviation, a measure of volatility and investment risk, is used to determine a measure of symmetric risk. In portfolio analysis, standard deviation is used to determine the volatility of investment returns in a portfolio. This means that the higher the standard deviation, the higher the investment risk.

The standard deviation is determined by the variability of investment returns over time. An increase in the standard deviation means that an investment is riskier because investment returns are more variable. Conversely, a decrease in the standard deviation means that the investment is less risky because the investment returns are more stable.

Standard deviation is one of the most important risk indicators in portfolio analysis. Using this measure, investors can compare different investment portfolios and select those that provide the most optimal combination of risk and return. In practice, investors usually aim to minimise the standard deviation of their portfolio, i.e. to achieve the lowest possible risk with the highest possible investment returns.

The annual standard deviation over the study period for bitcoin was 77.64%, which can be interpreted that such was the fluctuation of the BTC price over the year. The standard deviation for the conservative strategy was 47.5% and for the dynamic strategy 56.7%. This means that the conservative strategy was almost 40% less risky than investing in bitcoin and the dynamic strategy was 27% less risky.

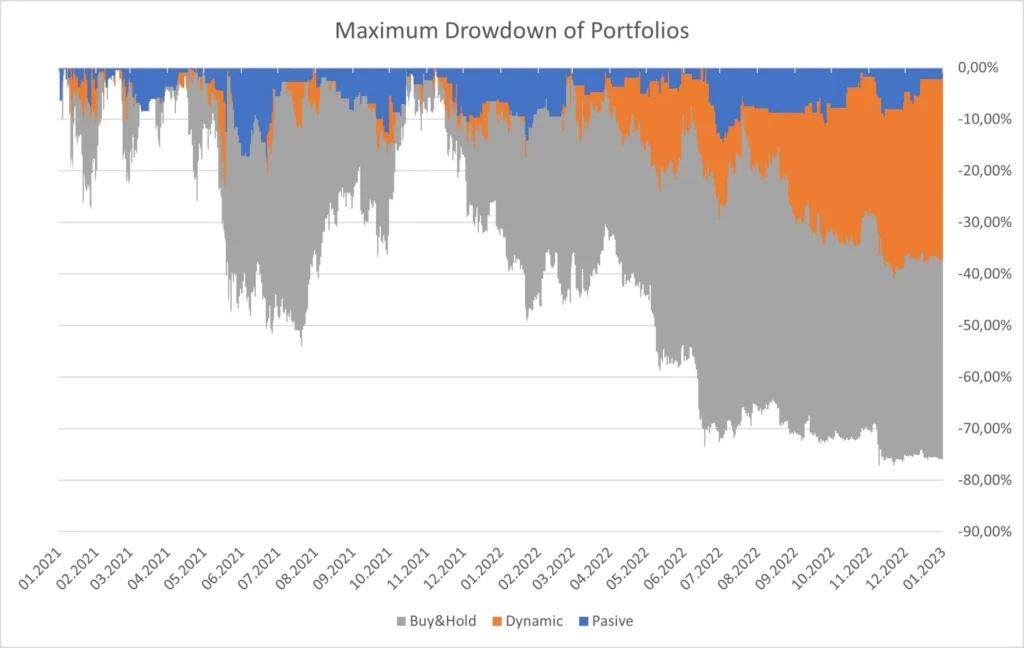

Portfolio Drowdown

The standard deviation analysis seems to contain one key problem, which is the failure to identify the direction of risk. We may have, for example, two different portfolios. One of them will have a lower standard deviation and yet it may have a lower return or even come out in the negative. For this reason, asymmetric risk analysis uses, among other things, the maximum slippage of an investment portfolio from its peaks (drowdown). In the case that we were to follow a Buy&Hold strategy on bitcoin, we would experience a reduction in portfolio value of as much as 77.3%. As expected, the conservative strategy was the safest, with the largest value loss of only 18.6%. The dynamic strategy lost a maximum of 40.7% in value during the study (see Chart V).

Chart V: Maximum fall in portfolio value, all strategies

Portfolio correlation and beta

The direct factor that affected the portfolio is the change in the price of bitcoin. The correlation, which is the level of dependence measured in values from 1 to -1, indicates how much a change in the price of bitcoin interacted with a change in the value of the portfolio. For the conservative strategy, the correlation was 0.42 (R^2=18%) and for the dynamic strategy 0.66 (R^2=44%). Both strategies, as one would expect, therefore react in the same direction as bitcoin. However, it is the dynamic strategy that is much more correlated to changes in the price of the cryptocurrency.

Beta is a measure of the systematic risk of an investment that determines the sensitivity of an investment to market movements. That is, beta determines how an investment moves in relation to market movements. Beta also measures the degree of volatility of an investment’s returns in relation to the underlying portfolio taken (in this case, the price of bitcoin). A beta of 1 means that the investment moves with the market, a beta greater than 1 indicates that the investment is riskier than the market, and a beta less than 1 tells us that the investment is less risky than the market. The beta of the conservative strategy was 0.26 and for the dynamic strategy it was 0.48. Both strategies proved to be at least twice as risky as investing in bitcoin.

The risk study shows that over the analysis period, investments made by the bot had a lower level of risk than an investment in bitcoin, regardless of the risk measure used. This means that the bot had greater investment stability and was less exposed to market volatility than bitcoin.

Investment performance and portfolio analysis

In terms of the percentage of successful trades (the so-called win ratio), the conservative strategy achieved an efficiency of 52.2%, meaning that just over half of the trades ended profitably. In the case of the dynamic strategy, the result was 47.7%, meaning that just under half of the trades ended with a profit.

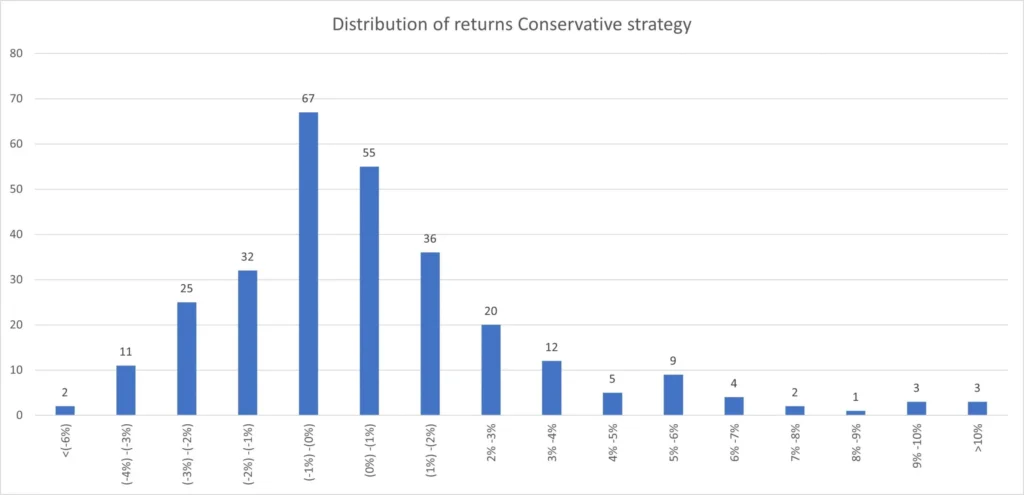

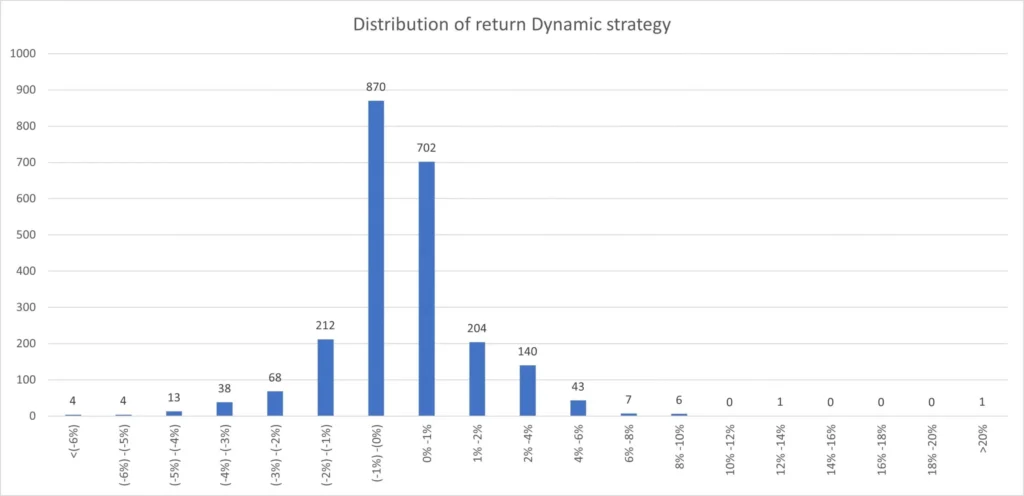

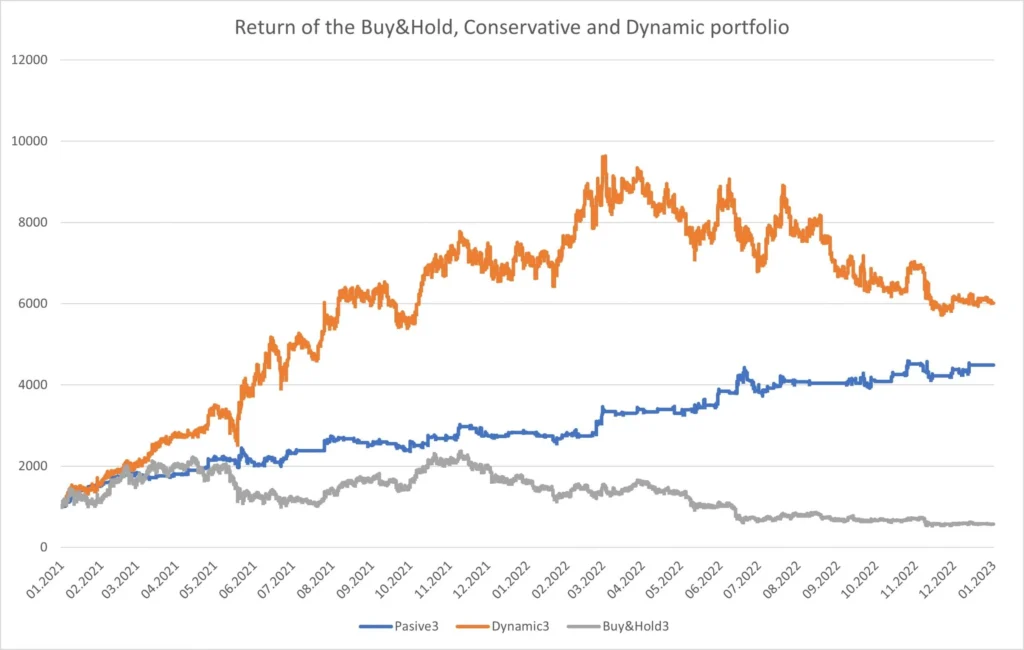

Although the efficiency of the transactions may seem unsatisfactory, let us consider where this result came from and does it really matter? The total return for the conservative strategy was 348.8% (5.3% on average per month) and the dynamic strategy as high as 501.3% (7% on average per month). Meanwhile, the return for the Buy&Hold strategy was -43.1%. The returns of the conservative and dynamic strategies shown in Charts VI and VII maxed out at 4.14% and 7.73% respectively for a single trade. The highest return in a single trade was 12.5% for the conservative strategy and as much as 22% for the dynamic strategy. In both strategies, the average return slightly exceeds zero.

Chart VI: Distribution of returns, conservative strategy

Chart VII: Distribution of returns, dynamic strategy

Both graphs are right-skewed, meaning that the median for each is smaller than the mean. Such a distribution is characteristic of strategies that rely on holding gains for a long time and reducing losses quickly. The total returns on the initial US$1,000 can be seen in Chart VIII.

Chart VIII: Comparison of strategies over time

How have the different strategies fared during periods of growth and decline?

In order to assess the effectiveness of the strategy in relation to trends in the bitcoin market, let us divide the period from the beginning of 2021 to the peak price on 11 November 2021. (almost 12 months) into two parts.

During the first period, the price of the cryptocurrency increased by 137% (1.4% on average per month). The conservative strategy recorded an increase of 197.1% (3.1% monthly average) and the dynamic strategy as much as 666.8% (9% monthly average).

Since the peak, however, the price of bitcoin has fallen by 76%. During this time, the conservative strategy portfolio recorded a gain of 51% (3.1% on average per month) despite the instrument’s decline, while the dynamic strategy portfolio lost 21.6%. It appears that we can clearly deduce that the conservative strategy proved to be better during bitcoin’s downturn.

Key portfolio analysis indicators (Sharpe & Calmar ratio)

Various portfolio analysis metrics are used to assess the effectiveness of investment strategies. One of the most popular is the so-called Sharpe ratio. It estimates the above-average returns over an investment in a risk-free asset (measured as the yield on government bonds, in this case 3% per year) relative to the risk (the volatility of the portfolio, measured as the standard deviation) needed to achieve these returns. In other words, the Sharpe ratio compares the degree of risk taken by the investor with the returns obtained. Ratio values above 3 are considered to be among the best investments.

During bitcoin’s rise, the Sharpe ratio was 1.9 for the cryptocurrency investment, 6.5 for the conservative strategy and 14.7 for the dynamic strategy. Only the conservative strategy can record a positive rate of return during bitcoin’s decline, with a Sharpe ratio of 1.48. We can deduce that during increases, up to 7.7 times the dynamic strategy proved to be better than investing in bitcoin itself. The value of the Sharpe ratio for the entire period in question for bitcoin was minus 0.32, for the conservative strategy it was 6.02, for the dynamic strategy it was 3.57. This would mean that the conservative strategy had the highest ratio of profit to assumed risk over the entire period in question.

We can also determine the composition of investment portfolios through the Calmar ratio (Calmar ratio). It is constructed similarly to the Sharpe ratio, but the risk is measured as the largest decrease in the value of the portfolio, which gives a picture of the ratio between profit and maximum risk of loss. The value of the ratio for bitcoin during the high-growth period was 3.17, at that time for the conservative strategy 14 and 36.16 for the dynamic strategy. During the period of bitcoin’s decline, only the conservative strategy achieved a positive return, with a Calmar ratio of 2.8. For the investment period as a whole, the Calmar ratio values for the conservative strategy were 6 and for the dynamic strategy 3.6. Which, as with the Sharpe, would mean that the conservative strategy ultimately dominated during the period studied.

This article is only an analysis made by Grzegorz Dróżdż MPW, CAI for his research purposes on 01.04.2023. The article does not constitute investment advice nor is it intended to encourage the purchase, sale, or investment in any assets specifically mentioned in it. The author of the article accepts no responsibility for any investment decisions made based on the information contained in the article.

I encourage you to use the information contained in the article for educational and informational purposes only, and to consult an experienced financial adviser before making any investment decisions.