Everyone expects an increase in the value of the portfolio, regardless of the market situation. This is understandable. But is this the only indicator by which to judge the effectiveness of investment strategies or the tools behind them? Let’s take a look at July and the first two decades of August.

After a profitable June and a sideways July, most market commentators expected a strong rebound in August. Reasons for this (aside from FOMO and, as always, wishful thinking) included anticipation of a series of positive SEC decisions against ETF applications on Bitcoin. Several articles appearing online further fueled the atmosphere of an impending bull market.

Was the same sentiment evident in the spontaneously expressed emotions on social media, which Senti-Bot mainly relies on? Assessing the behavior of the bot, learned from historical Tweets (X-ts😉) from more than two years in correlation to five-minute candles, this was not the case.

Despite analyzing behavioral data from the market every quarter-hour, Senti-Bot only occasionally entered a position, fleeing it after a sharp reversal. Likewise, the few attempts made to buy did not find a willing buyer in the market to resell, at a price for which it would pay to perform the operation. Especially since, it is worth mentioning, the bot has to take into account exchange commissions every time, as an additional cost of the operation, and does not enter a position in which a gross profit would be recorded, but in the end, after deducting exchange fees, the client would be a net loss on it. As you already know, we constantly try to report our net efficiency. We don’t color with gross results that don’t include commissions, we don’t change the evaluation periods of the bot to make it as favorable as possible, and we don’t use other tricks. The statistics will defend themselves. Let’s check it out:

Senti-Bot versus HODL

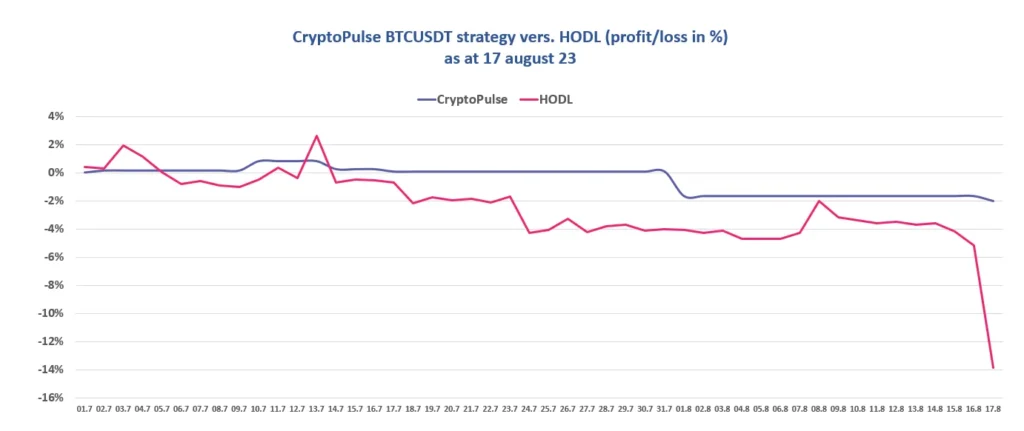

The averaged BTC price as of July 1 was about $30,300. At the time of writing this summary (August 18, 2023), the value of BTC was around $26,000. Based on Binance data, the decline in July was -4.10% and in August -9.30%, totaling for the entire period from July 1: -13.40%. During the same period, the change in the value of the portfolio supported by the CryptoPulse BTCUSDT strategy, was: for July: +0.10%, for August: -2.10% and total for the entire period: -2.00%

Change in the value of our client’s portfolio

The average value of the Binance account that Senti-Bot has access to is, as of the date of writing this article, $10,000. We take this opportunity to thank you for your confidence, seeing that most clients regularly increase the value of their portfolio, often starting with $100, “on a trial basis”.

With this assumed value of the portfolio, if it had remained in BTC, it would have recorded a loss of -1,340.00 USD. The bot at the same time lost -2.00% on operations, that is $200.00. The fee for the bot at this point is $49. In these last 6 weeks, for the averaged Sentistocks customer, the bot, by protecting capital, has earned its costs for the next 24 months. Even if the value of the portfolio had been half as much, the Senti-Bot, watching the investor mood in the market all the while, earned itself another year by protecting the client’s capital. One could say, lucky those who did not buy BTC at the beginning of the month or earlier and are now unfortunately counting a loss, but took advantage of the strategy sewn into Senti-Bot and stayed in USDT.

Good strategy is not just about profits

Equally important are the parameters chosen to simultaneously protect capital in uncertain situations. A balanced approach to the market, honest reporting of results, continuous work on optimization – these are the values that have and will continue to define Sentistocks.