The last period was characterized by a dynamic increase in Bitcoin’s price. Besides, the “direction-north” periods for cryptocurrencies have already repeated several times in 2023. This situation has prompted many questions from Senti-Bot users – whether it is time to apply a dynamic version of the current CryptoPulse 2.0 strategy. So let’s take a closer look.

Bitcoin exchange rate changes in 2023

From the beginning of the year to November 13, Bitcoin’s exchange rate rose 121%. The biggest increases were recorded in January, March, June, as well as October and the first half of November 2023. On the other hand, the exchange rate also recorded significant declines, especially in May and in the July-August period, leaving investors and traders unmoved.

In particular, the recent increases in the price of Bitcoin (October and November) have led to increased user interest in Senti-Bot, a dynamic version of the CryptoPulse 2.0 strategy. We are constantly monitoring the situation and testing this version of the strategy. Today, we would like to share the results of our observations and provide an answer to the question being asked – whether the time has come for changes in the Senti-Trading-Bot strategy.

Current CryptoPulse 2.0 strategy versus CryptoPulse Dynamic

How the dynamic version of the CryptoPulse strategy differs from the current 2.0 strategy. Now the parameters aimed at limiting investment risk are set at the maximum level. This results in faster closure of open positions as a result of even small fluctuations in investor sentiment, measured by the intensity of emotions in opinions expressed on social media. In the case of CryptoPulse Dynamic, only a significant fluctuation in the intensity of investor emotions triggers the parameters that control the closing of open positions. This approach to measuring the intensity of investor emotions has been attributed to a market where a long-term upward trend prevails. We have repeatedly pointed out in our publications this aspect of the strategy’s connection to market trends.

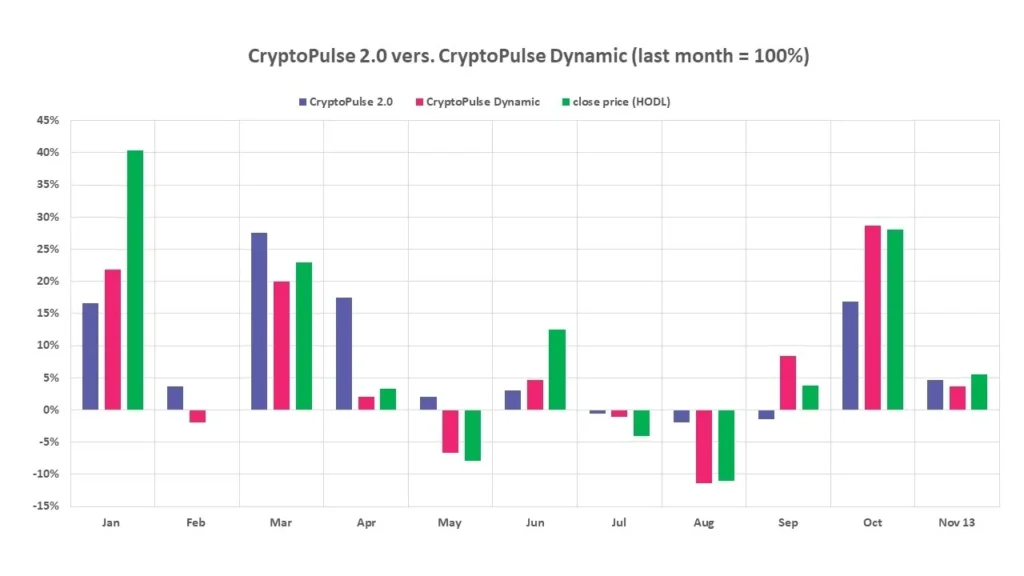

In Figure 2, we present the results of our observations and analysis on the application of the dynamic strategy to the Bitcoin market in 2023. We present the results by comparing them to the results achieved in the previous month.

As you can see, the dynamic strategy records the best results during periods of a rising market for BTC. This was especially the case in January, June, and October. There, the dynamic strategy allowed to obtain results better than in the currently used CryptoPulse 2.0 strategy. On the other hand, during periods of a downward or sideways trend for the Bitcoin price (February, April, May, July, August). The CryptoPulse 2.0 strategy gives investors far more security in terms of protecting the capital involved (it gives profits or definitely minimizes potential losses)).

The fundamental differences between the CryptoPulse 2.0 and Dynamic strategies can be seen even more clearly over the long-term horizon (Figure 3). The net results obtained using the CryptoPulse 2.0 strategy (+124%) are significantly higher than those possible using its dynamic version (+81%). A bot using the current strategy (CryptoPulse 2.0) during periods of significant declines in Bitcon’s price looks even more favorable compared to the dynamic version, but also to the so-called HODLing. This is shown in Figure 3, where during periods of steep declines in the price of BTC, Sent-Bot effectively protected the capital involved, protecting investors from losses and preserving the profits made while using the bot.

Summary

We are working on a dynamic strategy for the bot. The above results are still working versions that we are optimizing. However, we believe that its launch should still wait until a clear and steady uptrend really takes hold. For now, it is still difficult to talk about a bull market. As soon as it appears, we will be ready!