For over a year, we have published on our website https://sentistocks.com/ and on social media (Facebook and Twitter) the results of our forecasts relating to changes in the trend of the bitcoin exchange rate (BTC).

Forecasting tools

Forecasts of the BTC exchange rate trend changes are made solely on the basis of the Sentistocks Model developed by us. This model uses the proprietary Sentimenti tool that measures the intensity of 8 basic emotions and arousal in texts (mentions) posted on social media relating to bitcoin.

Thanks to algorithms embedded in artificial intelligence, we are able to correlate these emotions with financial data (open, high, low and close rates) and on this basis forecast the trend of the BTC exchange rate (recently also ETH and in the near past other assets, not only cryptocurrencies).

Currently, we conduct our forecasts in four-time frames – for 24 hours, 8 hours, 4 hours and for 1 hour.

How to use our forecasts

We have faced the following questions many times:

- How to use forecasts in stock exchange trading,

- Whether it is possible to effectively invest in the stock market by using information about the expected change in the trend.

Today we would like to demonstrate you on a specific example, how to use our BTC price predictions. For this purpose, a virtual account was created in early 2021. In buy / sell operations, we used:

- real financial data from the Bitstamp exchange (OHLC)

- our 1-hour predictions of the average BTC rate.

We have not applied any sophisticated investment strategy based on technical analysis indicators. Buy / sell decisions were made solely on the basis of our predictions (BTC trend forecasts).

Assumptions adopted:

- If the 1-hour trend of the predicted BTC rate avg is upward compared to the true avg of the last hour, then SELL,

- If the 1-hour trend of the predicted BTC rate avg is downward compared to the true avg from the last hour, then BUY,

- The price limit for SELL is the last known rate close + 0.48%,

- The BUY price limit is the last known rate close – 1.87%,

- 100% of the funds held are involved in each operation,

- Maker commission – 0.04% on each transaction made,

- Involved virtual capital – 1000 USD,

- Investment period from 01/01/2021 to 06/30/2021.

Results achieved

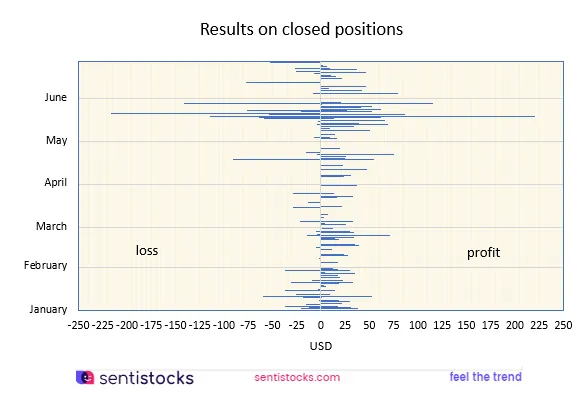

Using the information from our forecasts, we obtained very interesting results concerning 182 closed positions executed in the period from 1 January to 30 June 2021.

The results on individual transactions are presented in the chart below.

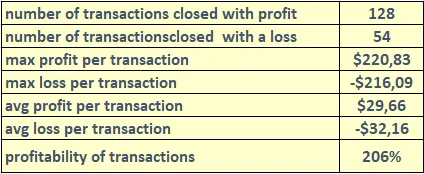

The summary of aggregated results is presented in the table below.

The closed positions resulted in a total profit of USD 2,059.53 with the invested capital of USD 1,000, which stands for a profitability of 206% in the period of 6 months (see Chart below).

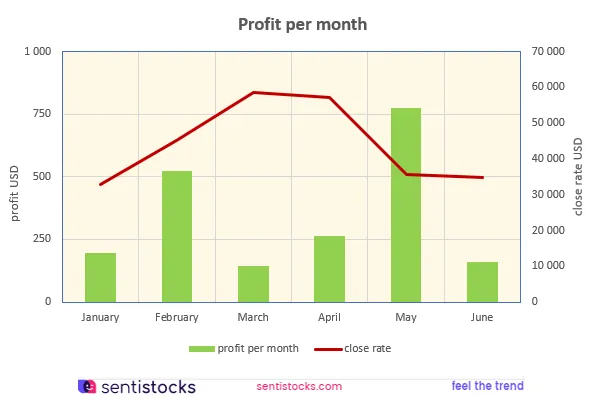

The summary of monthly profits is presented in the chart below.

It should be noted that we make profits from closed positions, regardless of whether the BTC price was in the upward or downward phase. In particular, it should be emphasized that we achieved the highest level of monthly profit in May 2021, in the context of a significant decline in the BTC rate.

The data presented by Sentimenti neither in whole nor in part constitute a “recommendation” within the meaning of the provisions of the Act of 29 July 2005 on trading in financial instruments or the Regulation of the European Parliament and the Council (EU) No 596/2014 of 16 April 2014. on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulations (EU) 2017/565 of 25 April 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive. The contents do not meet the requirements for recommendations within the meaning of the above- mentioned Act, inter alia, they do not contain a specific valuation of any financial instrument, are not based on any valuation method and do not specify investment risk