October was a month of growth in the Bitcoin market. This was also evident in the emotions of investors, which affected its price.

Table of contents

Table of Contents

Senti-Bot results

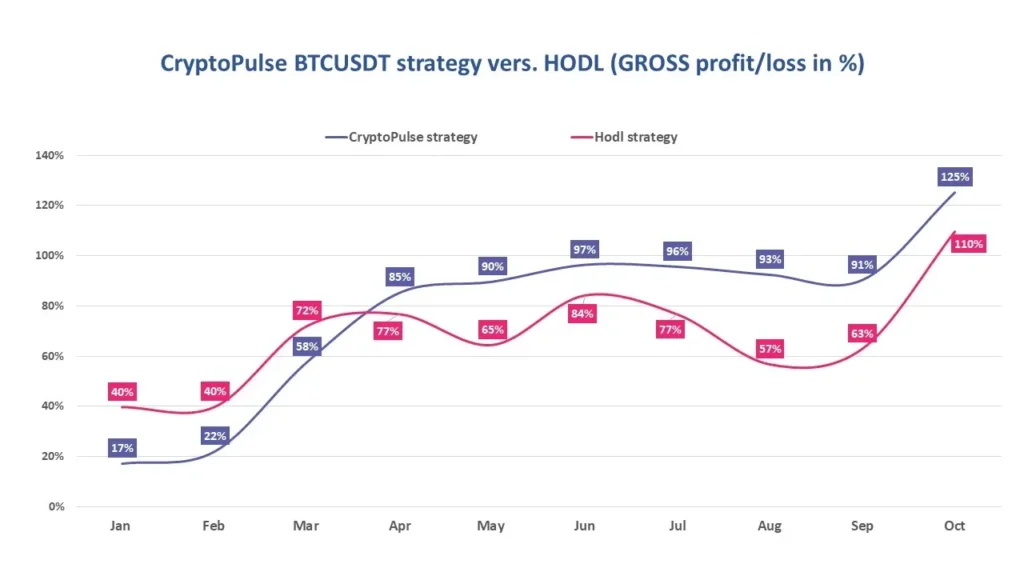

To make it easier to compare the effectiveness of Senti-Bot’s performance on the Bitcoin market to other tools and other financial instruments, for starters we present its results in gross terms. That is, without taking into account the cost of commissions charged by the exchange, in this case Binance. This is a common way of presenting results, unencumbered by the commissions of a given exchange, broker, liquidity provider, etc.

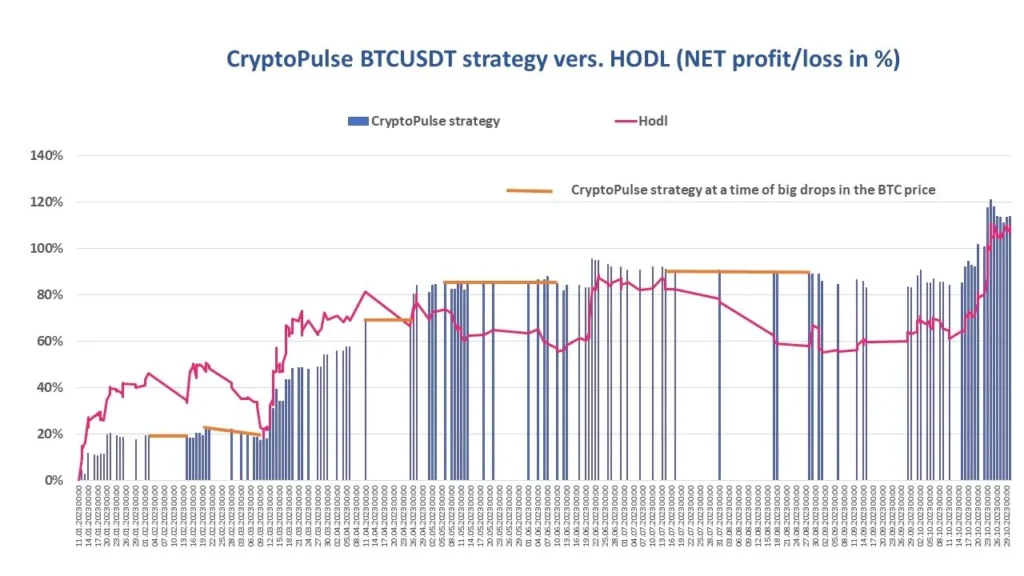

In the following analysis, Senti-Bot’s results are presented and analyzed in net terms (including the cost of commissions paid to the exchange).

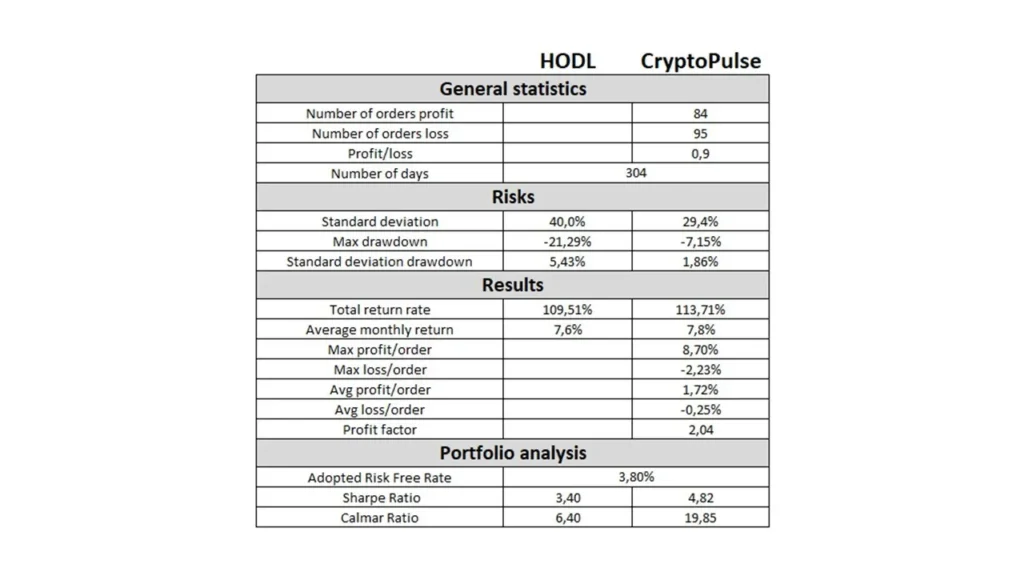

The analysis for the period January – October for closed positions shows that even during dynamic increases in the price of BTC, the cumulative results obtained by the bot operating on the CryptoPulse BTCUSDT strategy (+114%) are higher than those obtained using the hodl method (+110%). Although it should be objectively noted that in October, the dynamics of incremental gains in hodling exceeded the dynamics of growth of the bot.

This is due to the main goals of Sent-Bot’s operating strategy. This strategy includes as primary objectives:

- protection of committed capital from losses resulting from spikes in the BTC exchange rate

- followed by the generation of profits from the operations carried out.

The achievement of these goals can be seen most clearly when analyzing the results obtained against the change in Bitcoin’s rates in 2023.

The chart above clearly shows how effectively the bot hedged the capital involved in BTC transactions while giving the opportunity to generate profits.

In the January-October period, there were at least five longer time frames in which there were significant declines in the BTC price. These declines definitely reduced the profitability of hodling and showed how risky such an investment strategy is. During this time, Senti-Bot successfully hedged capital by anticipating declines and exiting BTC to USDT and giving its users “peace of mind.” By “peace of mind” is meant the absence of the dilemmas that plagued HODL investors, among others:

- What to do during longer declines in the price of BTC,

- Whether to close positions with losses,

- or wait out a difficult period,

- how long to watch the declining balance in the account,

- how often to check and watch your position in an attempt to protect it from excessive losses.

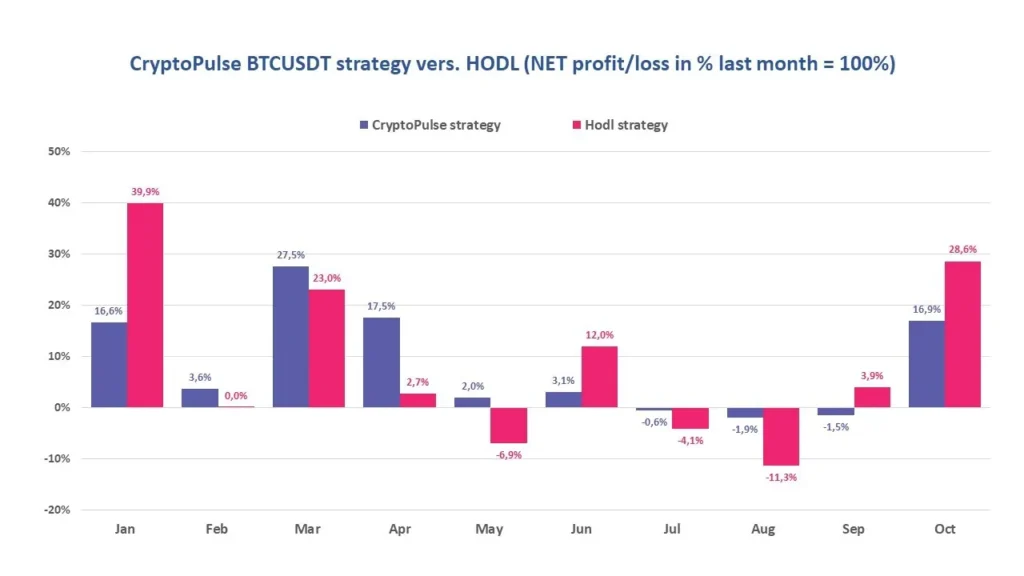

An analysis of Sent-Bot’s monthly results shows that even if the bot recorded losses – they were several times lower than in the case of breeding. This also confirms the bot’s realization of the primary goal of its operation, that is, maximum protection of the capital invested in the Bitcoin market.

This was and is generally the guiding principle behind the Sentistocks project. We achieve it by choosing the largest asset, the largest exchange and just a safe strategy so that the investor feels as comfortable as possible in the unregulated and still dynamically changing cryptocurrency environment.

Senti-Bot performance indicators

From the very beginning, we emphasize that the effectiveness of Senti-Bot should be considered over a period of more than one or two months. Important elements of assessing the effectiveness of our tool are measurements of such indicators as:

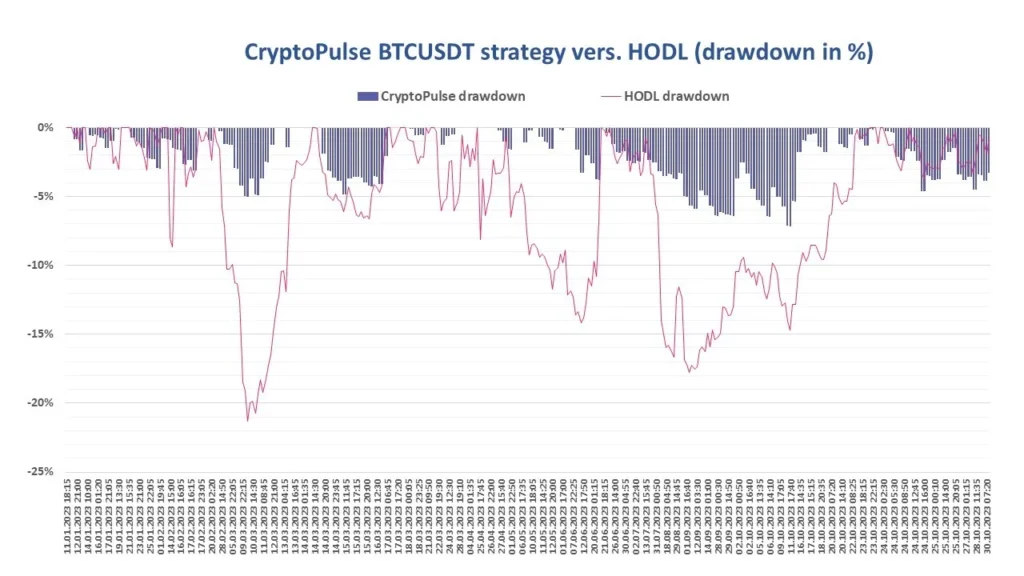

Drawdown

This indicator stands for capital slippage. It is the difference between peaks and lows on the capital curve. The indicator is most often expressed in the form of maximum capital slippage, where the comparison of the minimum historical capital value to the current one is chosen for the calculation

The maximum Drawdown (in January-October) for the CryptoPulse BTCUSDT strategy was -7.15%, while in HODL-ing it was as high as -21.29%.

Profit Factor

Another measure that deserves attention is the Profit Factor. This ratio is defined as the sum of all transactions with a profit, divided by the sum of all transactions closed with a loss. Its value above 1.50 is considered good enough, and above 2.0 is considered ideal.

The Profit Factor for Senti-Bot was 2.04 at the end of October 2023.

Also important for investors are ratios that measure the rate of return achieved to the risk taken. In this case, we present the Sharpe Ratio and Calmar Ratio.

Sharpe Ratio

The Sharpe ratio measures the risk-adjusted return. The higher this ratio is, the better the investment performance. If it is negative, the return on investment will not be higher than the return on risk-free assets. A Sharpe Ratio of 3.0 or higher is considered excellent.

For Senti-Bot, the ratio stood at 4.85 as of the end of October, which is significantly higher than for breeding.

Calmar Ratio

Calmar Ratio is a risk indicator that determines the ratio of the return (calculated on an average annual basis) in relation to the maximum slippage. In general, the higher its value, the better. This is because it signifies by how many times the average annual cumulative return exceeds the landslide to date. Values below 1 mean that the slippage was higher than the rate of return.

For Senti-Bot, the value of this indicator was 19.85 at the end of October, three times higher than for breeding.