November is another month that allows us to happily present the results of Senti-Bot. The SentiStocks team has developed and delivers to you a tool that allows you to combine efficiency in the cryptocurrency market with maximum risk protection.

Table of contents

Table of Contents

Senti-Bot results

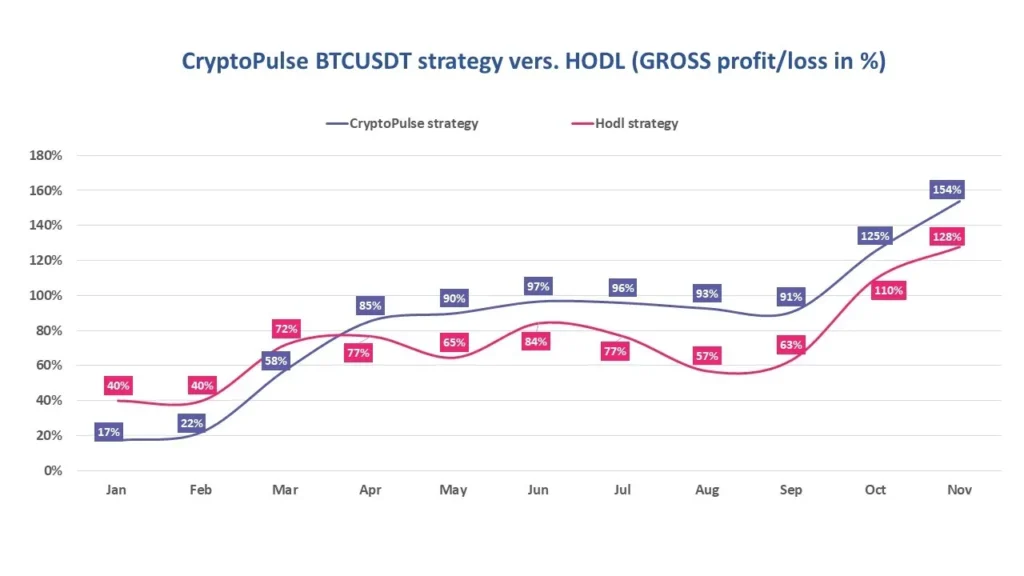

In order to objectively compare Senti-Bot’s performance in the Bitcoin market with other available tools and various financial instruments, we first present its performance in gross terms (not including the cost of commissions charged by the exchange – in our case Binance).

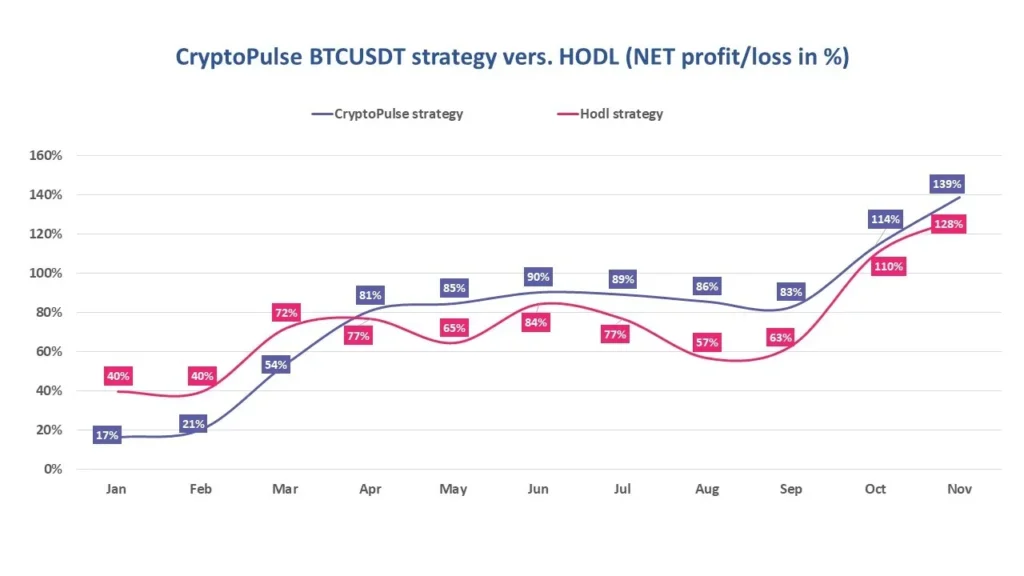

At the end of the day, however, the key results for each of you are the net results (after commission costs). We present these in the graphics below.

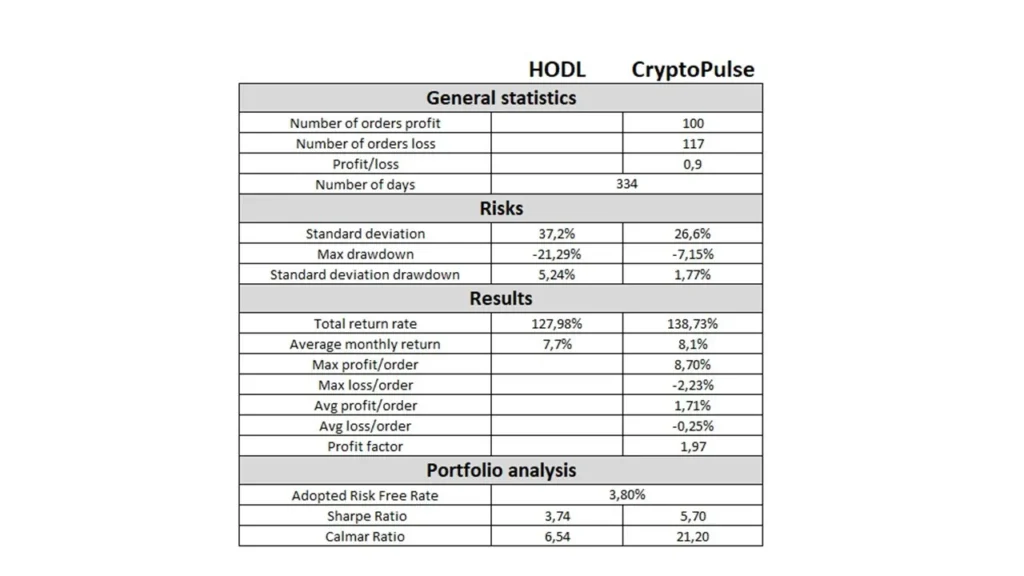

The January-November period was characterised by significant fluctuations in the Bitcoin exchange rate, which makes the results achieved by Senti-Bot particularly noteworthy. The tool made available to you achieved a profitability of +139%, which exceeds the results recorded using the so-called herding strategy (+128%).

It is worth noting that Senti-Bot is currently operating with the CryptoPulse BTCUSD strategy, whose main objectives are:

- Protecting investment capital from losses resulting from sharp falls in the BTC exchange rate.

- And, in the next instance, generating profits from the operations carried out.

The effectiveness of achieving these objectives is clear from an analysis of the results obtained to date in the context of the volatility of the bitcoin exchange rate.

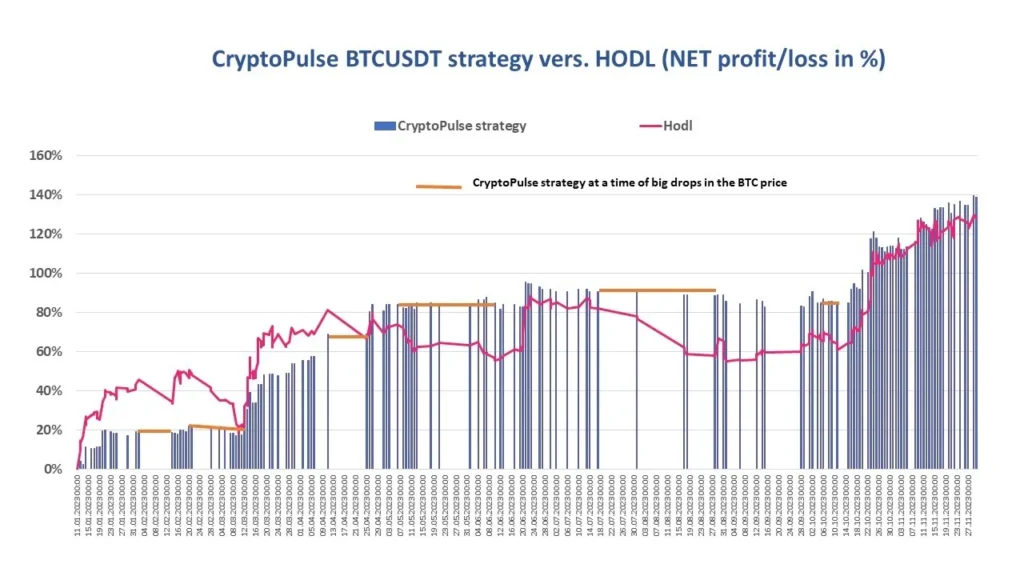

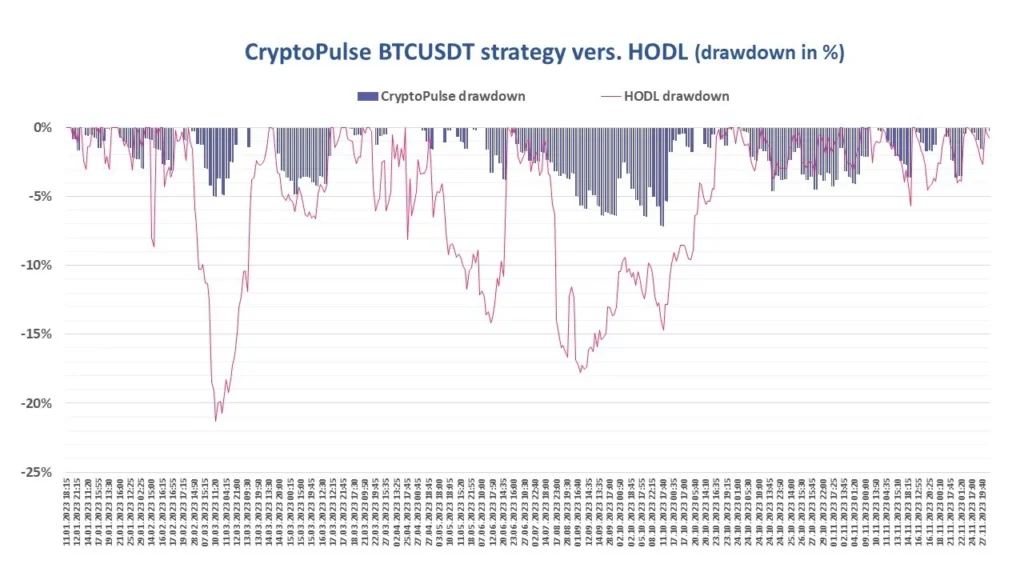

The chart above shows (in orange) how effectively Senti-Bot has hedged the capital involved in BTC transactions, while allowing profits to be generated.

Since the beginning of the year, there have been at least six prolonged periods during which there have been significant declines in the price of BTC. These declines significantly reduced the profitability of the hodling strategy, while highlighting the risky nature of this investment approach. At the same time, Senti-Bot effectively hedged capital by anticipating dips and closing out so-called long positions. In this way, users of the tool minimised decision dilemmas during BTC declines, such as:

- whether to close positions with losses,

- or wait out a difficult period,

- how long to watch the account balance decline.

Which dilemmas accompanied traders relying on the ‘hodl strategy’.

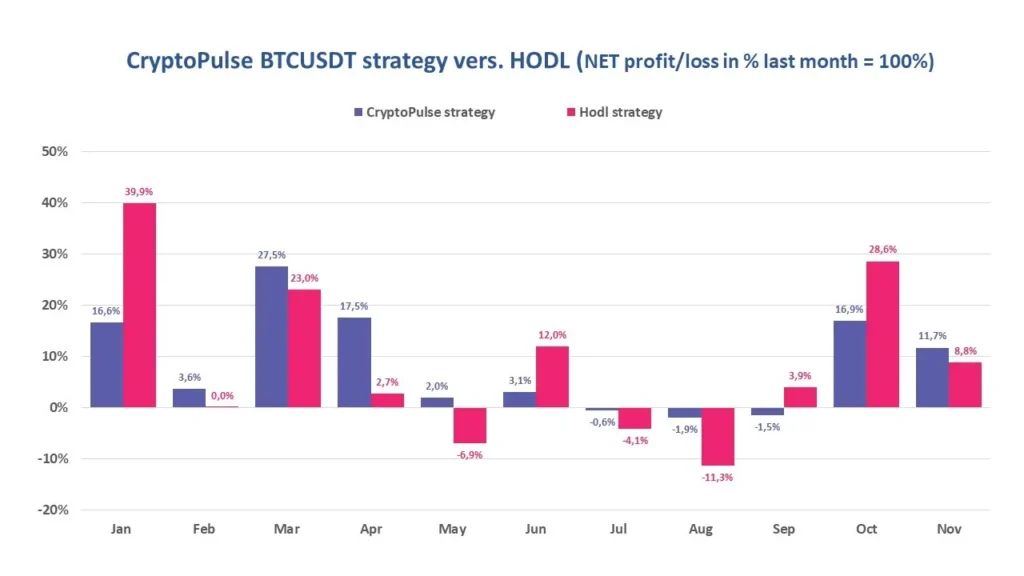

An analysis of Senti-Bot’s monthly performance shows that even when the bot was experiencing losses, these were six to seven times lower than with the herding strategy. This confirms the bot’s successful achievement of its main performance objective of maximum protection of capital invested in the Bitcoin market.

Senti-Bot performance indicators

From the beginning, we emphasise that Senti-Bot’s effectiveness should be considered over a period of more than one or two months. In assessing the effectiveness of the tool, important elements are the measurement of indicators such as:

Drawdown

Drawdown is simply the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous level of capital with its current value.

The maximum drawdown (in the January-November period) for the CryptoPulse BTCUSDT strategy was -7.15%, while the breeding was as high as –21.29%.

Profit Factor

Another measure that deserves attention is the profit factor. This factor is defined as the sum of all transactions with a profit divided by the sum of all transactions closed with a loss. A profit factor above 1.50 is considered good enough and above 2.0 is considered ideal.

Profit Factor for Senti-Bot was 1.97 at the end of November 2023.

Wskaźnik Sharpe’a

In order to assess the ratio of the return achieved to the risk taken, we track two main indicators. The first is the Sharpe ratio, which measures the risk-adjusted return (measured by mean deviation). The higher the values of this indicator, the better the investment is considered. Investments for which the Sharpe Ratio is greater than 3.0 are considered among the best.

Senti-Bot achieved a Sharpe ratio score for you that was higher than for most investment funds, scoring an impressive 5.70 at the end of November! This allowed it to outperform the herding strategy (3.74).

Wskaźnik Calmar

Calmar Ratio is the second main indicator of investment performance, determining the ratio of the return (calculated on an average annual basis) in relation to the maximum slippage. In general, the higher its value, the better. This is because it indicates by how many times the annual average cumulative return exceeds the slippage to date. Values above 1 mean that the rate of return, was higher than the landslide.

For Senti-Bot, the value of this indicator was 21.20 at the end of October, more than three times higher than for breeding. (see table below).

Table – summary overview

Thank you for your trust and encourage you to follow Senti-Bot’s performance in the coming months!

SentiStocks Team