Senti-Bot results

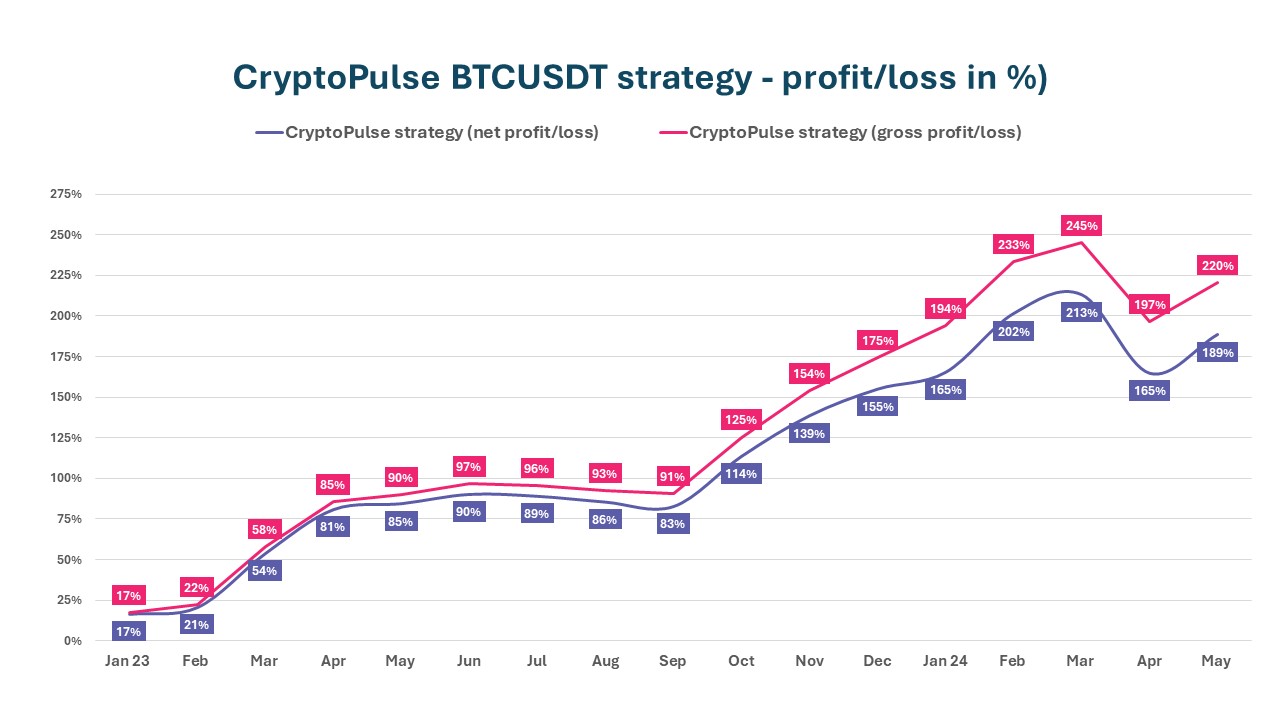

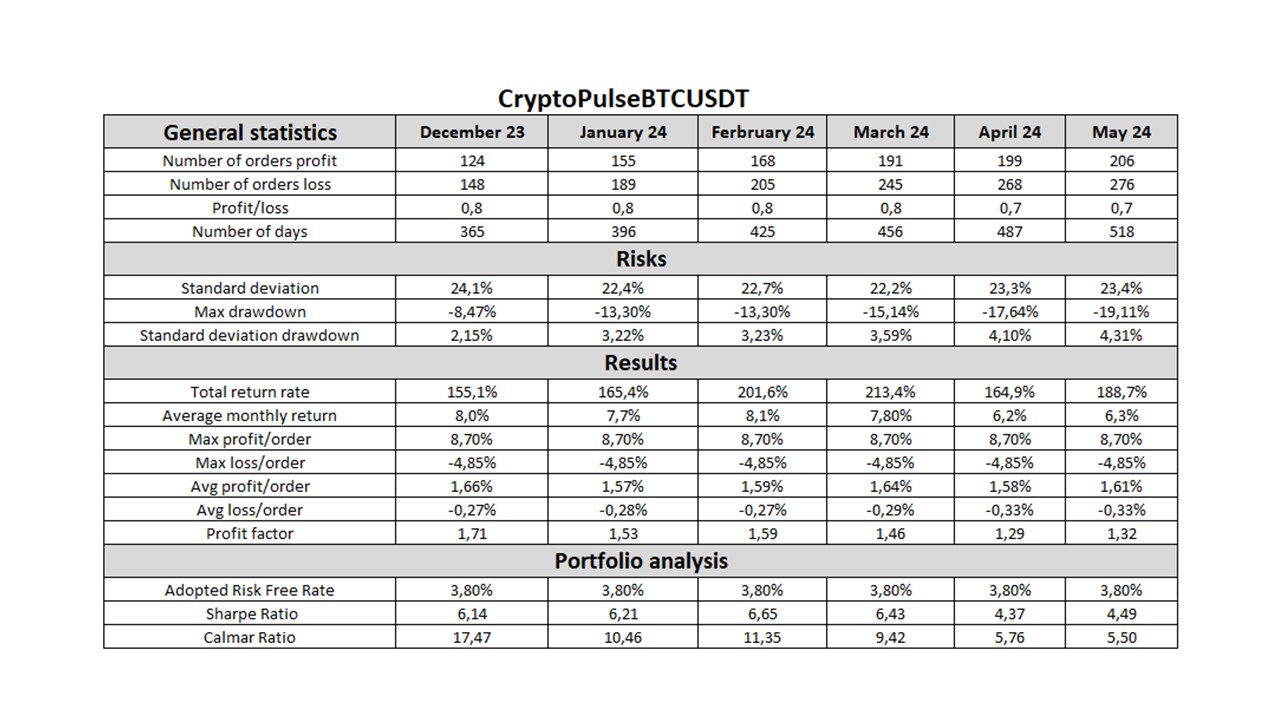

We want to share with you an analysis of Senti-Bot’s effectiveness in the cryptocurrency market, allowing you to compare it with other available tools. We present the gross results (in red), which do not include the cost of Binance exchange commissions, which allows you to accurately compare the effectiveness of our bot with other solutions. After a difficult April, it appears that the Senti-Bot update is beginning to yield positive results, as reflected in a total net gain since the start of the project of 189% (blue).

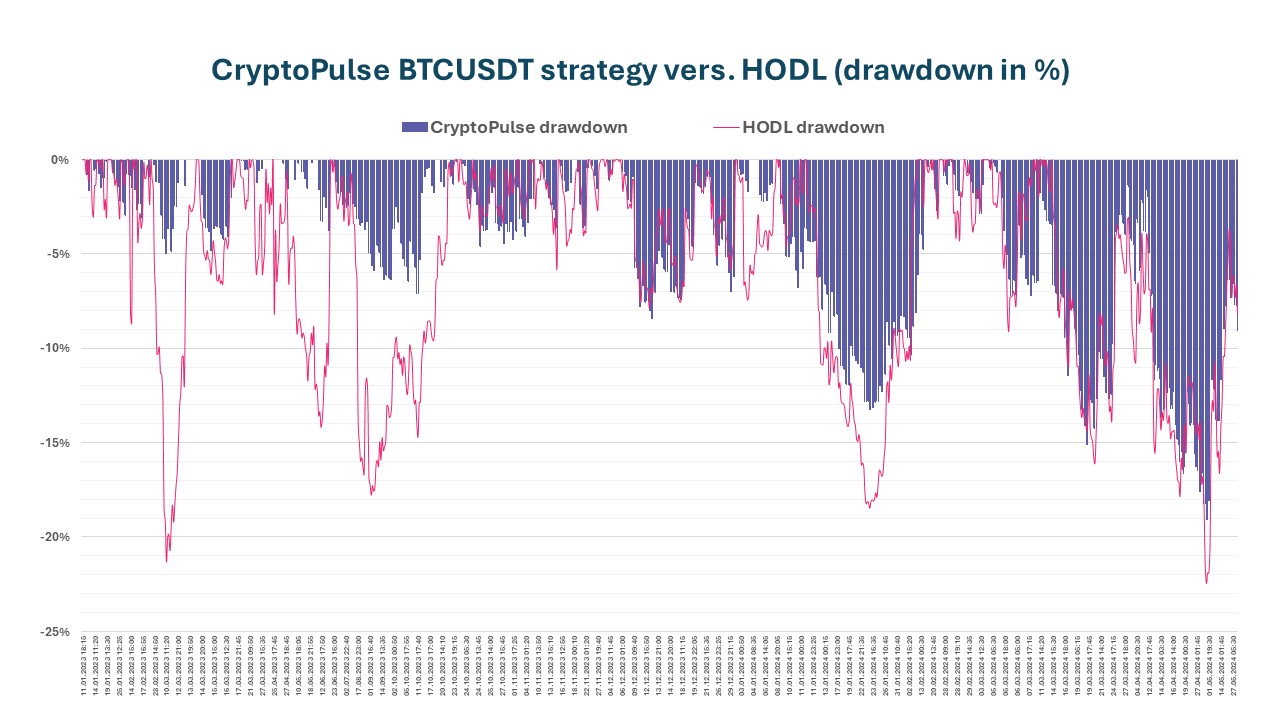

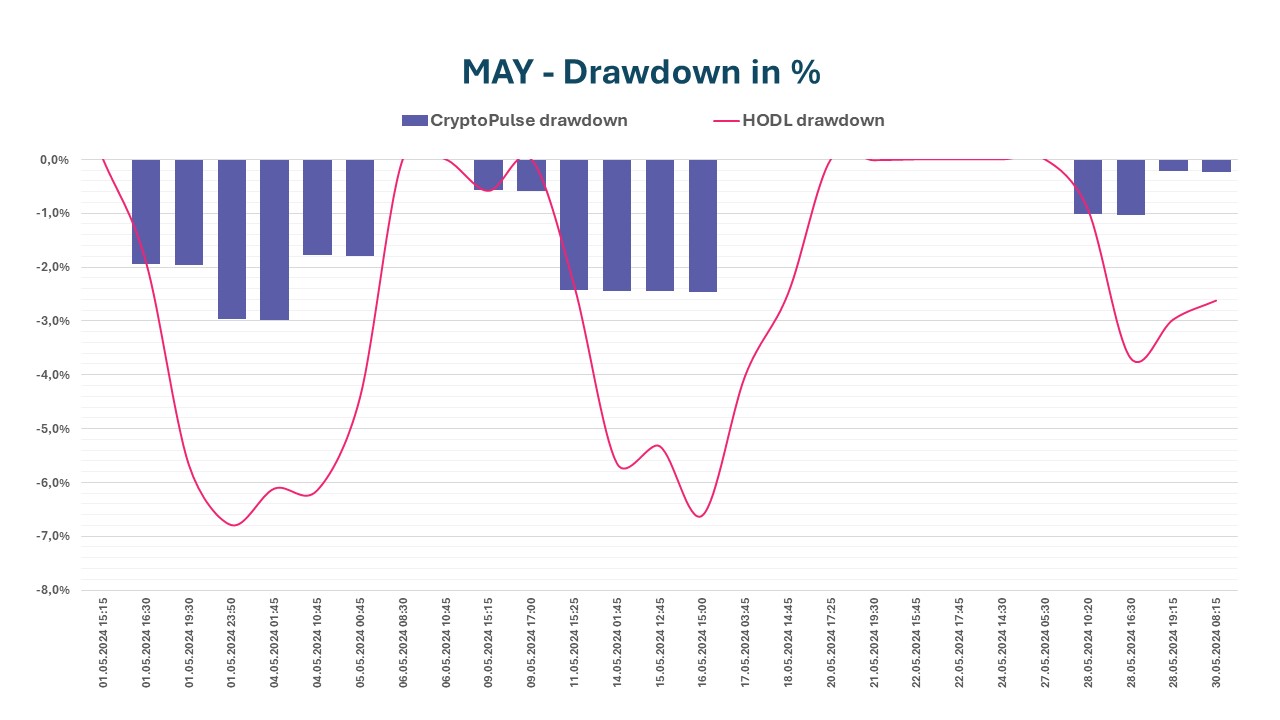

Recall that the update introduced much stricter parameters for entering positions, which noticeably translated into a decrease in Senti-Bot risk. Senti-Bot’s main objective is to reduce losses first and only secondarily to generate profit. In the chart below, you can see the maximum decrease in the value of the portfolio in May, the so-called “portfolio drop”. drawdown. This decline we were able to significantly reduce compared to the strategy of holding Bitcoin (hodl).

Senti-Bot achieved its effectiveness, mainly by anticipatory exiting positions ahead of anticipated declines in Bitcoin’s price, discernible in emotions analyzed from social media. Evidence of the effectiveness of this approach was provided by the average values of transactions ending in profit and loss:

- The average profit per order is: +1,61%,

- The average loss per order is: -0,33%.

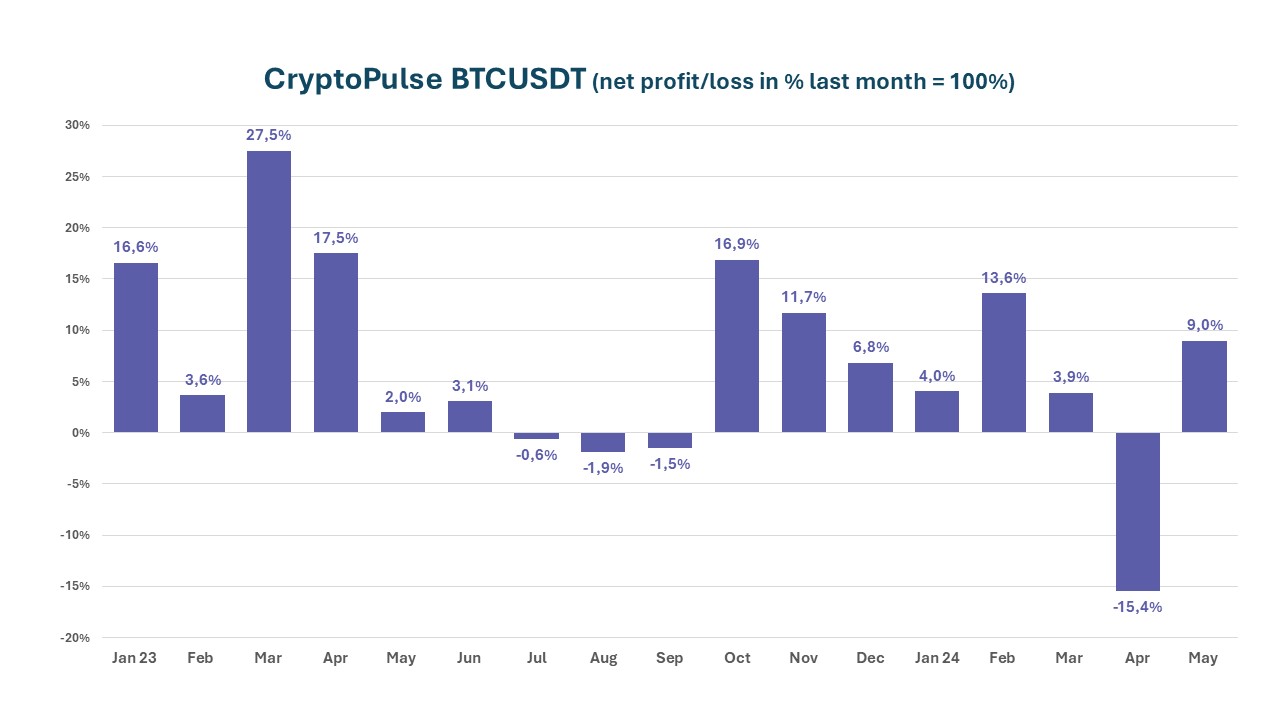

After significant declines in the cryptocurrency market in April, May brought a return to growth, which Senti-Bot took advantage of almost perfectly, achieving a 9% return for the month.

Senti-Bot performance indicators

We emphasize that the effectiveness of Senti-Bot should be considered over a period of more than one or two months.

Important elements of evaluating the effectiveness of our tool are measurements of such indicators as:

- Drawndown

- Profit Factor

- Sharpe ratio

- Calmar indicator

Drawdown

Drawdown is, simply put, the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous capital level with its current value.

The maximum drawdown (over the entire period) for the CryptoPulse BTCUSDT strategy was -19.11%, while in the Bitocin hodling it was already -22.5%.

Profit Factor

Another measure that deserves attention is the profit factor. The ratio is defined as the sum of all transactions with a profit divided by the sum of all transactions closed with a loss. A profit factor above 1.50 is considered good enough, and above 2.0 is considered ideal.

The Profit Factor for Senti-Bot was 1.32 at the end of May 2024. We can interpret that for each transaction the bot gained on average 32% more than it lost.

Sharpe ratio

In order to assess the ratio of the return achieved to the risk taken, we track two main indicators. The first is the Sharpe ratio, which measures risk-adjusted return (measured by average deviation). The higher the values of this indicator, the better the investment is considered. Investments for which the Sharpe Ratio is greater than 3.0 are considered among the best.

For Senti-Bot, the Sharpe ratio at the end of May was 4.49, significantly higher than for most mutual funds. This is significant because a higher Sharpe ratio means 4.5 times higher returns relative to risk, which still confirms the attractiveness of our investment strategy.

Calmar indicator

Calmar Ratio is the second main indicator of investment performance, which determines the ratio of the rate of return (calculated on an average annual basis) in relation to the maximum slippage. In general, the higher its value, the better. This is because it means by how many times the average annual cumulative rate of return exceeds the past slide. Values above 1 mean that the rate of return, was higher than the landslide.

At the end of May, Senti-Bot’s Calmar index was 5.5. Thanks to high profits, the bot has provided you with a result of almost 6 times its maximum drop in value.

Table – summary summary

We thank all our users for their trust and words of approval. We encourage you to follow Senti-Bot’s performance in the coming months!

SentiStocks team