We are excited to share with you the Senti-Bot results for June 2023. The SentiStocks team delivers a performance-focused tool in the rapidly changing world of cryptocurrencies.

June was a month full of change for Senti-Bot. We completed a period of testing the new CryptoPulse strategy, which allows the bot to perform sell/buy operations every 15 minutes, instead of every 1 hour as before.

Table of Contents

Table of Contents

Senti-Bot results

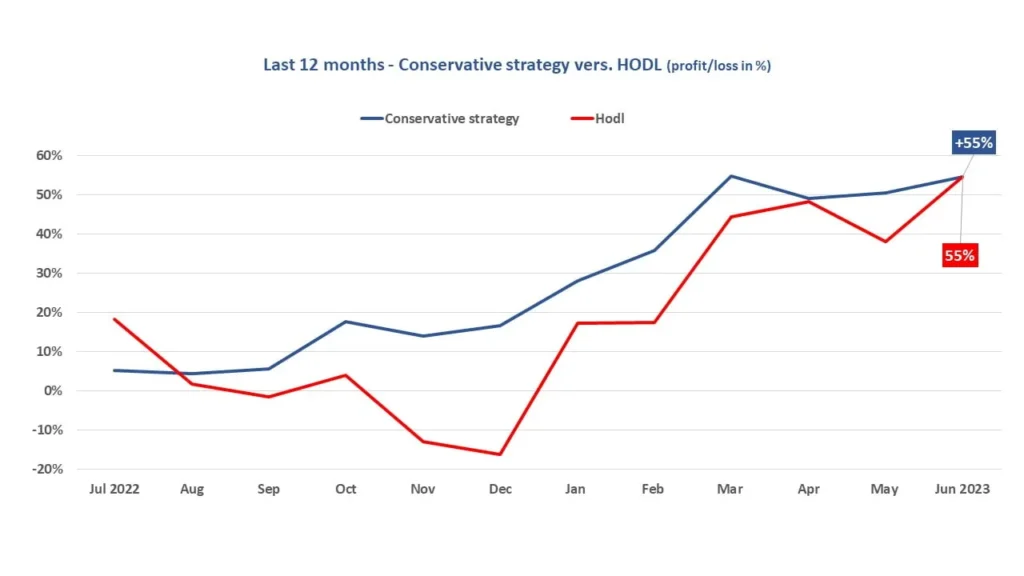

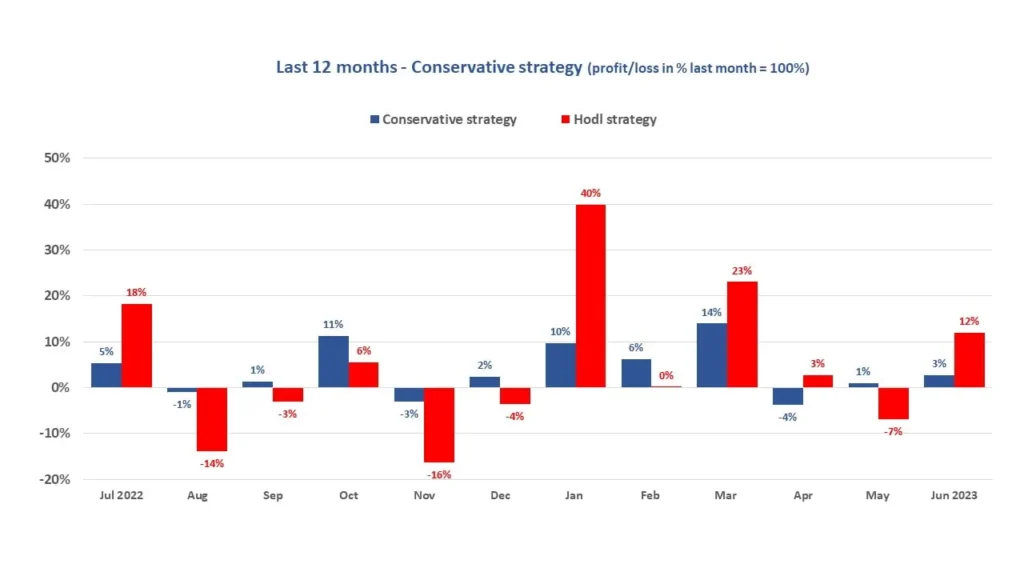

An analysis of the results for the last 12 months shows that the performance of SentiBot with a conservative strategy (+55%) was comparable to the performance of bitcoin hodling (+55%).

At this point, it is important to note that breeding from July to November 2022 recorded significant monthly declines exceeding even -15% in November. In comparison, at the end of this period Senti-Bot generated a gain of 14% for you.

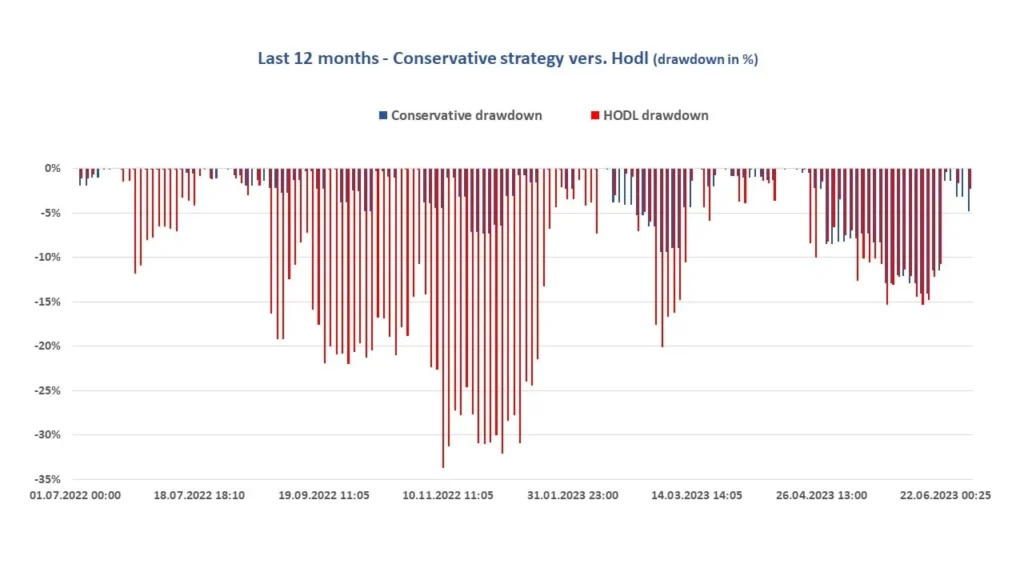

Drawdown

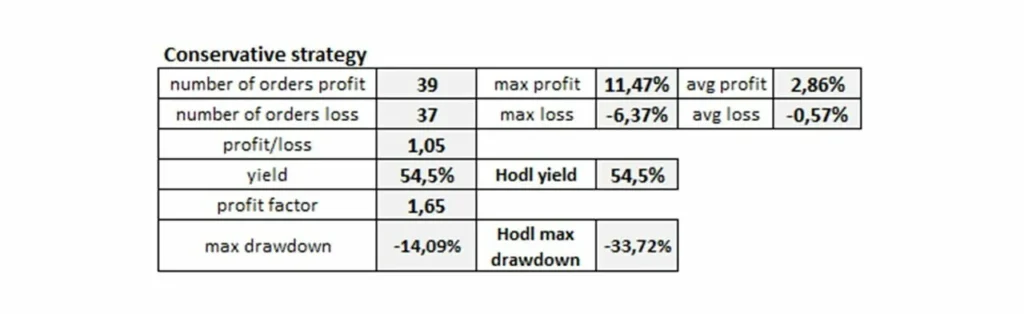

In addition, the effectiveness of the conservative strategy is perfectly illustrated by the measurement of the drawdown ratio. It can be seen that throughout the analysed period this strategy effectively protected your capital from significant losses. Suffice it to mention that the maximum drawdown for the conservative strategy was -14%, while for hodling it reached as high as -34%.

Profit Factor

Senti-Bot’s performance over the 12 months was impressive, with an average profit level on closed positions of +2.86%, which far outweighed the average level of losses (-0.57%). The profit factor at the end of June 2023 was 1.65, which is considered a good result.

New version of Senti-Bot

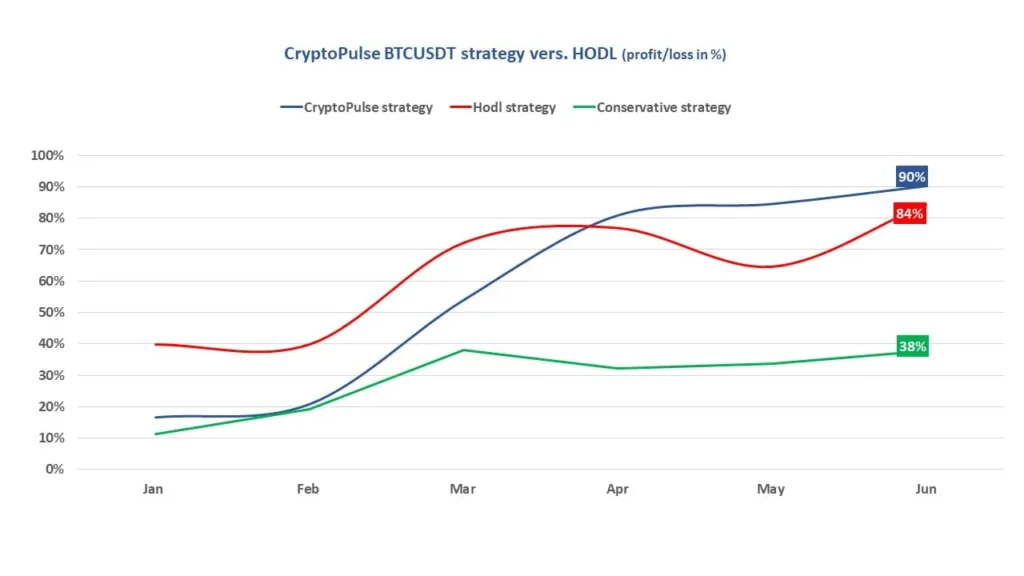

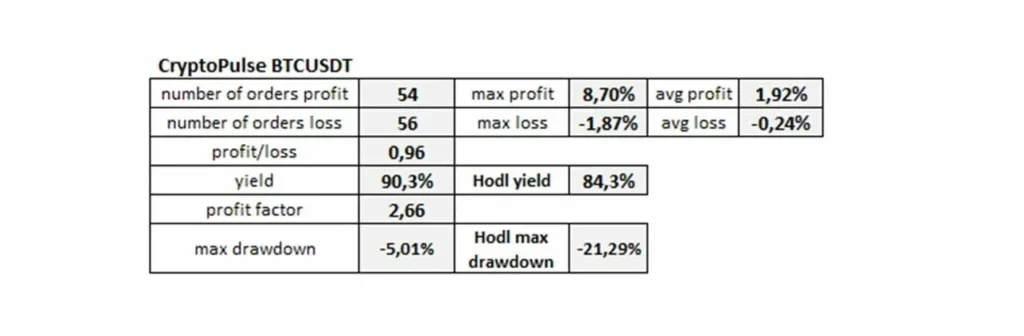

Testing of the new CryptoPulse BTCUSDT strategy, which allows for more frequent sell/buy operations every 15 minutes, was completed in June. Tests for the period January-June 2023 showed that the updated version of the bot with the new strategy allows for a significant increase in both the number of positions closed and their profitability. From 1 July, all bots launched for clients will run on the basis of the new CryptoPluse BTCUSDT strategy.

Increased profitability

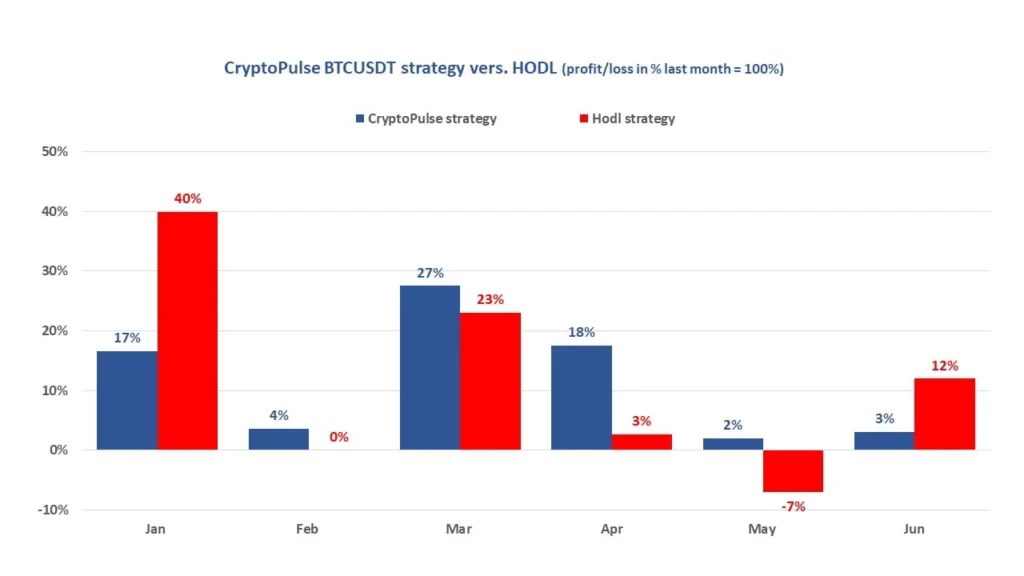

The increased frequency of positions taken allows it to react more quickly to changing emotions in the market, making it more effective at catching opportunities that arise, which translates into an increase in Senti-Bot’s profitability to as much as 90% since the beginning of the year.

As can be seen, the increased responsiveness of the bot has resulted in not a single month since the beginning of the year that has resulted in a loss.

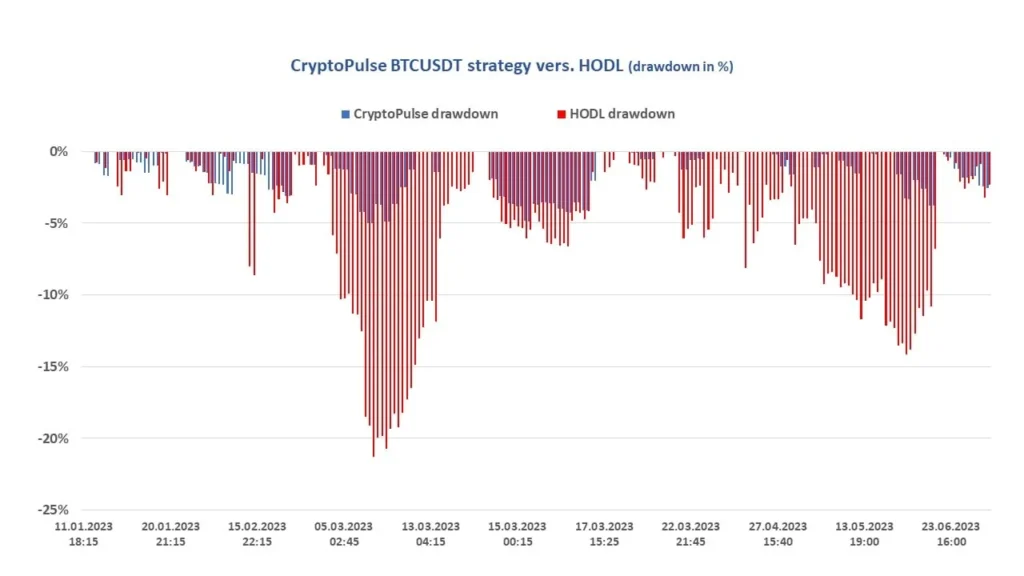

Increased capital security

Faster reaction to changes in market emotions mainly enables you to hedge your capital more effectively. The maximum drawdown for the new CryptoPulse strategy has fallen to -5%, compared to -14% for the Conservative strategy and -33% for bitcoin hodling.

Increased number of closed positions

The new CryptoPulse strategy is generating around 40% more trades in the market. The results of this new SentiBot strategy show that the average profit from closed positions was (+1.92%), while the average loss was much lower (-0.24%). As a result, the portfolio’s profit factor improved from 1.65 to 2.66.

Thank you for your trust and encourage you to follow Senti-Bot’s performance in the coming months!

SentiStock Team