Emotive analysis is a new tool for effective prediction of the financial instruments prices. In this article we present you a case study of how including data from emotive analysis affects the process of forecasting price trends of financial instruments.

Emotive analysis. Emotions in everyday life

Emotions have one of the most important functions in our lives. It is under their influence that various thoughts appear in our heads, which then manifest in the form of actions we take. This also applies to the financial world.

Currently, the market offers a wide range of different tools, automating the analysis and comparison of financial data. They are designed to help investors make the right decisions in managing their investment portfolios, however, the issue of analyzing investor moods (so-called behavioral analysis) still requires manual manpower.

Keeping up to date with information and industry articles and then trying to predict the investor community reaction consumes a lot of time, however at the end of the day it is largely subject to the intuition of the investor himself.

Is it possible to effectively measure emotions in the text?

We tried to solve this problem by creating our own product called Sentistocks. Based on the results of scientific research conducted jointly with the Wroclaw University of Technology and the Institute of the Nencki Polish Academy of Sciences, we have created an artificial intelligence model that predicts the trends of averaged prices of financial instruments.

Using emotion measurement for investing

With the model already working, we decided to test it in the context of financial markets, where emotions play as important role as raw financial data. To give Sentistocks its first test drive we took a cryptocurrency Bitcoin and downloaded for it both historical financial data and textual references from the Internet (e.g. tweets, posts from the reddit portal) to train the artificial intelligence model.

Mentioned data comes from the whole of 2018 and 2019 years (more information on how our model exactly works can be found here). Then we launched the trained model, which worked in real time and downloaded all the data continuously since. From January 1st to May 31st, 2020, the model analyzed a total of 4,436,107 mentions (!) and returned 148 predictions of the Bitcoin daily average price trend.

Can emotive analysis support the investment process?

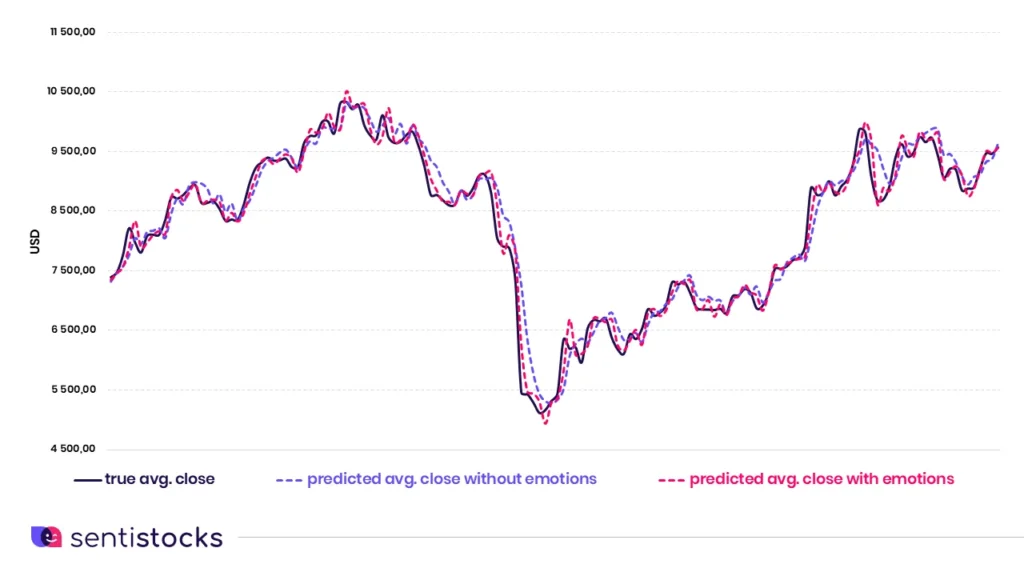

In the mentioned period (January – May 2020), we studied two parallel models of prediction of average daily Bitcoin closing prices. The first one included only financial data, the second one included financial data and data from emotive analysis.

Figure 1. True and predicted prices in the period January – May 2020

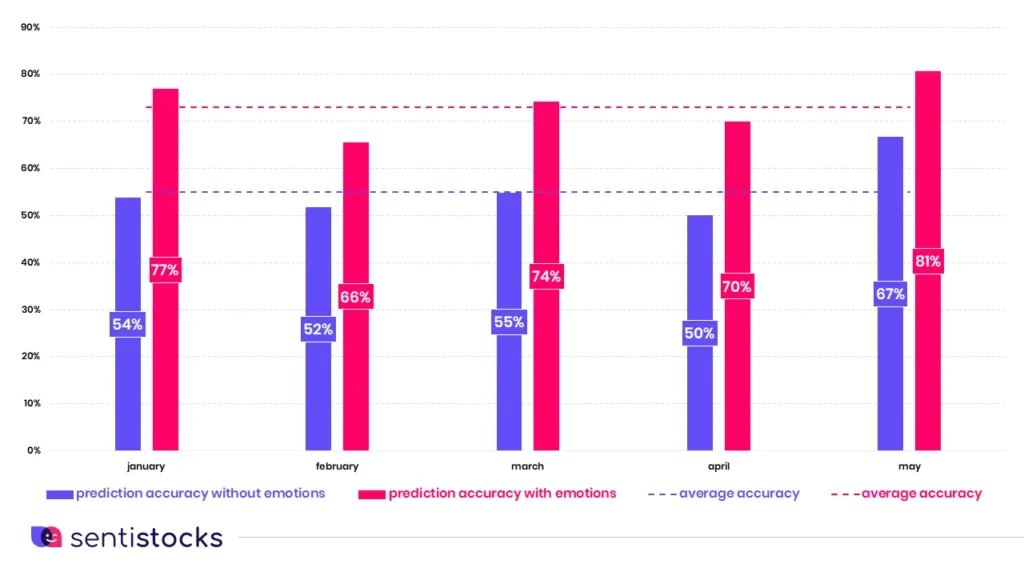

The results of effectiveness (accuracy) of the predictions of both models are presented in Figure 2.

Figure 2. Prediction accuracy for the period January – May 2020

The average effectiveness (accuracy) of the Bitcoin price predictions for the period January – May 2020 was accordingly:

- for predictions based only on financial data 55%,

- for predictions based on financial and emotional data 73%.

There is a noticeable advantage of the model based on financial and emotional data, which also applies to results recorded in particular months.

For investors it is extremely important to forecast the effectiveness of the jumping price changes. In the comparative analysis of both models we adopted three value ranges of the predicted price change:

- the sideways price range (within +/- 0.66%),

- the range of the rising price change (above + 0.66%),

- the range of the falling price change (below – 0.66%).

Figure 3. Prediction accuracy for the period January – May 2020

The results presented in Figure 3 confirm the advantage of the predictive model based on simultaneous analysis of financial and emotional data.

New tool, more possibilities

To sum up: enriching the range of information with emotional data significantly improves the effectiveness in predicting the trend of average prices for financial instruments in this case Bitcoin rate.

Emotive analysis expands the professional instruments available so far, which translates into an increase in the potential return on investment and also results in significant time savings. The example quoted in the article concerns Bitcoin and due to the ease of access to its data, we have focused the tests of our tool on it.

Nonetheless, we are planning to test it on other financial instruments in the near future. All those who want to see our tool in action are welcome to join our private Facebook group, which you can find at the address: https://www.facebook.com/groups/sentistocks, (password to join the group: “SENART1220”) where we share our prediction for the next day each day at a fixed time.