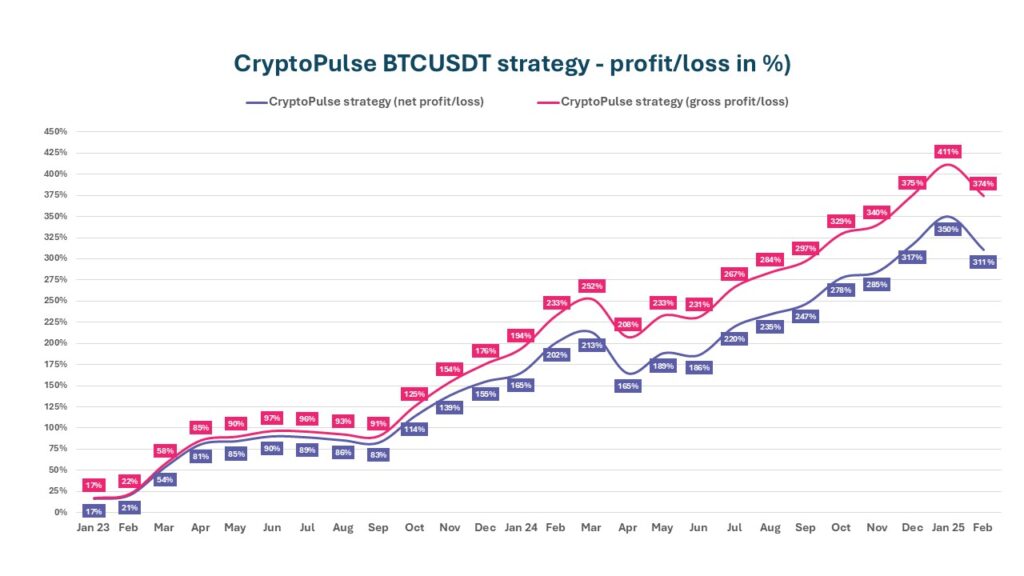

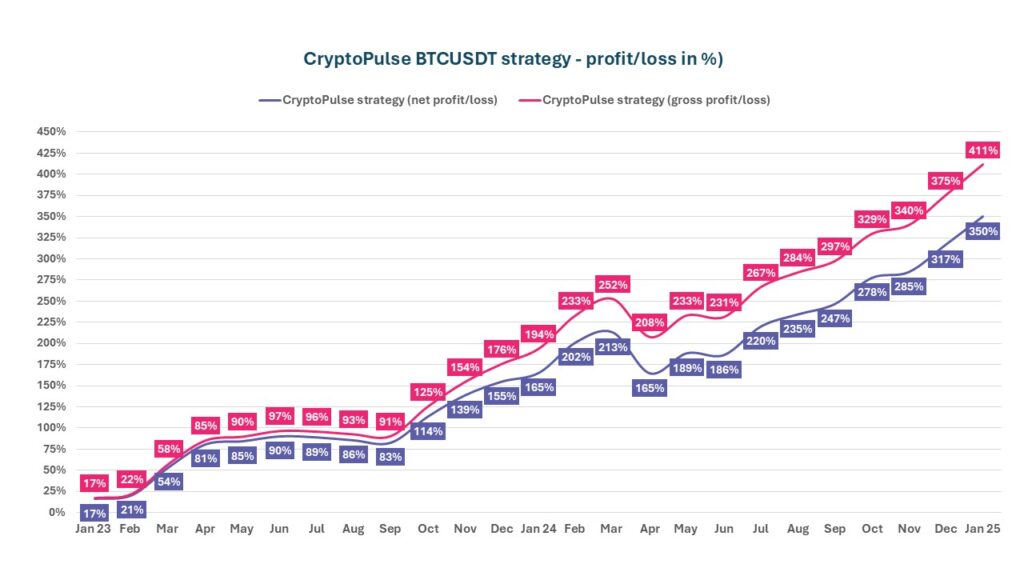

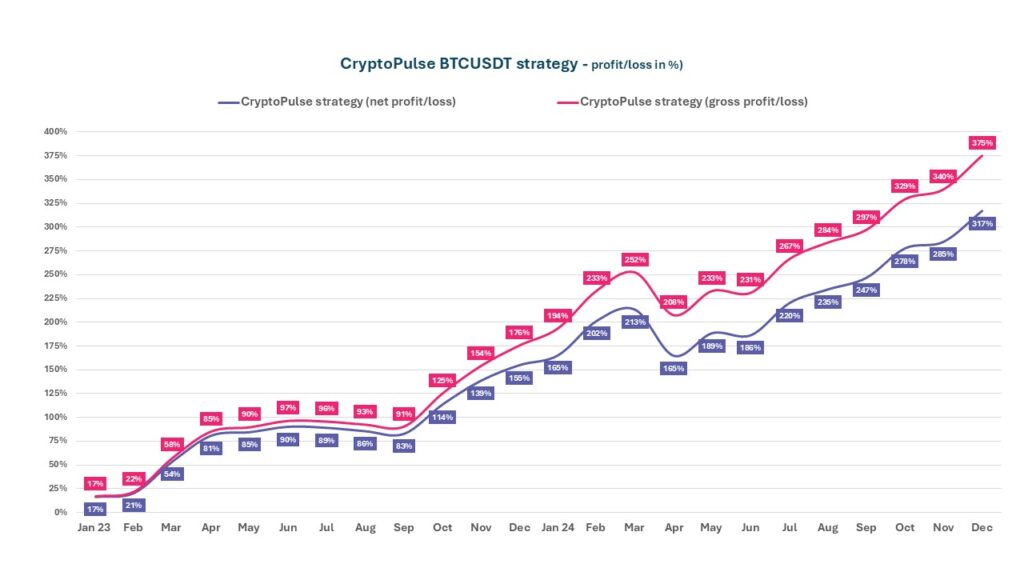

Senti-Bot in November 2025

November 2025 turned out to be a month of correction in the cryptocurrency market. After a series of increases in the previous months, the market said “check.” At SentiStocks, we believe that the key to success is not only the ability to make money on the upside, but most importantly to manage risk in moments of decline. How did our