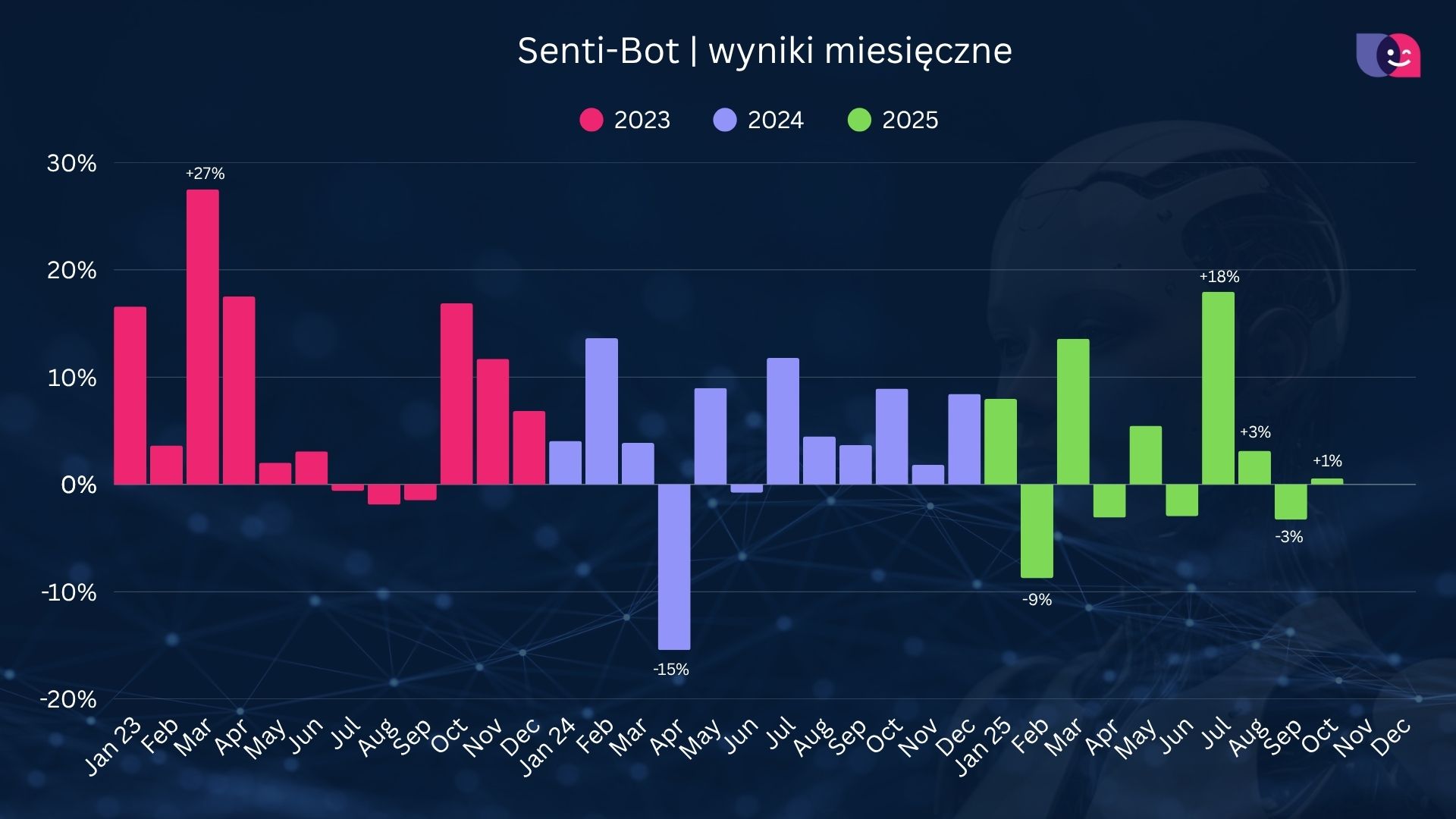

October 2025 we close with a result of +1%. It was another month of, admittedly small, increases, following the good results of the previous months. Particularly pleasing is this result in comparison with the decline in the price of BTC during this period of about -10%

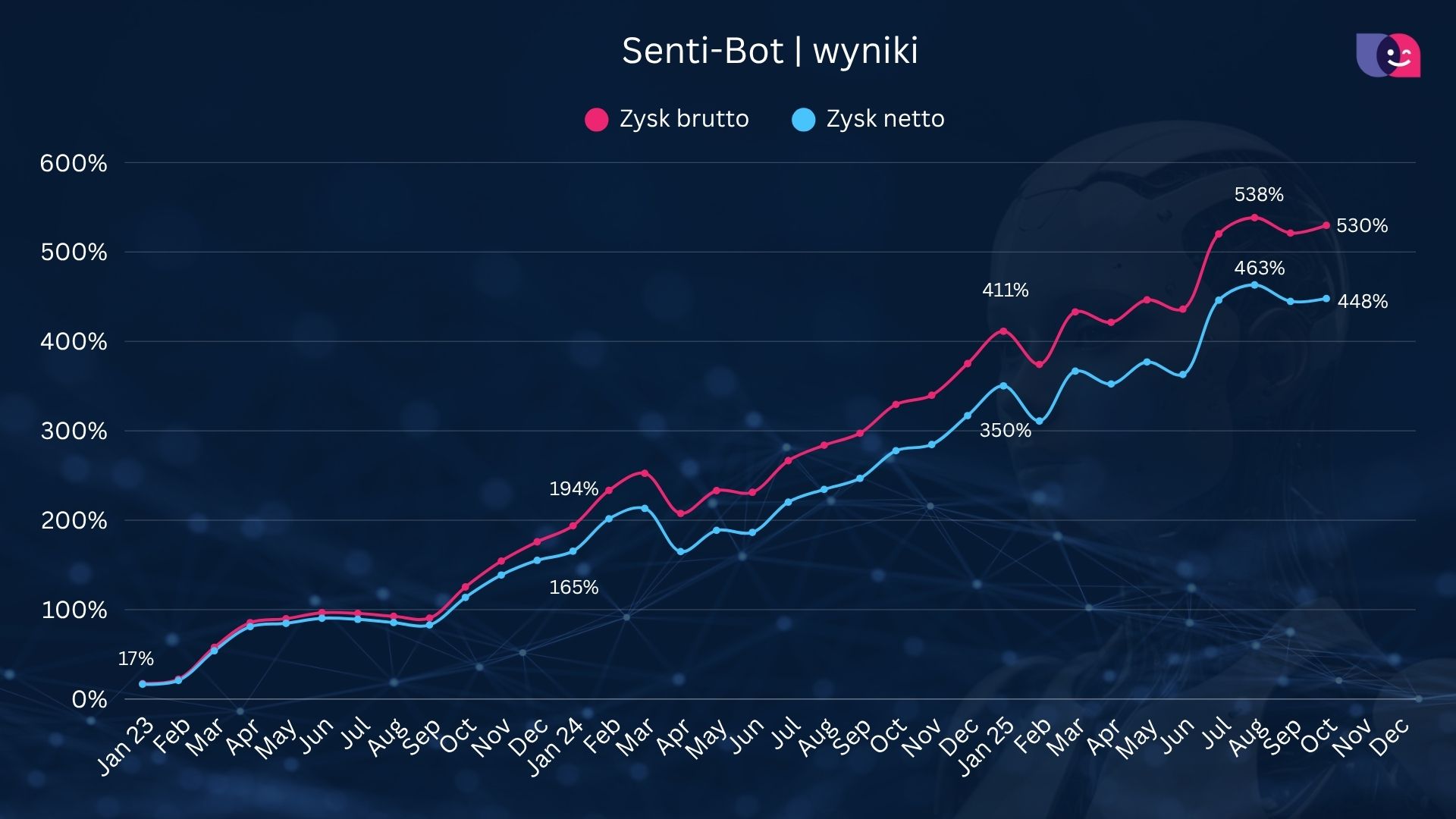

Since its inception , Senti-Bot has generated 448% net profit.

Table of Contents

Video Summary (Polish version)

Senti-Bot results

Since the beginning of 2023, Senti-Bot has generated a rate of return of 444,50% (net).

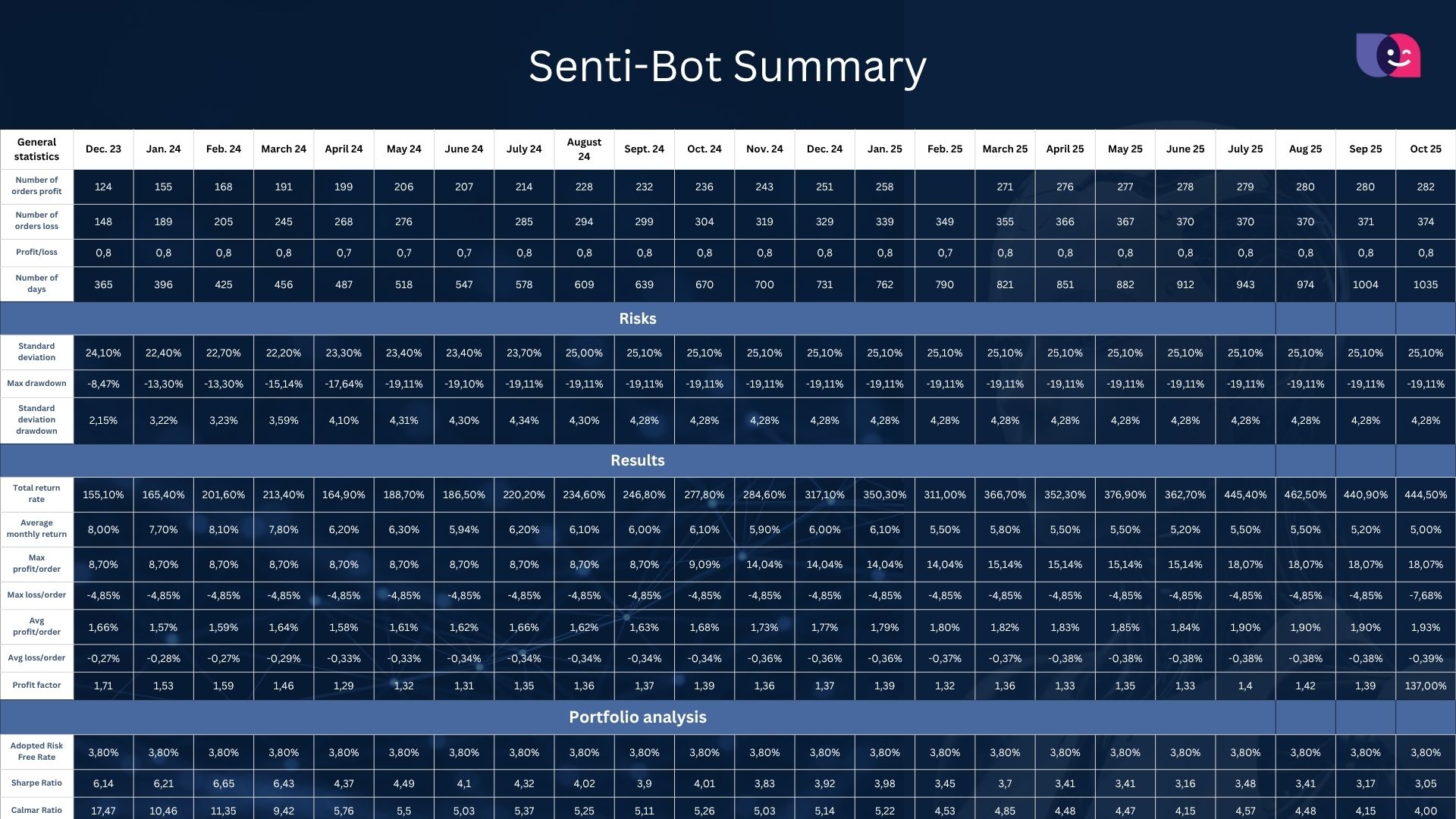

The maximum drawdown for Senti-Bot (calculated for the entire period) was -19,11%.

The Sharpe ratio for the strategy was 3,17 (data as of the end of September 2025). (Note: The value for October 2025 in the PDF table appears to be an error ).

Senti-Bot vs HODL

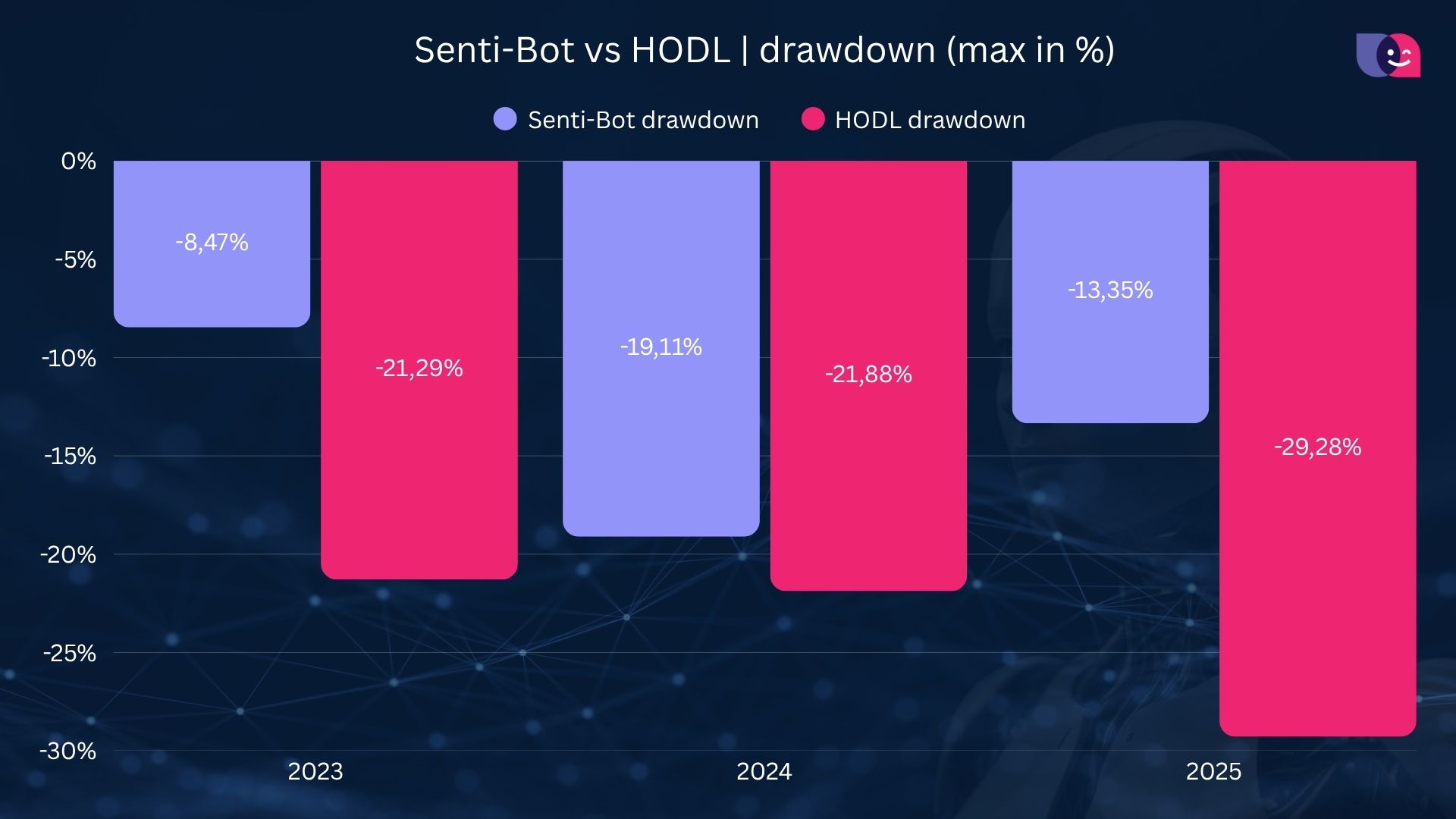

Comparing the maximum capital slip (drawdown) in 2025, Senti-Bot compares much more favorably than the HODL (buy and hold) strategy.

Senti-Bot maximum drawdown (2025): -13,35%

Maximum HODL drawdown (2025): -29,28%

Summary

October brought a correction and profit realization, closing with a result of -3%. Despite the temporary decline, the strategy’s cumulative net gain since inception (January 2023) is 444.50%, showing the strategy’s strength over the long term.

Senti-Bot statistics

Below are Senti-Bot’s detailed statistics as of the end of October 2025.