November 2025 turned out to be a month of correction in the cryptocurrency market. After a series of increases in the previous months, the market said “check.” At SentiStocks, we believe that the key to success is not only the ability to make money on the upside, but most importantly to manage risk in moments of decline. How did our sentiment analysis-based algorithm perform in this environment? Read on for a detailed summary.

Table of Contents

Video Summary (Polish version)

Monthly result and market situation

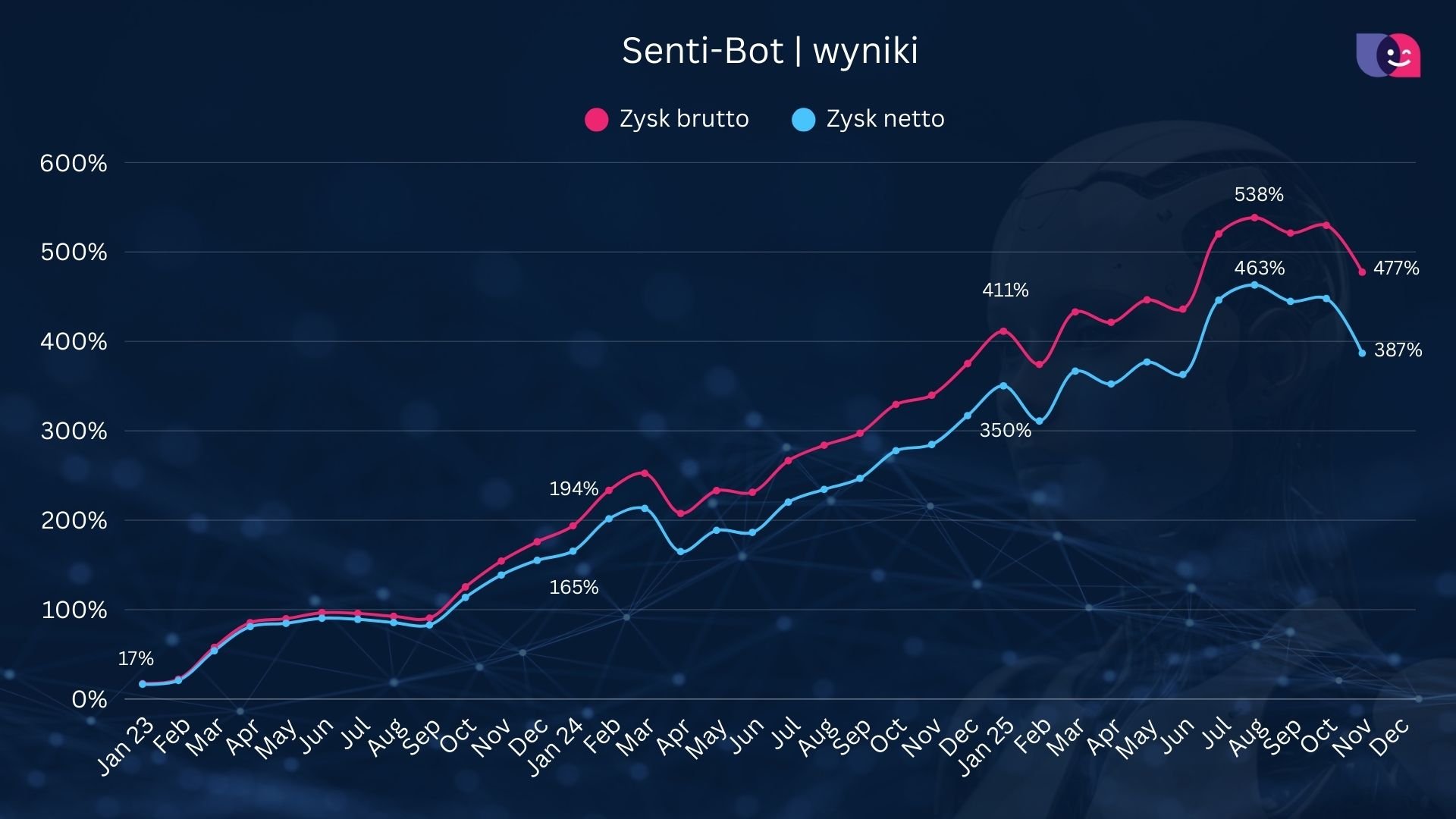

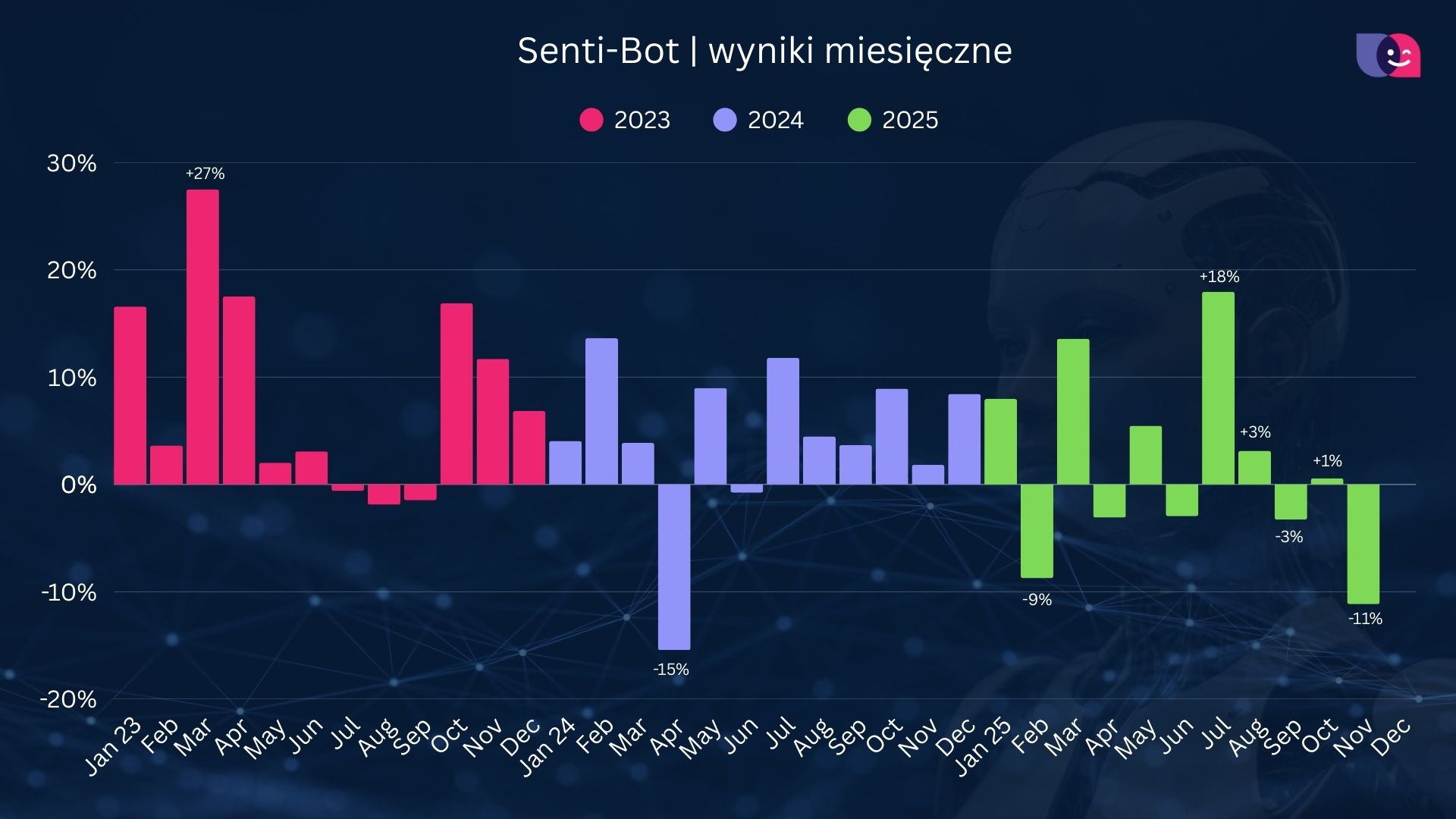

We ended November with a result of -11%. This is the first such clearly declining month in the second half of the year, after a series of profitable periods (July +18%, August +3%, October +1%).

However, it is worth looking at the bigger picture. Despite the November correction, the Total Return Rate at the end of November 2025 is 383,70%. This confirms that a long-term strategy based on the emotions of the crowd brings tangible results.

Senti-Bot vs. HODL – Key comparison

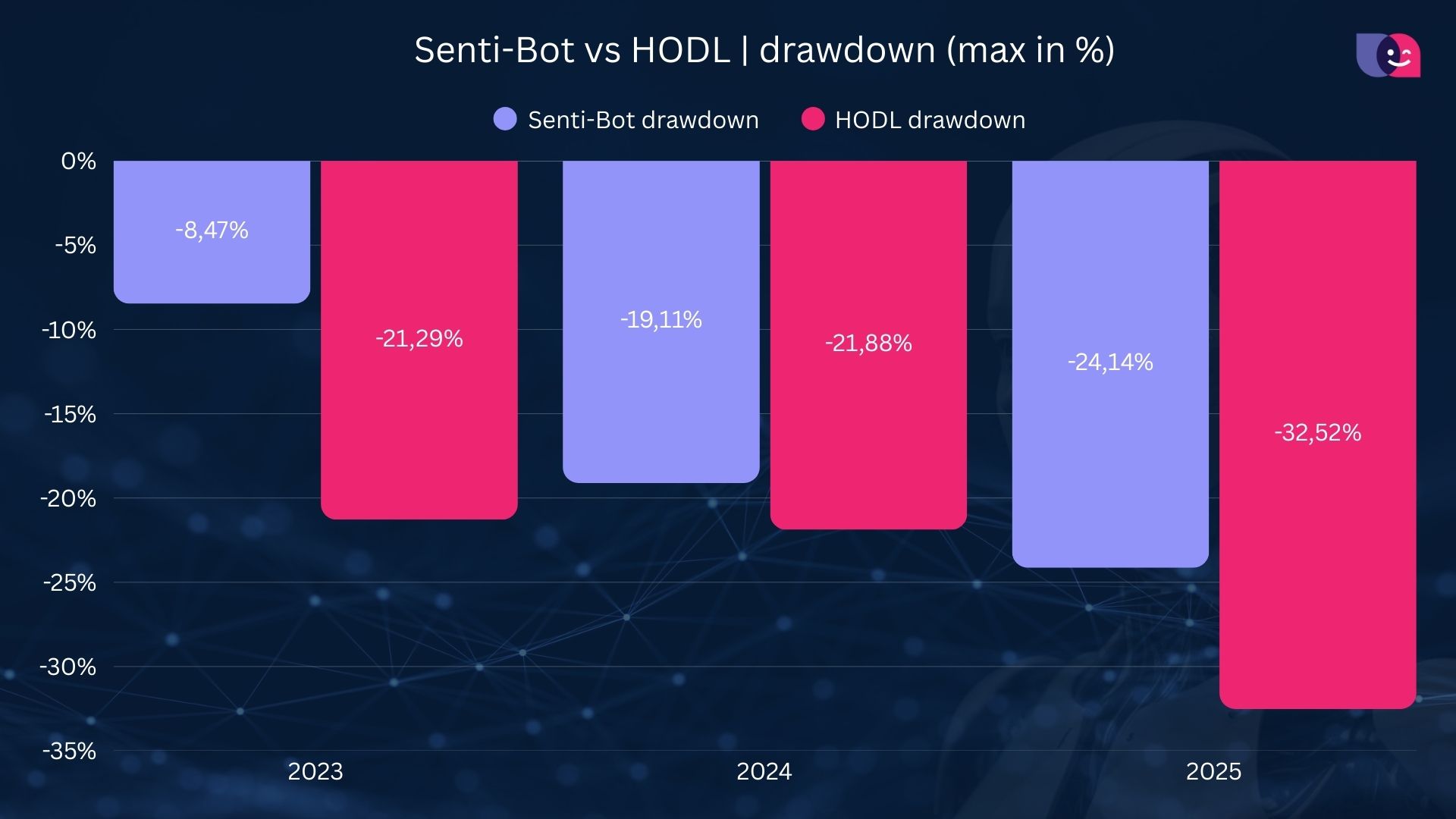

One of the most important aspects of the bot is capital preservation. 2025 showed high volatility on Bitcoin. How do we compare to the buy and hold (HODL) strategy?

Max Drawdown 2025 (Senti-Bot): -24,14%

Max Drawdown 2025 (HODL): -32,52%

The above data show that the algorithm is more effective in protecting the portfolio from deep declines than passively holding the asset, which is crucial for the investor’s psychological comfort.

Detailed statistics – November 2025

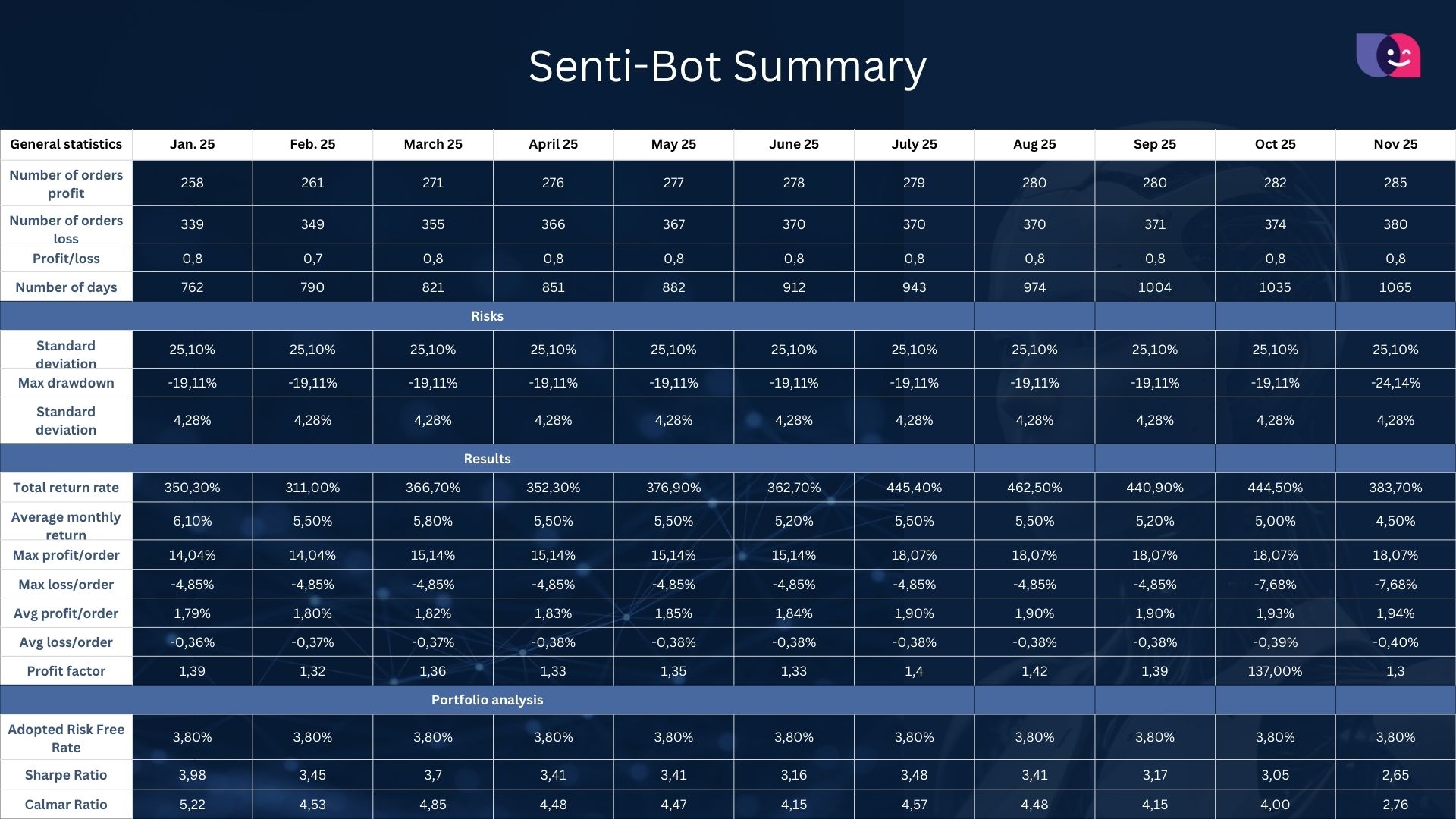

Let’s take a look at the numbers behind the bot’s performance after 1065 days of activity:

Number of profitable transactions (YTD): 285

Number of loss transactions (YTD): 380

Profit Factor: 1.30

Sharpe ratio: 2.65

Average monthly return: 4.50%

Although the number of losing trades is higher than the number of profitable ones, the system generates profit through asymmetry – the average profit per trade (1.94%) is much higher than the average loss (-0.40%). This is a classic example of how the “cut losses quickly, let profits grow” principle works.

Summary

November reminded us that the market does not move only one way. For Senti-Bot, it was a period in which the priority was to protect previously earned profits. With a cumulative result of more than 380% and stable risk indicators, we are optimistic about the end of the year.

Do you have questions about how the bot works? Want to start using crowd emotions to your advantage? Visit SentiStocks.com.