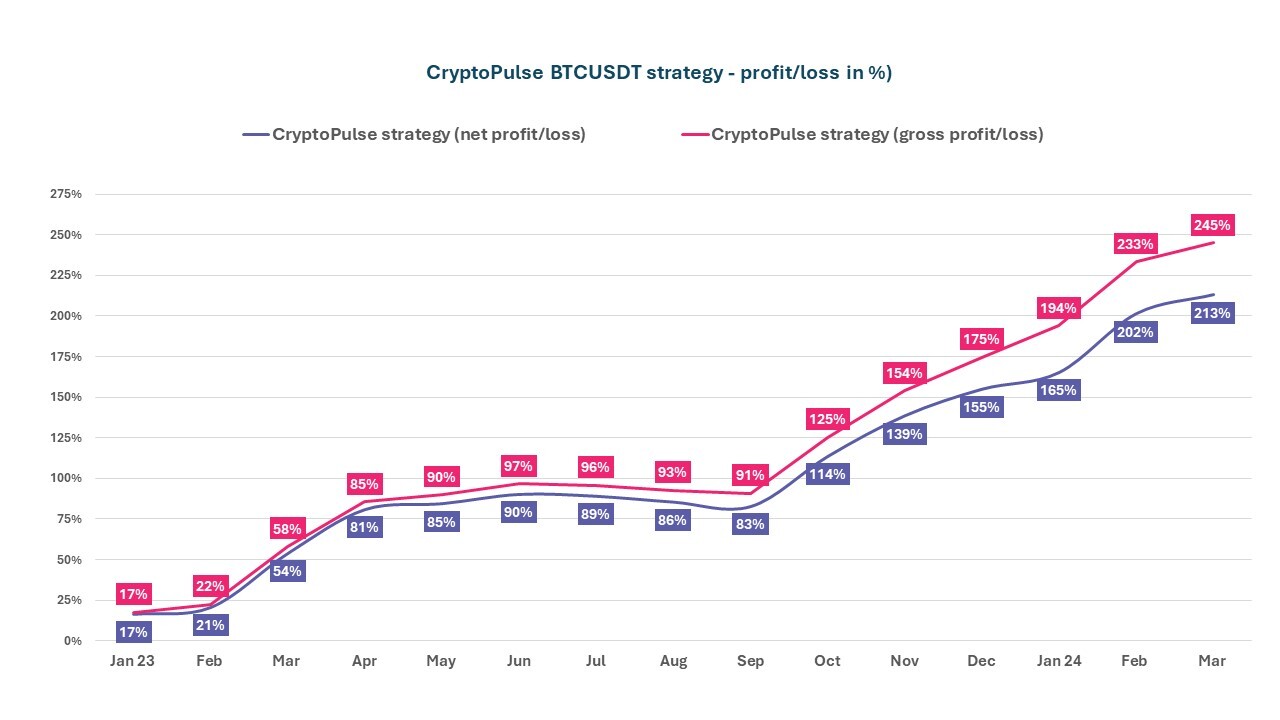

Harnessing market emotions to generate profits is the main goal of the Sentistock project. For this reason, we are happy to present Senti-Bot’s results on the cryptocurrency market for March this year. Despite the difficulties encountered, “the results speak for themselves.” Since the beginning of last year, the artificial intelligence created for you has recorded an impressive 213% growth.

Table of contents

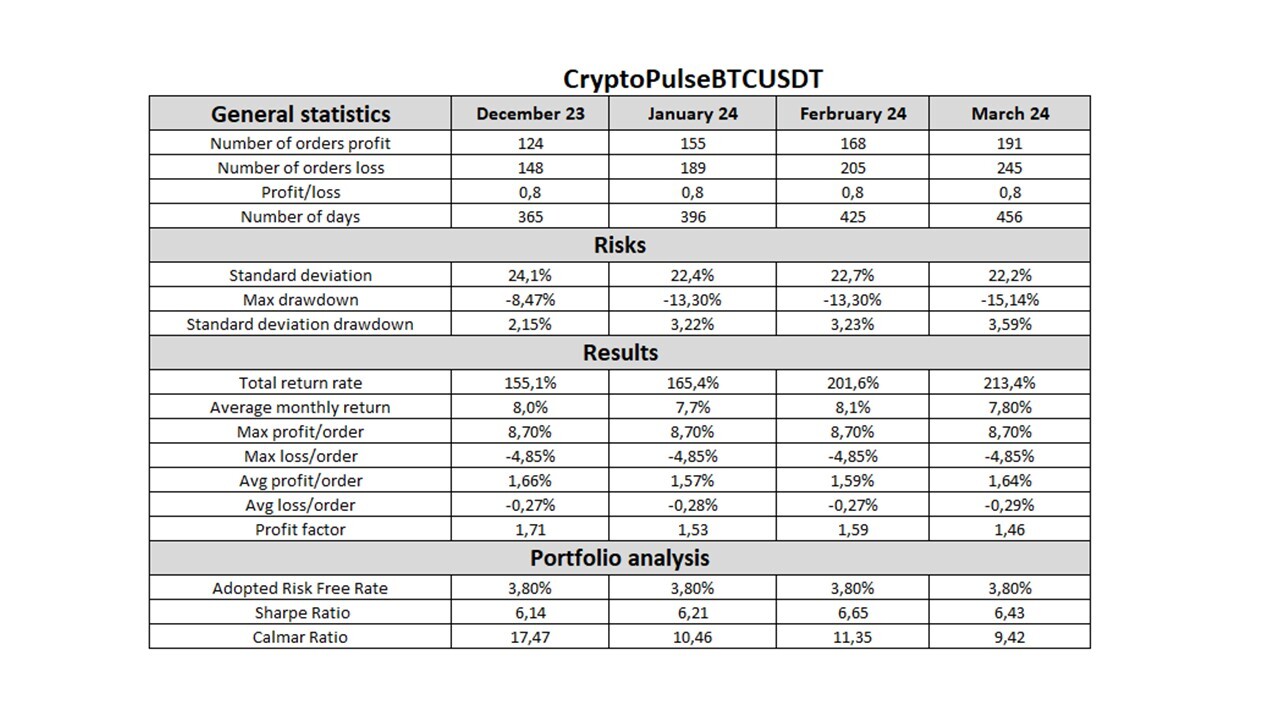

Senti-Bot results

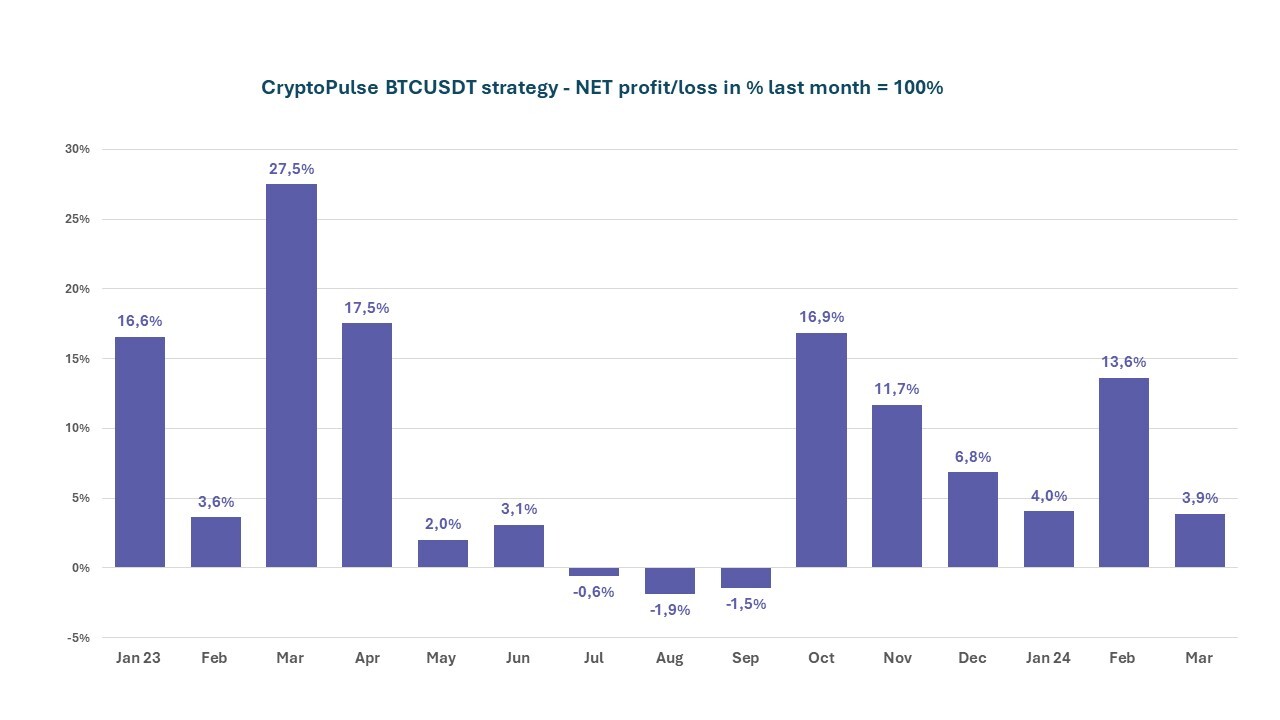

We want to share with you an analysis of Senti-Bot’s effectiveness in the cryptocurrency market, comparing it with other tools available on the market. We present the gross results (in red), which do not include the cost of Binance exchange commissions, which allows you to accurately compare the effectiveness of our bot with other solutions. Despite the difficulties, March proved to be a successful period for Senti-Bot – after deducting costs, net profit reached 3.9%, which contributed significantly to the total profit of 213% (in blue) since the project’s launch.

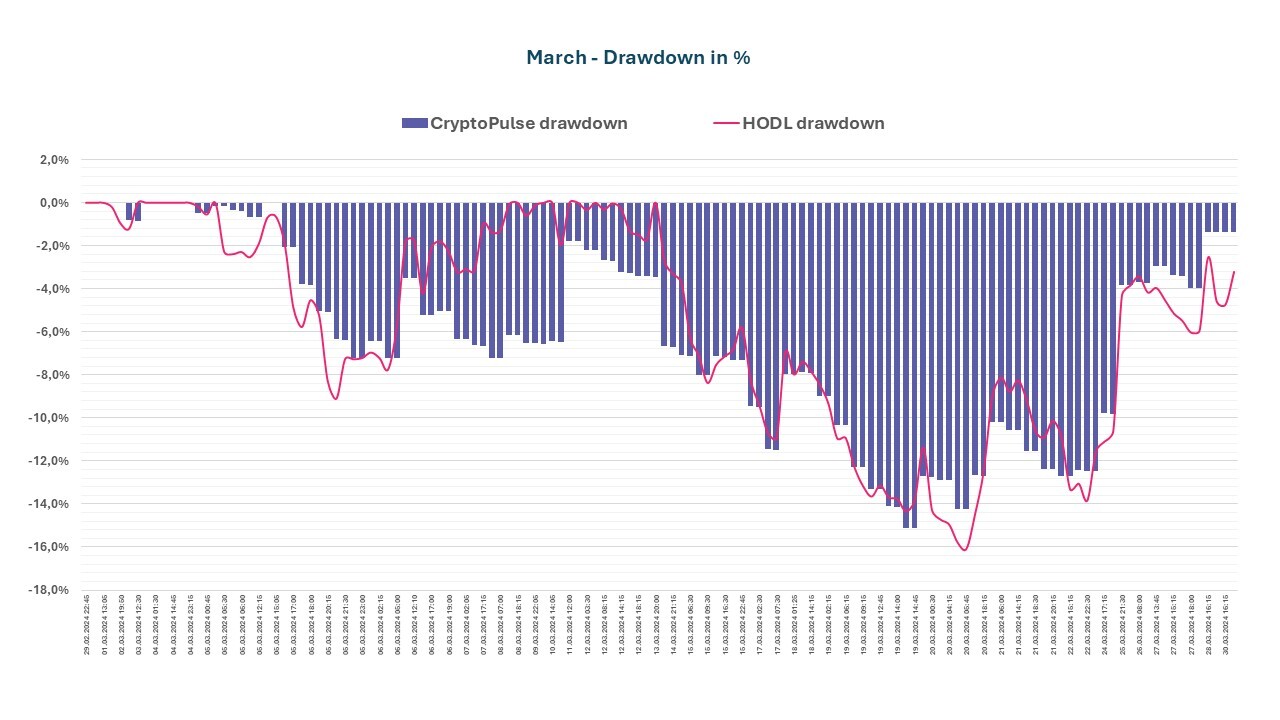

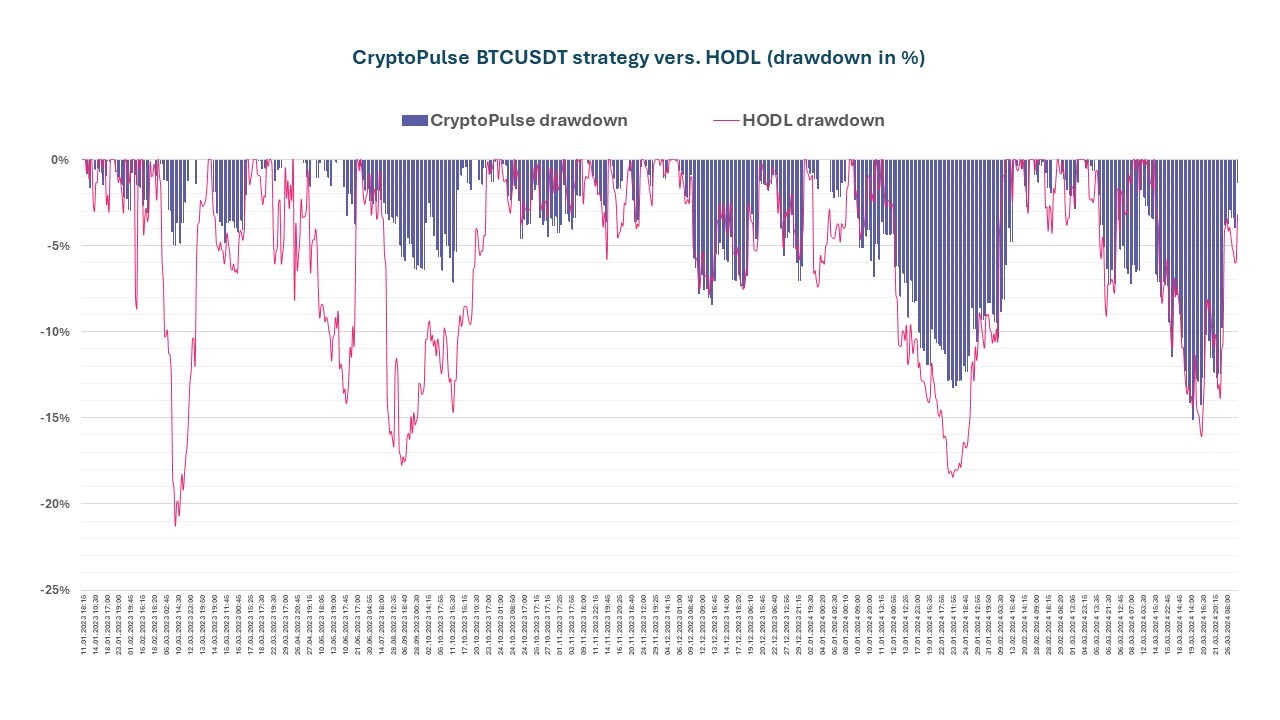

As we recently mentioned, Senti-Bot’s first rule states: “don’t waste money,” and the second reminds us: “don’t forget the first rule.” Although, the last month was not the best in terms of implementation of these principles it, managed to end the month with a positive rate of return. The effectiveness of the artificial intelligence of the bot created for you can be observed in the chart below, which shows the maximum decrease in the value of the portfolio in March, the so-called “portfolio drop”. Drawdown. This decline was comparable to Bitcoin’s breeding strategy. As a result, we spent most of March fixing these problems, which should make similar situations less frequent.

The current volatility in the cryptocurrency market is largely due to Bitcoin’s upcoming halving, which is estimated for April 21. Despite the volatility, characterized by a 15.1% decline in the value of the portfolio (Drawdown), Senti-Bot not only managed to recover its losses in March, but also achieved a return of 3.9%. As a result, this was the sixth month in a row in which Senti-Bot generated positive results, recording an average growth of 9.5% per month.

Senti-Bot achieves its effectiveness mainly by anticipatory exiting positions ahead of anticipated declines in Bitcoin’s price, discernible in emotions analyzed from social media. Proof of the effectiveness of this approach is provided by the average values of transactions ending in profit and loss:

- The average profit per order is: +1,64%,

- The average loss per order is: -0,29%.

This means that the bot is effective in minimizing losses by reacting quickly to market changes.

Senti-Bot’s positive performance in February was largely aided by a surge of optimism in the cryptocurrency market, which grew strongly for most of the month. This enabled Senti-Bot to effectively exploit the prevailing conditions. As a result, this was the fifth consecutive month in which Senti-Bot generates a positive result for you, growing at a monthly average of 10.6% during this time.

Senti-Bot achieves its effectiveness mainly by anticipatory exiting positions ahead of anticipated declines in Bitcoin’s price, discernible in emotions analyzed from social media. Proof of the effectiveness of this approach is provided by the average values of transactions ending in profit and loss:

- The average profit per order is: +1,59%,

- The average loss per order is: -0,27%.

This means that our bot is effective in minimizing losses by reacting quickly to market changes.

Senti-Bot performance indicators

We emphasize that the effectiveness of Senti-Bot should be considered over a period of more than one or two months.

Important elements of evaluating the effectiveness of our tool are measurements of such indicators as:

- Drawndown

- Profit Factor

- Sharpe ratio

- Calmar indicator

Drawdown

Drawdown is, simply put, the largest percentage reduction in capital value from its highest level. It is calculated by comparing the highest previous capital level with its current value.

The maximum drawdown (over the entire period) for the CryptoPulse BTCUSDT strategy was -15.1%, while in the Bitocin hodl it was already -21.3%.

Profit Factor

Another measure that deserves attention is the profit factor. The ratio is defined as the sum of all transactions with a profit divided by the sum of all transactions closed with a loss. A profit factor above 1.50 is considered good enough, and above 2.0 is considered ideal.

The Profit Factor for Senti-Bot was 1.64 at the end of March 2024. We can interpret that for each transaction the bot gained on average 46% more than it lost.

Sharpe ratio

In order to assess the ratio of the return achieved to the risk taken, we track two main indicators. The first is the Sharpe ratio, which measures risk-adjusted return (measured by average deviation). The higher the values of this indicator, the better the investment is considered. Investments for which the Sharpe Ratio is greater than 3.0 are considered among the best.

For Senti-Bot, the Sharpe ratio at the end of February was 6.43, significantly higher than for most mutual funds. This is significant because a higher Sharpe ratio means more than 6 times higher returns relative to risk, which confirms the attractiveness of our investment strategy.

Calmar indicator

Calmar Ratio is the second main indicator of investment performance, which determines the ratio of the rate of return (calculated on an average annual basis) in relation to the maximum slippage. In general, the higher its value, the better. This is because it means by how many times the average annual cumulative rate of return exceeds the past slide. Values above 1 mean that the rate of return, was higher than the landslide.

At the end of February, Senti-Bot’s Calmar index was 9.42, surpassing Bitcoin’s hodling with a score of 9.36. With high profits and a lower drawdown, the bot has provided you with a result of more than 10 times its maximum drawdown.

Table – summary summary

We thank all our users for their trust and words of approval. We encourage you to follow Senti-Bot’s performance in the coming months!

SentiStocks team