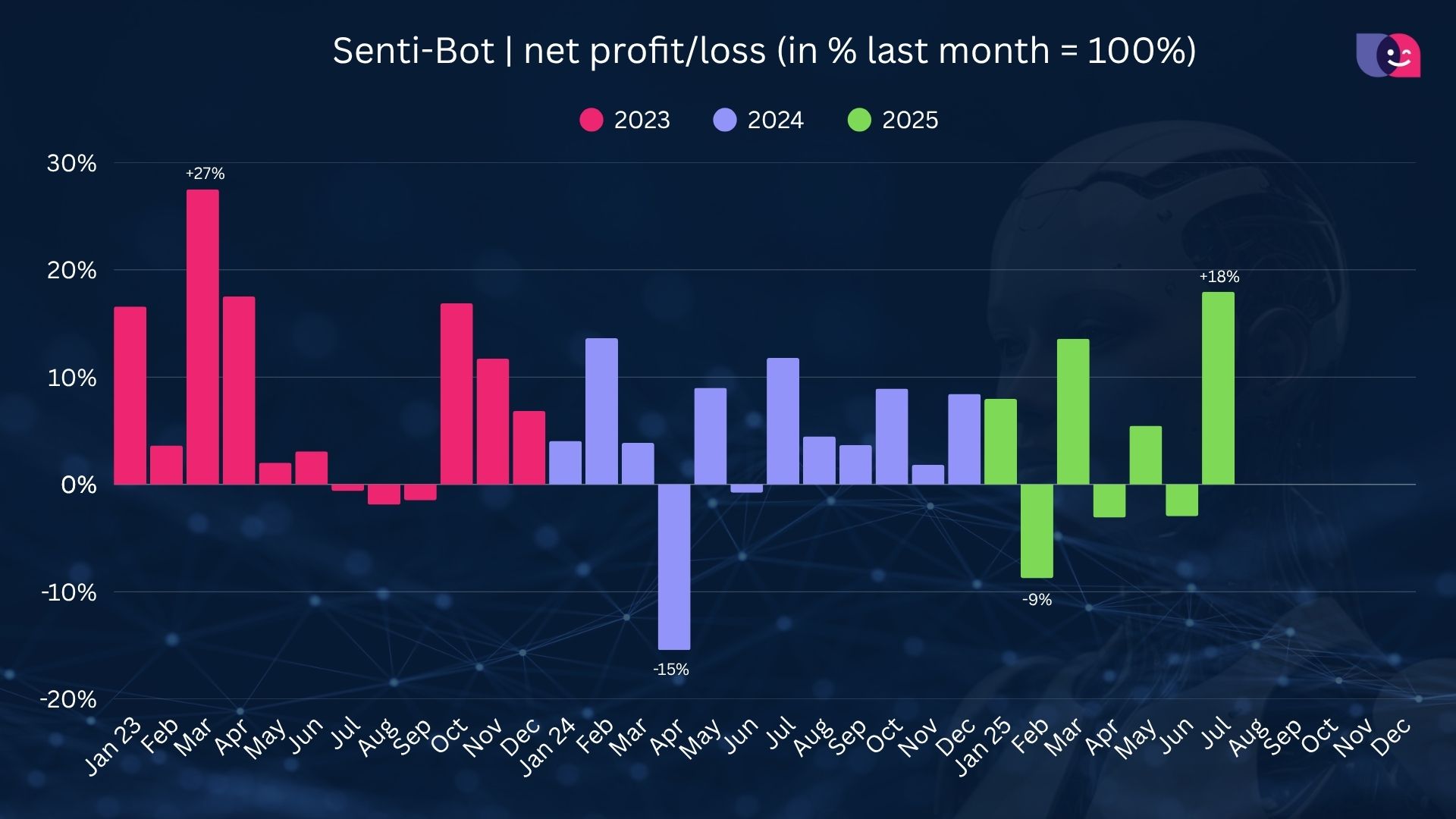

July was the month of truth for Senti-Bot. After the June migration from the Futures market to the Spot market, it was the first full period in which our refreshed strategy could show its full potential. The results exceeded our expectations – Senti-Bot not only proved its effectiveness in the new conditions, but also generated A solid profit of +18%, while perfectly protecting capital.

Table of contents

Video Summary (Polish version)

Senti-Bot in a nutshell

A reminder of what Senti-Bot is. Financial markets are ruled by human emotions – fear and greed. Professional investors know this and use sentiment analysis to gain an advantage. Senti-Bot is an automated investment strategy, which does it for you. It analyzes social media sentiment every 15 minutes, making decisions based on data, not impulses.

Our investment philosophy remains the same:

Capital preservation is a priority. Limiting losses is more important than generating profits, leading to stable growth in the long term.

Repeatability is what counts. We evaluate each modification of the strategy through the lens of key indicators, such as Sharpe and Calmar, to ensure its effectiveness in the future.

We are thinking long-term. Any decision must support stable results over many months.

Monthly Summary – July 2025

July was extremely successful for us and confirmed the correctness of the direction taken after the transition to the Spot market.

Net profit in July: +18%

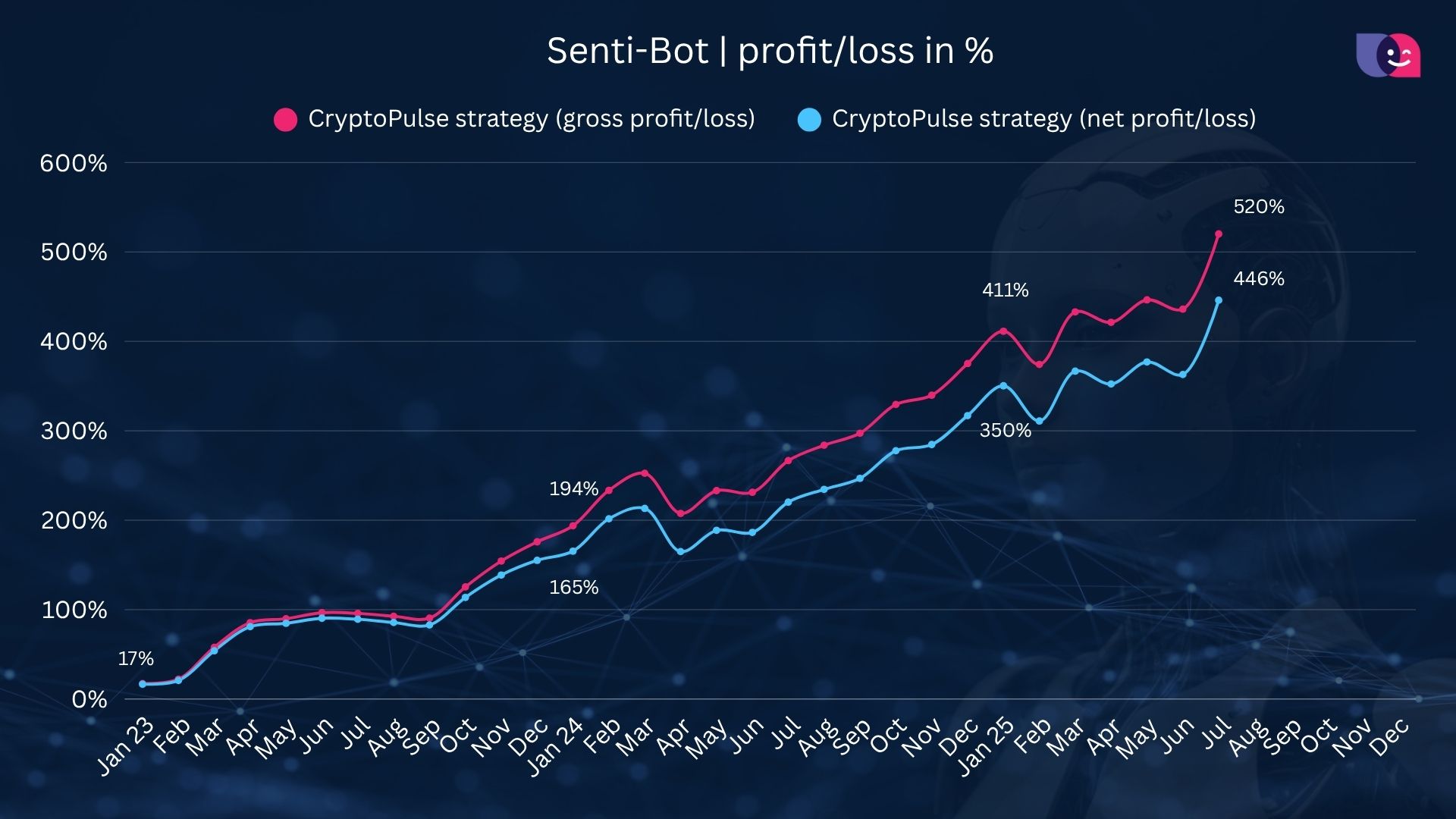

Total rate of return: 445,37%

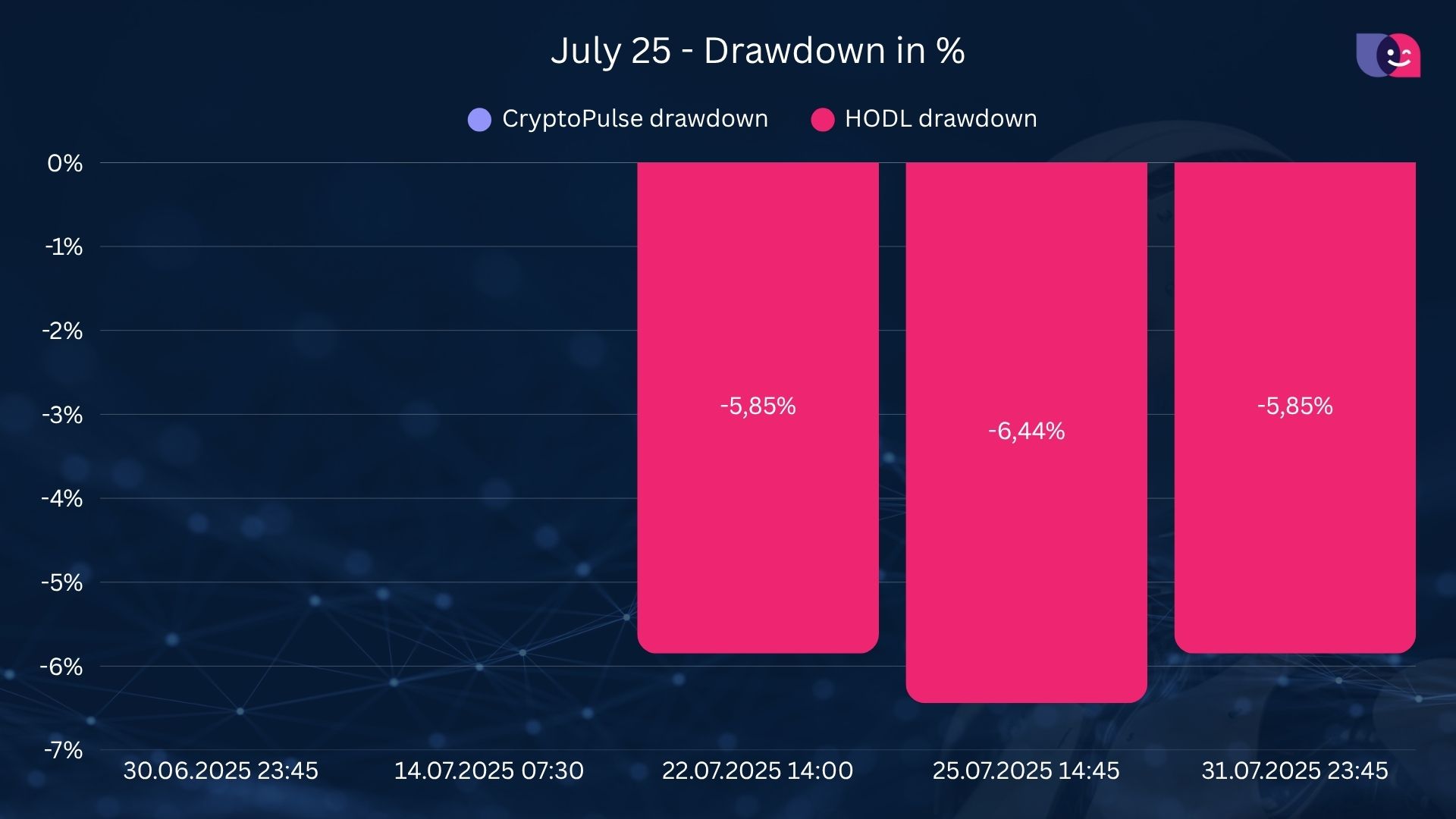

Capital slippage (Drawdown) in July: 0%.

After a June adaptation period, July showed the strength of the modified strategy. Despite almost ten times higher spot trading costs, Senti-Bot managed to generate an impressive result.

Most importantly, this was accomplished with zero capital slip (drawdown). At the same time, the “buy and hold” (HODL) strategy saw a decline of more than 6%. This is the best proof that our capital preservation philosophy works, minimizing risk even in volatile market conditions.

The strategy’s total return since inception has risen to 445,37%, which is the result of our consistency and continuous improvement of the algorithm.

Performance indicators in July

Solid profit is one thing, but equally important to us is the quality and repeatability of results. The performance indicators for July confirm that the strategy is developing in the right direction:

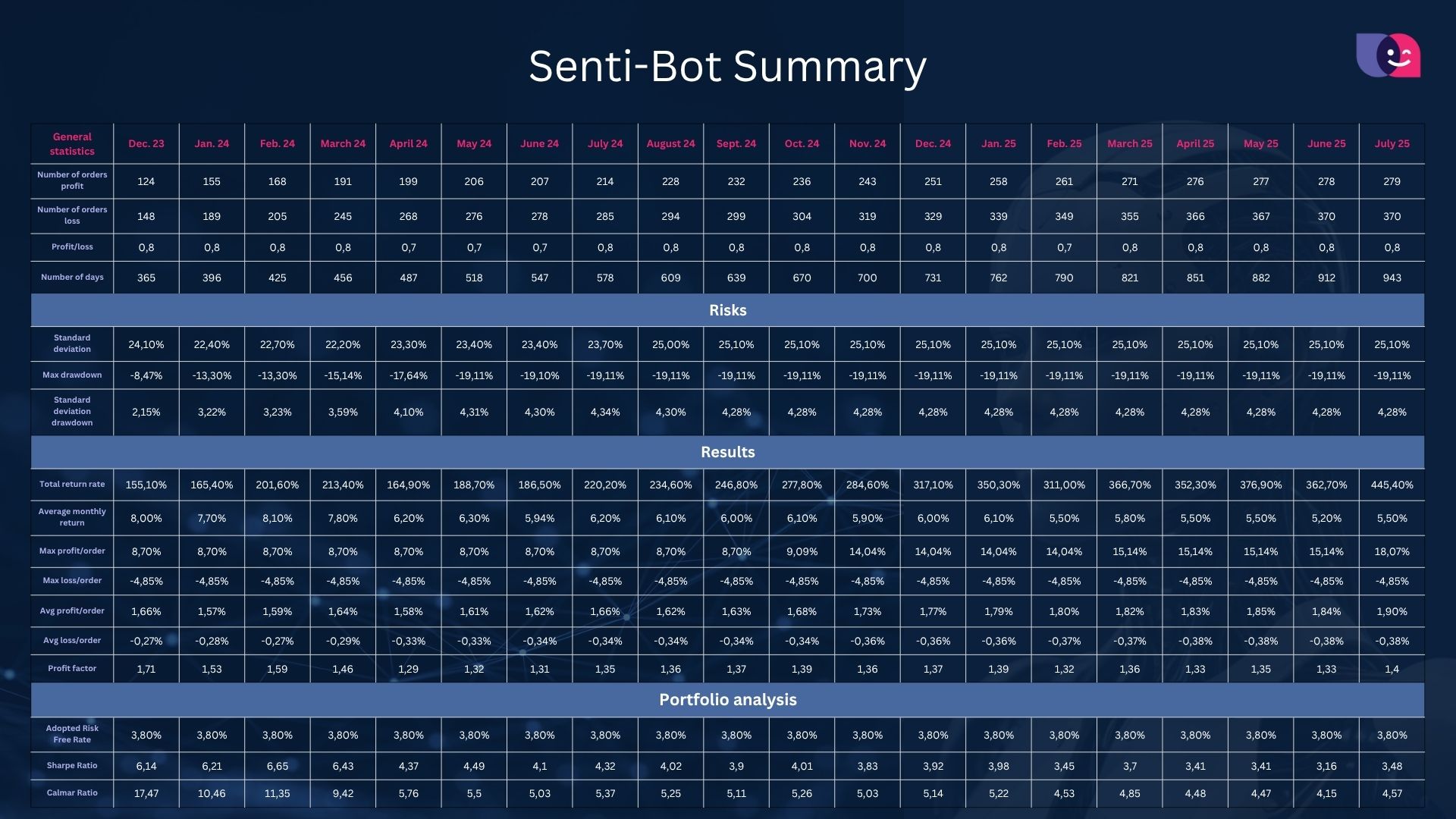

Profit Factor: 1.40 – This indicator shows that the profits generated by the strategy are 40% higher than the losses incurred.

Sharpe Ratio: 3.48 – Significant increase from 3.16 in June. A higher Sharpe ratio means the strategy is generating better returns relative to the risk taken.

Calmar Ratio: 4.57 – Also a marked increase from 4.15 in the previous month. This confirms the excellent ratio of profit to maximum capital slippage.

Average monthly return: 5,54%

Maximum profit per transaction: 18,07%

We see the increase in key indicators such as Sharpe and Calmar, while keeping risks in check, as the best confirmation of the effectiveness of the modifications made.

What’s next?

The fantastic result in July is a powerful boost of motivation for us and confirmation that Senti-Bot is perfectly positioned to continue generating steady profits on the Spot market. Thank you for your trust and stay tuned for more recaps!