For quite some time now, we have been presenting the results of the trend prediction of the average Bitcoin exchange rate on our Facebook group. The prediction model presented predicts the trend direction for the next 24 hours, and we publish the data as of 15:00 UTC.

What are our Bitcoin price predictions?

These are the kinds of questions we encounter when dealing with Internet users who follow our predictions. Surely, our predictions cannot be the only signpost based on which decisions are made: buy, hold, sell. What is certain is that predictions fill a gap in the market of tools dedicated to players. The gap, which until now was the lack of concrete information about the impact of emotions on the value of a financial instrument (behavioral analysis) being in constant trading (and this is Bitcoin).

Here we would like to present our strategy of using the results of the prediction of the average Bitcoin price in the 24-hour interval.

How to use Bitcoin rate prediction

How can the information from the 24-hour average Bitcoin price trend prediction be used practically? This is the question we asked ourselves at the beginning of our work on the Sentistocks tool, and this is the question Internet users are asking us.

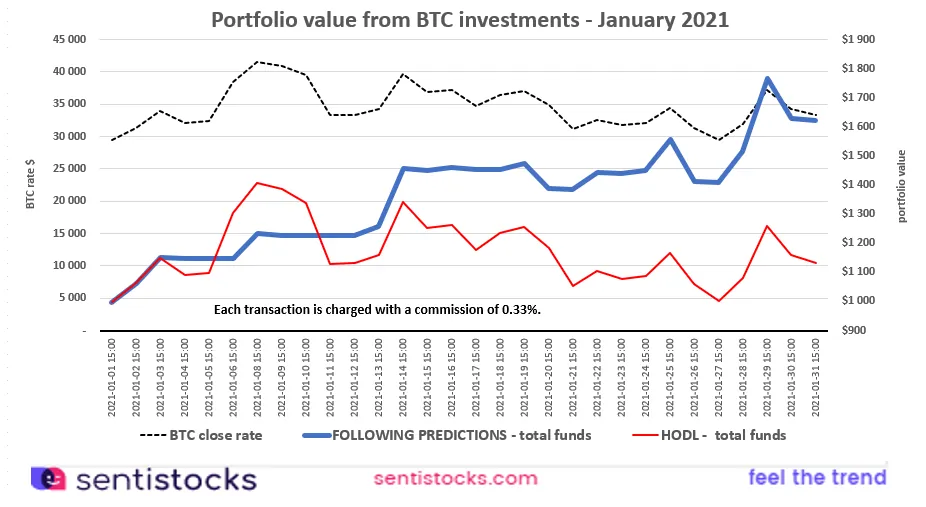

Here we will present, using two variants as examples, the simplest approach to using the information from the 24-hour prediction in investment decisions. We developed the examples using: actual stock market exchange rate data, our emotive analysis data, and our exchange rate predictions recorded in January 2021.

Option I

The option is based on a 24-hour prediction of the average BTC price – we made the following assumptions:

- investment in Bitcoin is $1.000,00,

- 100% of the principal / portfolio is invested,

- the investment is made on the spot market (only buy-sell operations are executed),

- each operation is charged with 0.33% commission.

The signal for a buy BTC transaction (or hold if you already have BTC in your portfolio) is a situation where the forecasted average price of BTC for the next 24 hours is higher than the actual close BTC price at 15:00 UTC on the day when the prediction was set. The transaction is executed at the close price at 15:00 UTC on the day the prediction of the average price of BTC for the next 24 hours was set.

The signal for a sell BTC transaction is when the forecasted average BTC price for the next 24 hours is lower than the actual close BTC price at 15:00 UTC on the day the prediction was set. The transaction is executed at the close price at 15:00 UTC on the day the prediction of the average price of BTC for the next 24 hours is made.

The return on investment when using 24-hour average BTC price prediction data was 66%. In comparison, the return on investment when using the HODL strategy was 13%.

Option II

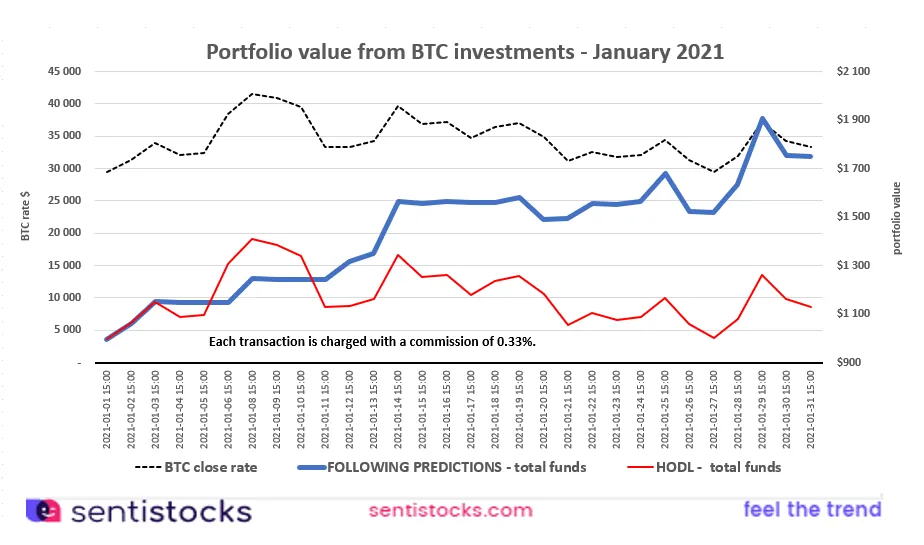

The option is based on a 24-hour prediction of the average BTC rate, but additionally using information from a 1-hour prediction of the average BTC rate – we made the following assumptions:

- investment in Bitcoin is $1.000,00,

100% of the principal / portfolio is invested,

the investment is made on the spot market (only buy-sell operations are executed),

each operation is charged with 0.33% commission.

The signal for a buy BTC trade (or hold if you already have BTC in your portfolio) is when the predicted average BTC price for the next 24 hours is higher than the actual close BTC price as of 15:00 UTC on the day the prediction was set.

- If the forecasted average price of BTC for the next 24 hours is higher than the actual close price of BTC at 15:00 UTC on the day the prediction was made, the buy transaction is made at the close price at 15:00 UTC on the day the prediction of the average price of BTC for the next 24 hours was made.

- If, in addition, the average price of BTC for the next 1 hour is lower than the actual close price at 15:00 UTC on the day the prediction was made, the buy transaction is executed at a price lower than the close price at 15:00 UTC or at the close price at 16:00 UTC (if there is no such lower price within 1 hour – from 15:00 UTC to 16:00 UTC).

Formula:

IF Ka > Kb AND Kc < Kb THEN buy at price < Kb OR buy at price Kd

Legend:

Ka = predicted average price of BTC for the next 24 hours (prediction as of 15:00 UTC),

Kb = BTC close rate as of 15:00 UTC,

Kc = predicted average price of BTC for the next 1 H (prediction as of 15:00 UTC),

Kd = BTC close rate at 16:00 UTC.

The signal for a sell BTC trade is when the predicted average BTC price for the next 24 hours is lower than the actual close BTC price at 15:00 UTC on the day the prediction is set.

- If the forecasted average price of BTC for the next 24-hours is lower than the actual close price at 15:00 UTC on the day the prediction was made, the sell transaction is executed at the close price at 15:00 UTC on the day the prediction of the average price of BTC for the next 24 hours was made.

- If, in addition, the average price of BTC for the next 1-hour is higher than the actual close price at 15:00 UTC on the day the prediction was made, the sell transaction is executed at a price higher than the close price at 15:00 UTC or at the close price at 16:00 UTC (if no such higher price has occurred within 1 hour, i.e. from 15:00 UTC to 16:00 UTC).

Legend:

Jeżeli Ka < Kb oraz Kc > Kb to sell po kursie > Kb lub po kursie Kd

IF Ka < Kb AND Kc > Kb THEN sell at rate < Kb OR sell at rate Kd

Legend:

Ka = predicted average price of BTC for the next 24 hours (prediction as of 15:00 UTC),

Kb = BTC close rate as of 15:00 UTC,

Kc = predicted average price of BTC for the next 1 H (prediction as of 15:00 UTC),

Kd = BTC close rate at 16:00 UTC.

The return on investment when using 24-hour BTC average price prediction data combined with using 1-hour BTC average price prediction data was 75%. In comparison, the return on investment when using the HODL strategy was 13%.

In addition, we present a table of possible decisions that led to the results presented earlier.

| Prediction Date | Expected change (prediction/close) | What we can do | Realisation price in $ (in option I) | Realisation price in $ (in option I) |

| 2021-01-01 15:00 | buy | |||

| 2021-01-02 15:00 | 0,5% | hold/buy | 31 344,73 | 31 344,73 |

| 2021-01-03 15:00 | 0,2% | hold/buy | 33 924,68 | 33 924,68 |

| 2021-01-04 15:00 | -0,1% | sell | 32 144,43 | 33 950,00 |

| 2021-01-05 15:00 | -2,4% | sell | 32 375,62 | 32 375,62 |

| 2021-01-06 15:00 | -0,7% | sell | 38 504,46 | 38 504,46 |

| 2021-01-08 15:00 | 0,0% | hold/buy | 41 522,56 | 38 142,00 |

| 2021-01-09 15:00 | -0,51% | sell | 40 874,45 | 40 874,45 |

| 2021-01-10 15:00 | -0,59% | sell | 39 471,42 | 39 471,42 |

| 2021-01-11 15:00 | -0,20% | sell | 33 288,47 | 33 288,47 |

| 2021-01-12 15:00 | 0,58% | hold/buy | 33 398,99 | 31 332,00 |

| 2021-01-13 15:00 | 1,00% | hold/buy | 34 229,18 | 34 229,18 |

| 2021-01-14 15:00 | 0,82% | hold/buy | 39 595,80 | 39 595,80 |

| 2021-01-15 15:00 | -0,16% | sell | 36 901,38 | 36 901,38 |

| 2021-01-16 15:00 | 0,02% | hold/buy | 37 227,12 | 37 227,12 |

| 2021-01-17 15:00 | -0,57% | sell | 34 749,38 | 34 749,38 |

| 2021-01-18 15:00 | -0,09% | sell | 36 443,11 | 36 443,11 |

| 2021-01-19 15:00 | 0,70% | hold/buy | 37 021,96 | 37 021,96 |

| 2021-01-20 15:00 | 0,29% | hold/buy | 34 901,72 | 34 901,72 |

| 2021-01-21 15:00 | -0,15% | sell | 31 100,00 | 35 069,00 |

| 2021-01-22 15:00 | 1,14% | hold/buy | 32 549,93 | 32 549,93 |

| 2021-01-23 15:00 | -0,21% | sell | 31 740,68 | 31 740,68 |

| 2021-01-24 15:00 | 0,88% | hold/buy | 32 099,31 | 32 099,31 |

| 2021-01-25 15:00 | 0,70% | hold/buy | 34 448,10 | 34 448,10 |

| 2021-01-26 15:00 | 0,09% | hold/buy | 31 291,93 | 31 291,93 |

| 2021-01-27 15:00 | -0,36% | sell | 29 540,00 | 29 540,00 |

| 2021-01-28 15:00 | 0,96% | hold/buy | 31 887,05 | 31 887,05 |

| 2021-01-29 15:00 | 0,76% | hold/buy | 37 186,56 | 37 186,56 |

| 2021-01-30 15:00 | 0,20% | hold/buy | 34 246,82 | 34 246,82 |

| 2021-01-31 15:00 | -0,65% | sell | 33 362,31 | 33 362,31 |

The data presented by Sentimenti neither in whole nor in part constitute a “recommendation” within the meaning of the provisions of the Act of 29 July 2005 on trading in financial instruments or the Regulation of the European Parliament and the Council (EU) No 596/2014 of 16 April 2014. on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulations (EU) 2017/565 of 25 April 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive. The contents do not meet the requirements for recommendations within the meaning of the above mentioned Act, inter alia, they do not contain a specific valuation of any financial instrument, are not based on any valuation method and do not specify investment risk.