Sentimenti has developed several tools for those investing in cryptocurrencies (bitcoin), including basic investment strategies. More on this topic can be seen in the video

How our bot works

The operations performed by the bot are based on the prediction of the future average BTC exchange rate (avg) https://sentistocks.com/blog/finance-emotions-analysis-predicting-price-trend-btc-bitcoin-forecast-emotions/. Changes in this rate form the basis for setting sell or buy rates. The sell or buy operations depend on the current position of the bot and the predicted trend of the future average price of BTC . The bot invests all the capital. It has a built-in stop-loss mechanism, the level of which depends on the adopted strategy. Bot as a tool does not have a built-in mechanism – a “typical” short (i.e. “borrowing” BTC to sell with the need to buy it back). However, in the situation of a predicted fall in the BTC exchange rate, if the bot has a long position, it takes a short position and tries to sell its coins before the predicted fall in the exchange rate.

Three basic strategies

We have developed three basic strategies. We tested them in backtesting starting from January 1, 2021.

Aggressive strategy – worked best when there was a long-term uptrend interrupted possibly by relatively short periods of downtrend or following a sideways trend.

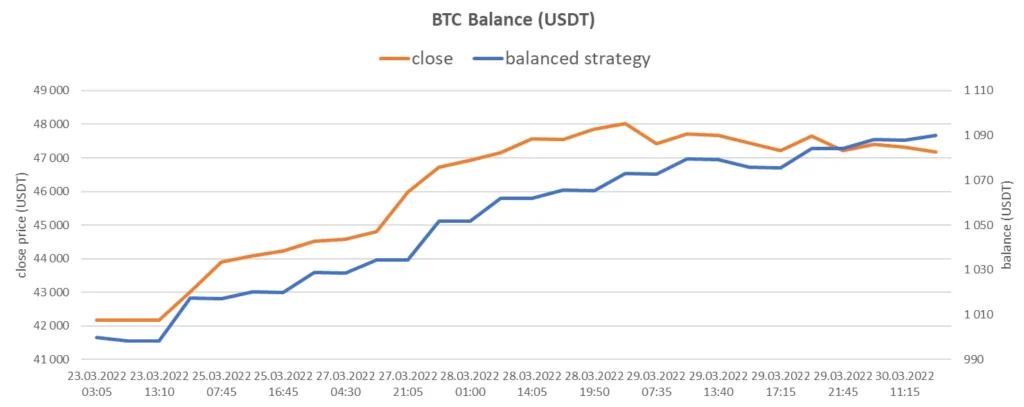

Balanced strategy – this strategy had clear positive results even in a sideways or short-term uptrend and worked well in a downtrend (protected against significant losses).

Passive strategy – was successful in a downtrend (protected against significant losses), had positive results in an uptrend and was passive in a sideways trend waiting for a clear signal to sell or buy.

Which strategy to choose today

We are currently observing increases in the price of BTC since March 22. However, this is still too short a period to consider the stability of the trend. Observing the behaviour of the close price, we can see periods of sideways trend, as well as downtrends, which “interrupt” periods of growth.

This indicates that the BALANCED strategy would be the most suitable strategy in this situation.

The data presented by Sentimenti neither in whole nor in part constitute a “recommendation” within the meaning of the provisions of the Act of 29 July 2005 on trading in financial instruments or the Regulation of the European Parliament and the Council (EU) No 596/2014 of 16 April 2014. on market abuse (Market Abuse Regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulations (EU) 2017/565 of 25 April 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive. The contents do not meet the requirements for recommendations within the meaning of the above- mentioned Act, inter alia, they do not contain a specific valuation of any financial instrument, are not based on any valuation method and do not specify investment risk.